Highlights

- Marks and Spencer Group’s clothing and home business revenue in the 19 weeks period ended 14 August 2021 grew by 92.2% year-on-year, while food revenue increased by 10.8% year-on-year.

- Next recorded a profit before tax of £347 million in H1 2021, representing an increase of 5.9% compared to £327.4 million in H1 2019.

- JD Sports Fashion’s revenue stood at £3,885.8 million in H1 2021 compared to £2,544.9 million in H1 2020.

Retailers in the United Kingdom registered stronger-than-anticipated sales rise for October after a slowdown in September. Nevertheless, supply chain issues led to the shrinking of stocks to record lows since 1985, according to a report by the Confederation of British Industry (CBI). Sales are expected to further increase in November, although retailers are keeping a close watch on the latest surge in new coronavirus infection in the country.

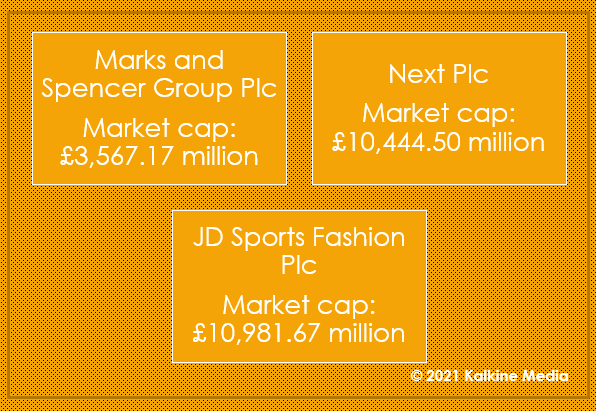

Shortage of workforce and HGV drivers, supply chains inadequacies combined with uncertain public health conditions are making it difficult for the retailers to plan ahead of the Christmas and holiday season. Here is a detailed review of the investment prospect in three FTSE retail stocks - Marks and Spencer, Next and JD Sports Fashion.

(Data source: Refinitiv)

Marks and Spencer Group Plc (LON: MKS)

Marks and Spencer Group is an international retailer engaged in selling clothes, homeware and food products. Marks and Spencer announced the launch of frozen festive offerings. It announced that sales of frozen Christmas delicacies have increased by 500 per cent since last year.

Marks and Spencer Group’s clothing and home business revenue in the 19 weeks period ended 14 August 2021 grew by 92.2% year-on-year, while food revenue increased by 10.8% year-on-year during the same period. The total group revenues registered a year-on-year growth of 29.1% in the same period.

Marks and Spencer Group raised its guidance for adjusted profit before tax for 2021 to more than £350 million.

The shares of Marks and Spencer Group closed at GBX 185.90, up by 2.06% on Tuesday, 27 October 2021. The market cap of the company stands at £3,567.17 million, and the shares returned 95.19% to shareholders in the last one year.

Next Plc (LON: NXT)

Next is a UK-based international retailer of footwear, homeware and clothing products. Its total group sales increased by 7.6% to £2,215.7 million in H1 2021 compared to £ 2,058.8 million in H1 2019.

Next recorded a profit before tax of £347 million in H1 2021, representing an increase of 5.9% compared to £327.4 million in H1 2019. The company’s online sales increased by 52% to £ 1,522.5 million in H1 2021 compared to £ 1,004.9 million in H1 2019.

Next upgraded its guidance for the year ended January 2022 with profit before tax expected to reach £800 million, representing an increase of 6.9% compared to 2019 and £36 million more than its previous guidance of £764 million.

The shares of Next closed at GBX 8,008.00, up by 1.93% on Tuesday, 27 October 2021. The market cap of the company stands at £10,444.50 million, and the shares returned 28.01% to shareholders in the last one year.

JD Sports Fashion Plc (LON: JD.)

JD Sports Fashion is a retailer of branded outdoor wear, fashionwear and sportswear. Recently, JD Sports Fashion completed the acquisition of an 80% stake in Cosmos Sport S.A. in Cyprus and Greece.

For H1 ended 31 July 2021, JD Sports Fashion’s revenue stood at £3,885.8 million compared to £2,544.9 million in H1 2020. Its profit before taxation increased to £364.6 million in H1 2021 from £41.5 million in H1 2020.

The shares of JD Sports Fashion closed at GBX 1,089.00, up by 2.30% on Tuesday, 27 October 2021. The market cap of the company stands at £10,981.67 million, and the shares returned 32.40% to shareholders in the last one year.

.jpg)