Highlights

- Card Factory’s revenue was £116.9 million in H1 2021 ended 31 July, compared to £100.5 million in H1 2020, representing an increase of 16.3% year-on-year.

- ASOS’ revenues reached £3,910.5 million for the year ended 31 August 2021 compared to £3,263.5 million in 2020, representing a year-on-year increase of 22%.

- Marks and Spencer’s clothing and homeware business segment reported a 92.2% year-on-year growth in revenue during the 19 weeks ended 14 August 2021.

Retail stocks have been among the most sought-after investment options for investors. The retail environment is now buzzing with action due to the reopening of the economy, rising vaccination rates and returning consumer confidence post the pandemic.

Even during the pandemic, retail sales were boosted by a rise in online shopping as people refrained from visiting stores. Nevertheless, the retail companies currently are facing some challenges due to supply chain issues and HGV driver shortages. Still, there are many investment options in the retail space, let us explore 3 retail stocks - Card Factory, ASOS and Marks and Spencer.

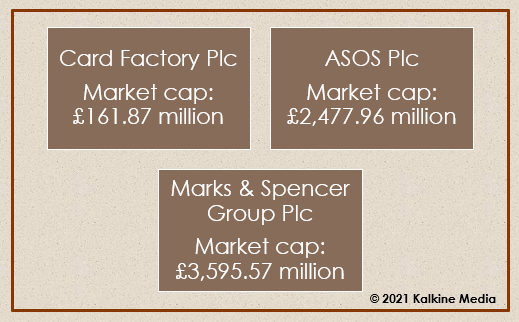

(Data source: Refinitiv)

Card Factory Plc (LON: CARD)

Card Factory is a UK-based greeting card and gift retailer. Its revenue was £116.9 million in H1 2021 for the period ended 31 July, compared to £100.5 million in H1 2020, representing an increase of 16.3% year-on-year.

The shares of Card Factory closed at GBX 49.50 on Monday, 1 November 2021. The shares of the company gave a return of 53.73% to shareholders in the last one year, and the market cap of the company stands at £161.87 million.

Card Factory’s loss before tax was £6.5 million in H1 2021, which was £22.2 million in H1 2020. The company targets £600 million in sales by FY2026.

ASOS Plc (LON: ASC)

ASOS is an AIM-listed online cosmetic and fashion retailer. The company reported a net sales growth of 22%, with 36% growth in the UK, 21% in the US, and 15% and 6% in the EU and the Rest of World, respectively.

The shares of ASOS closed at GBX 2,500.00 on Monday, 1 November 2021. The market cap of the company stands at £2,495.93 million.

The revenues of ASOS reached £3,910.5 million for the year ended 31 August 2021 compared to £3,263.5 million in 2020, representing a year-on-year increase of 22%. ASOS reported an adjusted profit before tax of £193.6 million for the year compared to £142.1 million in 2020.

Marks & Spencer Group Plc (LON: MKS)

Marks and Spencer is a multinational retailer of homeware, footwear, clothing and food items. It expects profit before tax for the year to be more than the previous guidance of £350 million.

The shares of Marks and Spencer Group closed at GBX 188.60 on Monday, 1 November 2021. The shares of the company gave a return of 110.73% to shareholders in the last one year, and the market cap of the company stands at £3,595.57 million.

Marks and Spencer’s revenue from the food business increased by 10.8% year-on-year in 19 weeks ended 14 August 2021, while the clothing and homeware business segments reported 92.2% year-on-year growth in revenue during the period.