BT Group Plc (BT.A) is a UK based communication services organisation. The company's services portfolio comprises of managed networked IT services, fixed voice and data, mobility, television, connectivity, and broadband services. It also offers copper and fibre connections between exchanges and homes and businesses. The company has a business presence across Asia-Pacific, Europe, the Middle East, Africa and the Americas.

On 5th June 2019, Wednesday, BT Group Plc announced that it will be reducing its property footprint to 30 sites from 300 current office including its head office in St Paulâs, London by 2023. The move was taken to reduce its cost by £1.5 billion. The company is further planning to reduce its workforce to about 75,000 professionals and will be placed in groups 8 key locations which include Manchester, Belfast, Birmingham, Bristol, Ipswich, Edinburgh, London and Cardiff.

As per BTâs chief executive, Philip Jansen, the move is to bring the best people together and innovate the new ways to work. The last couple of months were challenging for the company as it was involved in the Italian accounting scandal and a profit warning which affected the companyâs market value.

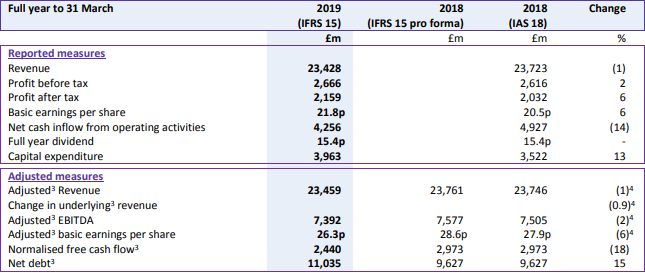

Financial Highlights (FY2019, £ million)

(Source: Annual Report, Company Website)

BTâs reported revenue stood at £23,428 million for the period FY19 and was reduced by 1 per cent as compared with the previous financial year, on account of regulated price reduction in Openreach and fall in their enterprise business.

Reported profit before tax surged by 2 per cent to £2,666 million. The reported profit after tax increased by 6 per cent to £2,159 million against the £2,032 million in FY18.

Adjusted EBITDA for the financial year 2019 climbed to £7,392 million, due to an increase in the revenue from its consumer business but the surge in consumer business was offset by the decrease in the revenue from its Enterprise and Openreach business.

Capital expenditure during the period surged by £441 million to £3,963 million, driven by a surge in BDUK grant funding deferral and increased investment in FTTP.

The net debt rose by £1,408 million to £11,035 million against the previous financial year. Adjusted FCF (free cash flow) declined to £2,440 million.

Reported basic earnings per share increased by 6 per cent to 21.8 pence as compared with the financial year 2018 of 20.5 pence. The Board proposed a final dividend per share of 10.78 pence, while total full-year dividend per share stood at 15.4 pence and remained flat against the previous year.

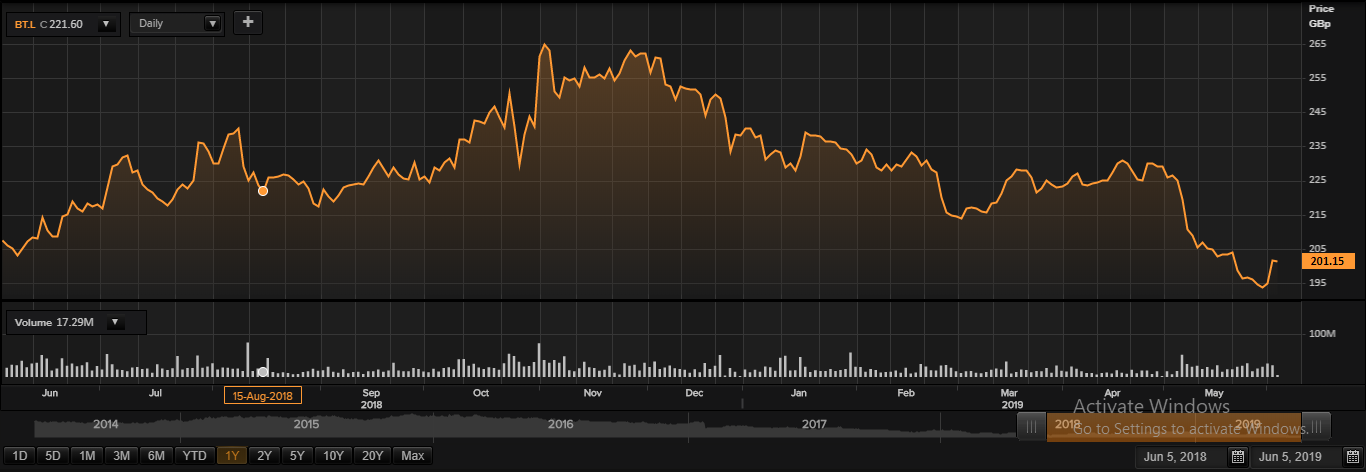

BT Group Plc Share Price Performance

Daily Chart as at June-05-19, before the market closed (Source: Thomson Reuters)

On 5th June 2019, at the time of writing (before the market close, GMT 2:27 PM), BT shares were trading at GBX 201.15, down by 0.25 per cent against the previous day closing price. Stock's 52 weeks High and Low is GBX 268.60/GBX 190.68. The companyâs stock beta was 0.82, reflecting lower volatility as compared to the benchmark index. The outstanding market capitalisation was around £20 billion, with a dividend yield of 7.64 per cent.