Summary

- Tech Nation has announced a Fintech Pledge in collaboration with the Fintech Delivery Panel and the HM Treasury

- The five most prominent banks of the United Kingdom Barclays, HSBC, Lloyds Banking Group, NatWest Group and Santander have joined as early signatories

- The main aim of the pledge is to set the leading standards for a transparent and effective collaboration between fintech firms and traditional banks in the United Kingdom

The banking sector has undergone a lot of technological advancement in past few decades. Most of the transactions can now be carried out online with just a few taps on your bank’s mobile application. The banking sector across the world has been joining forces with the emerging FinTech’s to provide better service offering to consumers.

Tech Nation, the growth platform for tech companies and leaders, has announced a Fintech Pledge in collaboration with the Fintech Delivery Panel and the HM Treasury (HMT) to speed up the growth of the UK’s fintech sector. The pledge will contribute towards enhancing the collaboration between banks and leading fintech firms, aiming to improve the overall product offerings and banking experience of consumers.

The five most prominent banks of the United Kingdom have joined as early signatories, which includes Barclays, HSBC, Lloyds Banking Group, NatWest Group and Santander. All other banks will be able to sign the voluntary pledge from 16 September 2020. The partner banks are expected to uphold the principles defined in the pledge. In addition, the signatory banks are expected to provide regular updates to Fintech Delivery Panel on the bank’s progress along with providing a senior sponsor from within the institution.

The signatory banks are supposed to abide by the principles defined in the pledge. The banks will have to reserve a landing page and a named contact, as well as assistance and feedback to firms looking for alliances, within six months of signing the pledge.

Aim of the Pledge

The primary aim of Tech Nation pledge is to set the leading standards for a transparent and effective collaboration between fintech firms and traditional banks in the UK. By setting standards for commercial partnerships, the pledge will help fintech’s grow and scale and create a competitive fintech ecosystem.

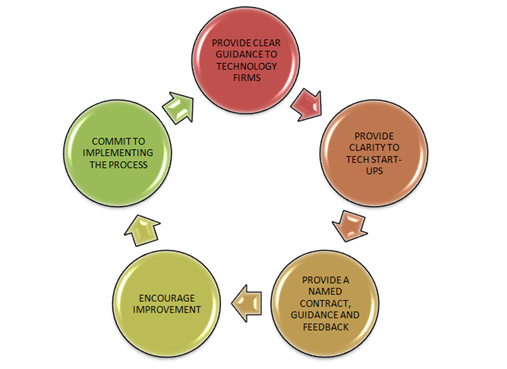

Principles of the Pledge

The pledge is based around five major principles:

- To provide clear advice to technology firms on how the onboarding procedure works through a specifically reserved online landing page.

- To provide clarity to tech start-up firms on their progress through the onboarding process.

- To provide a named contact, assistance, and response.

- To encourage good practice and improvement.

- To pledge to execute this process six months from signing this pledge and provide feedback every six month in the first year.

About Tech Nation

Tech Nation is a networking organisation which supports the UK’s domestic and international. It was started in 2010 with the vision to help companies develop by providing them with coaching, content and access to a community. Tech Nation’s main aim is to help develop 1,000 scaling tech leadership teams across the UK by 2022. Banks are realising the changing landscape, and the need to evolve in order to survive.

Reactions to the Pledge and Stock Performance of the signatory banks on the LSE

- Barclays Group PLC

According to the Group COO of Barclays, Mark Ashton Rigby the bank plays a vital role in helping technology companies to start up and grow. Therefore, the Fintech Pledge will be helpful in supporting transparent and efficient collaboration between the Fintech companies and the bank.

Barclays Group PLC (LON: BARC) stock was trading at GBX 101.64 on 16 September 2020, at 1:23 PM, down by 0.97 per cent from its previous close of GBX 102.64. The 52-week low/high price range was GBX 80.24/192.46. It was having a market capitalisation (Mcap) of £17,808.91 million.

- HSBC Holding PLC

Emma Bunnell, chief operating officer, HSBC UK, commented that HSBC recognises the valuable contribution that fintech companies can make to help the bank in building the future of the banking sector to best serve the customers, and help UK companies grow and navigate new opportunities in the UK and worldwide.

HSBC Holding PLC (LON: HSBA) stock was trading at GBX 315.40 on 16 September 2020, at 1:27 PM, down by 2.31 per cent from its previous close of GBX 322.80. The 52-week low/high price was GBX 317.00/624.60. It was having a market capitalisation (Mcap) of £65,744.78 million.

- Lloyds Group PLC

The chief technology officer of Lloyds Banking Group, Juan Gomez Reino stated that being the UK’s largest digital bank, Lloyds is committed to enhancing and strengthening customer experience. The partnership with fintech’s will allow them to speed up that makeover, delivering innovations that push the limits of what is achievable.

Lloyds Group PLC (LON: LLOY) stock was trading at GBX 26.15 on 16 September 2020, at 1:32 PM, down by 0.31 per cent from its previous close of GBX 26.16. The 52-week low/high price was GBX 25.88/67.25. It was having a market capitalisation (Mcap) of £18,514.59 million.

- NatWest Group PLC

The Director of Innovation of NatWest Group, Kevin Hanley said that partnering with fintechs and other tech start-ups have been a fundamental part of the bank’s approach to innovation. The Group is delighted to be one of the founding signatories of the Fintech Pledge.

NatWest Group PLC (LON: NWG) stock was trading at GBX 101.15 on 16 September 2020, at 1:36 PM, down by 0.04 per cent from its previous close of GBX 101.60. The 52-week low/high price was GBX 101.60/120.90. It was having a market capitalisation (Mcap) of £12,321.13 million.

- Banco Santander S.A.

The director of Innovation of Santander UK, Stephen Dury commented that fintech’s play an important part in driving innovation in the financial services sector, and by pledging to work collaboratively with fintech, the bank will be able to open up new services and bring greater choice to its customers.

Banco Santander S.A. (LON:BNC) stock was trading at GBX 160.54 on 16 September 2020, at 1:40 PM, down by 2.70 per cent from its previous close of GBX 165.00. The 52-week low/high price was GBX 160.36/347.80. It was having a market capitalisation (Mcap) of £27,419.89 million.

Conclusion

The FinTech industry is on the way to continuously transform how financial services are delivered. Consumers seeking such services will be great beneficiary from the convenience perspective as well as cost savings. The pledge signed by the banks will prove to be helpful for the start-ups and tech sector to place themselves in a better way in the market.