Summary

- House prices surged to a four year high in August 2020, driven by need for bigger homes and ongoing stamp duty holiday

- With a low interest rate regime, this might be a good time to buy houses and demand may continue to rise for few more months, say experts

- Focus on select housing company stocks: CLS Holding, St. Modwen Properties, Watkin Jones, Mountview Estates, and Helical

Britons have been accustomed to expecting rising house prices in real terms, as they have increased five times since the 1950s. Factors driving the rise are increasing real incomes, and an increasingly fixed supply of housing. The main reason for this rise in prices is that the supply of new houses is inflexible because the planning system is almost dysfunctional and the government finances provide virtually no incentives for local authorities to permit development.

While on a broader level, the experts believe the longer the lockdown, the slower the bounce-back is likely to be, leading to slower recovery in the demand for housing. However, with the ease in the lockdown restrictions, the house prices in the United Kingdom increased in August 2020. The prices have hit a four-year high, as buyers demand for properties with gardens has surged. With more people working out of their homes, demand for bigger homes is also on an upswing. The nation has witnessed an increase in price except for London, where they have remained flat over the past two months.

As per RICS (Royal Institution of Chartered Surveyors), the monthly gauge of house prices jumped to +44 in August 2020 from +13 in July 2020, hitting its highest level since February 2016. It also said that after lockdown, the buyers are inclined towards properties with gardens. According to the survey, 83 per cent of the respondents are expecting demand for such homes to go up over the next two years, whereas 79 per cent are estimating rising demand for properties near green space. RICS also commented that the rise in the house price in August 2020 was boosted by those buyers seeking to benefit from the stamp duty holiday.

Should One Buy a House- Is it a Good Time?

Coronavirus has disrupted the economy as well as industries, including the real estate sector. But it might be a good time for the buyers to own a house. Experts are of the opinion that volatile stock market and underperforming mutual funds have raised the need for a stable asset class, providing good returns. Moreover, house building stocks are at their best now, with lower interest rates and a buyer’s market. Recent surveys conducted by property consultants have reveal that homebuyers are willing to return to the market in the coming months.

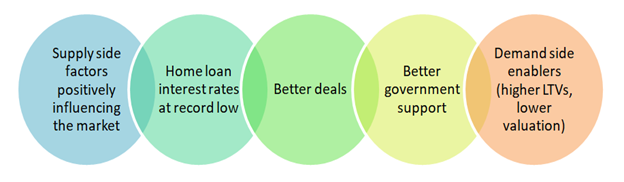

Let’s take a look at 7 reasons why this may be a good time to buy a new home:

What Has Been the Reaction of House Building Stocks Due to the Rise in House Price?

CLS Holding Plc (LON:CLI) - In the recent half-yearly result for the period ending on 30 June 2020, the company delivered a strong performance in spite of the Covid-19 adversity, with the EPRA NAV (net asset value) increasing by 3.2 per cent and EPRA NTA (net tangible assets) up 3.1 per cent, resulting from the increased EPRA earnings. The company also recorded a surge in the EPRA EPS 16.7 per cent from higher net rental income and foreign exchange. EPRA means the European Public Real Estate Association.

Stock Performance

CLI stocks were trading at GBX 216.50 on 10 September 2020, at 11:39 AM, down by 0.23 per cent from its previous close of GBX 217.00. It was having a market capitalisation of £884.05 million. The company recorded a negative return on the price of 29.77 per cent on a YTD (Year to Date) basis.

St. Modwen Properties plc (LON:SMP) – According to the recent half-yearly result for the period ending 31 May 2020, the company reflected the disruptions caused by the pandemic, with the NAV (net asset value) per share down by 12.6 per cent to 423.1 pence (Nov 2019: 484.2 pence) due to pressure on land/retail values. Total accounting return of (12.6) per cent (2019: 2.2 per cent) was recorded, in line with the reduction in NAV. However, the company has rebuilt momentum with increasing positive structural trends in industrial/logistics segments and a returning of residential demand since the lockdown eased out across Britain.

Stock Performance

SMP stocks were trading at GBX 330.00 on 10 September 2020, at 11:54 AM, down by 0.90 per cent from its previous close of GBX 333.00. It was having a market capitalisation of £740.52 million. The company recorded a negative return on the price of 33.67 per cent on a YTD (Year to Date) basis.

Watkin Jones plc (LON:WJG) – In the recent half-yearly result for the period ending on 31 March 2020, the company reflected a strong performance, with 16.7 per cent increase in revenue, underpinned by both student accommodation development. The company recorded a 6.4 per cent increase in its adjusted profit before tax to £26.6 million and robust gross margin of 22.6 per cent (H1 2019: 24.4 per cent).

Stock Performance

WJG stocks were trading at GBX 157.40 on 10 September 2020, at 12:06 AM, up by 0.38 per cent from its previous close of GBX 156.80. The company had a market capitalisation of £ 01.66 million. It recorded a negative return on the price of 35.74 per cent on a YTD (Year to Date) basis.

Mountview Estates plc (LON:MTVW) - In the recent half-yearly results released for the period ending 31 March 2020, the company reflected an increase of 1.5 per cent in its gross profits to £41.4 million. The company also recorded a 0.9 per cent increase in its profits before tax to £34.9 million, and a NAV per share of 3.5 per cent to 725.7 pence per share.

Stock Performance

MTVW stocks were trading at GBX 11,102.00 on 10 September 2020, at 12:14 PM, up by 0.92 per cent from its previous close of GBX 11,000.00. It was having a market capitalisation of £428.89 million. The company recorded a negative return on the price of 6.78 per cent on a YTD (Year to Date) basis.

Helical plc (LON:HLCL) – In the recent trading update for the period commencing on 1 April 2020 and ending on 22 July 2020, the company saw the return of several occupiers. It has been able to collect 77.3 per cent of the June quarter rent, with agreements in place for a further 13.6 per cent to be paid in installments for the period to the September quarter day. The cash position recorded by the group as on 22 July 2020 was £67 million.

Stock Performance

HLCL stocks were trading at GBX 302.00 on 10 September 2020, at 12:30 PM, up by 5.78 per cent from its previous close of GBX 285.50. It was having a market capitalisation of £346.21 million. The company recorded a negative return on the price of 37.93 per cent on a YTD (Year to Date) basis.

Conclusion

Though we are surrounded by huge uncertainty because of the Covid-19 crisis, one thing is clear that the UK government with its stamp duty holiday scheme has been able to drive the demand for buying homes across Britain. Lower interest rates and need to move to bigger homes due to the homeworking trend has also contributed positively. Some housing companies like CLS Holding, St. Modwen Properties, Watkin Jones, Mountview Estates, and Helical have performed reasonably well.