After reporting dismal sales in Europe for January, Tesla’s Model 3 and Model Y remained highly popular in the UK in February, ranking among the top three best-selling car models of the month.

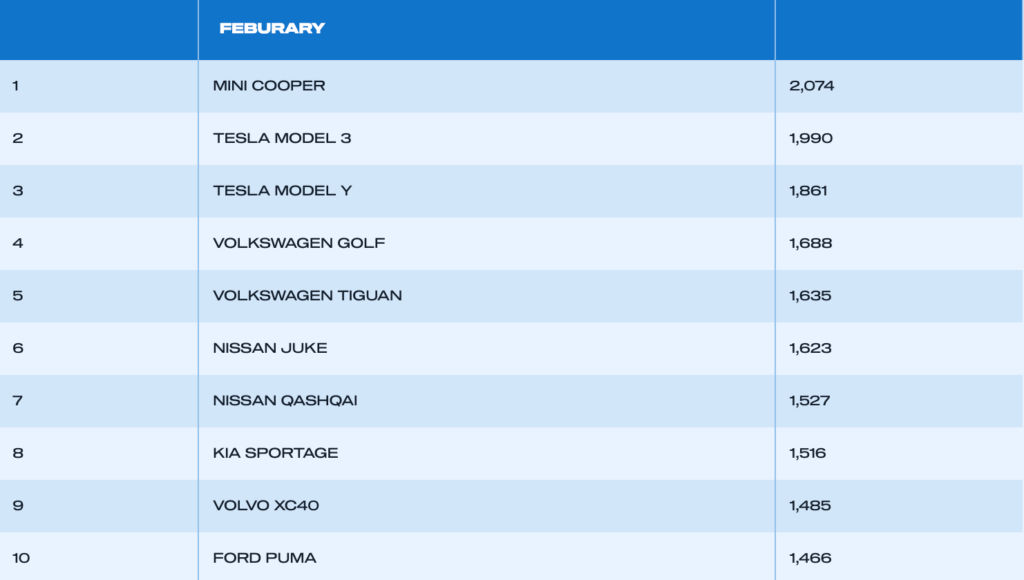

According to data from the Society of Motor Manufacturers and Traders (SMMT), nearly 4,000 Teslas were sold, making the Model 3 and Model Y the second and third most popular cars after the Mini Cooper.

The broader UK car market saw a slight decline, with total new registrations dropping 1% to 84,054 vehicles.

However, battery electric vehicles (BEVs) outperformed the market, with sales rising by almost 42%.

BEVs accounted for a quarter of all new registrations, driven by consumers looking to avoid an upcoming tax surcharge on expensive electric cars.

The tax, which comes into effect in April, will add £2,125 over six years to the cost of BEVs with a list price above £40,000.

Industry analysts suggest that many buyers rushed to purchase electric cars before the deadline, leading to a short-term sales boost.

EV tax changes fuel short-term sales boost

Despite the surge in BEV registrations, industry leaders warn that demand could slow once the new tax takes effect.

The Expensive Car Supplement (ECS), unchanged since 2017, disproportionately impacts electric vehicles, which tend to have higher production costs than their petrol and diesel counterparts.

Mike Hawes, chief executive of the SMMT, said the UK’s EV market needs more government incentives rather than financial penalties.

Top models sold in UK in Feb, Source: SMMT

“Although February’s figures show a subdued overall market, the good news is that electric car uptake is increasing, albeit at huge cost to manufacturers in terms of market support,” he said.

He added that the tax changes “perversely” discourage EV adoption and could hurt both the new and used markets, slowing the UK’s transition to electric mobility.

After January’s data, UK’s February data defies concerns

Data from the European Automobile Manufacturers’ Association (ACEA) last month showed that Tesla’s European sales nearly halved in January, bringing its market share down to just 1%.

In the UK, the company lost ground to Chinese competitor BYD for the first time, even as the overall electric vehicle (EV) market expanded by 42%.

Analysts suggested that Musk’s recent actions—including his vocal support for Germany’s far-right AfD party, controversial public gestures, and attacks on European politicians—alienated potential buyers.

His close ties to former US President Donald Trump have also raised concerns, particularly among liberal-leaning consumers in key European markets.

UK’s February data has managed to defy these concerns for now.

The post Tesla defies European slump in February as UK sales remain strong ahead of tax hike appeared first on Invezz