In May of 2019, the UK Department of International Trade published an investment case and a research report called âUK FinTech: State of the Nationâ which highlighted some of the key development made in the United Kingdom Fintech space in the recent past, and detailed how these developments and changes have shaped an environment for a healthy growth of the FinTech sector in the country. At that time, it was reported that the UK Fintech sector generated an average revenue worth £6.6 billion annually, from an estimated number of 1600 FinTech firms that were operating in the United Kingdom at the time of the report being published. This number is expected to double by the year 2030, which will also lead to a significant increase in the employment under this sector, the strength of which was reported to be 76,500 at the time of the publishing of the report but was expected to increase to 105,500 by the year 2030.

The report also mentions that the government will be making all kinds of regulatory changes, especially for the purpose of the growth of the digital payment mechanisms in the country, which will also be driven by some key technological areas such as Blockchain, Drones, Internet of Things, Robots, 3D Printing, Virtual and Augmented Reality as well as Artificial Intelligence.

The report also highlighted that approximately US $3.3 billion worth of Venture Capital, Private Equity and Corporate Venture Capital investments were made in FinTech space in the country by the end of 2018.

The rise of Revolut

This development of the FinTech space in the country has led to the growth of Revolut, which is a FinTech start-up, and which reportedly became the most valuable technology start-up in the country. As in a recent financing round, the companyâs value tripled from £1.3 billion to a little over £4.2 billion. This successful funding round has now put the company above its competitor Monzo, which also operates in a similar space of digital banking and payments system.

The companyâs flagship product is a prepaid card that offers free currency exchange to its customers. This product caters to individuals, along with many other services such as investment accounts, digital payments, Investment in Cryptocurrency as well as Insurance services. The company also has a business segment, through which it provides a host of similar payment services, corporate cards as well as checking and savings accounts for the employees of some of the biggest businesses in the country. The companyâs success has been of top-class in the last few years, it employs around 2000 people globally â 1000 of whom are based out of Krakow in Poland.

The prime challenge being faced by the company, as well as some of its competitors is that these companies have not started making profit yet. As a matter of fact, Revolut reported a loss before tax of around £33 million in 2018.

Another challenge the company faces is the controversy regarding its connections with the Russian State and the Kremlin, as its founder, Nik Storonsky, who was previously a trader at Lehmann Brothers, and is the son of the director at a division of the Russian natural gas group Gazprom. This had previously raised concerns both in and out of the UK administration, as Gazprom had been under US sanctions since 2014. The company though tried remaining away from the controversy and to show its strength in the sector announced some high-profile appointments at the higher levels of management.

Despite all these challenges, the investors have shown their faith and have valued the company at £4.2 billion, primarily because of the growth that the company, as well as this sector, is likely to see in the coming future.

The massive funding round of Revolut, and the progress made by some of the start-ups in this space is likely to impact other FinTech stocks trading on the London Stock Exchange. Let us have a brief look at how some of these stocks have reacted to this major announcement.

PAY Share Price Performance

As on 25th February 2020, at 08:30 A.M (Greenwich Mean Time), by the time of writing this report, the PayPoint Plc share was trading at a price of GBX 906.00 per share on the London Stock Exchange market, an increase in the value of 0.11 per cent or GBX 1.00 per share, as opposed to the price of the share on the previous trading day, which had been reported to be at GBX 905.00 per share. At the time of writing this report, the market capitalisation of PayPoint Plc has been reported to be at a value of GBP 618.65 million, with respect to the current trading price of the companyâs share.

It has been reported that the PayPoint Plc share had gained around 5.10 per cent in value, in the last twelve months, since February 25, 2019, when the share was trading at a price of GBX 862.00 per share at the time of the close of the market.

FIN Share Price Performance

As on 25th February 2020, at 08:35 A.M (Greenwich Mean Time), by the time of writing this report, the Finablr Plc share was trading at a price of GBX 76.45 per share on the London Stock Exchange market, an increase in the value of 2.07 per cent or GBX 1.55 per share, as opposed to the price of the share on the previous trading day, which had been reported to be at GBX 74.90 per share. At the time of writing this report, the market capitalisation of Finablr Plc has been reported to be at a value of GBP 524.30 million, with respect to the current trading price of the companyâs share.

It has been reported that the Finablr Plc share had lost around 52.35 per cent in value, in the last twelve months, since February 25, 2019, when the share was trading at a price of GBX 160.44 per share at the time of the close of the market.

APP Share Price Performance

As on 25th February 2020, at 08:40 A.M (Greenwich Mean Time), by the time of writing this report, the Appreciate Group Plc share was trading at a price of GBX 63.97 per share on the London Stock Exchange market, an increase in the value of 3.18 per cent or GBX 1.97 per share, as opposed to the price of the share on the previous trading day, which had been reported to be at GBX 62.00 per share. At the time of writing this report, the market capitalisation of Appreciate Group Plc has been reported to be at a value of GBP 115.54 million, with respect to the current trading price of the companyâs share.

It has been reported that the Appreciate Group Plc share had lost around 13.44 per cent in value, in the last twelve months, since February 25, 2019, when the share was trading at a price of GBX 73.90 per share at the time of the close of the market.

EQLS Share Price Performance

As on 25th February 2020, at 08:45 A.M (Greenwich Mean Time), by the time of writing this report, the Equals Group Plc share was trading at a price of GBX 43.25 per share on the London Stock Exchange market, no change in the price of the share, as opposed to the previous trading day. At the time of writing this report, the market capitalisation of Equals Group Plc has been reported to be at a value of GBP 77.25 million, with respect to the current trading price of the companyâs share.

It has been reported that the Equals Group Plc share had lost around 65.26 per cent in value, in the last twelve months, since February 25, 2019, when the share was trading at a price of GBX 124.50 per share at the time of the close of the market.

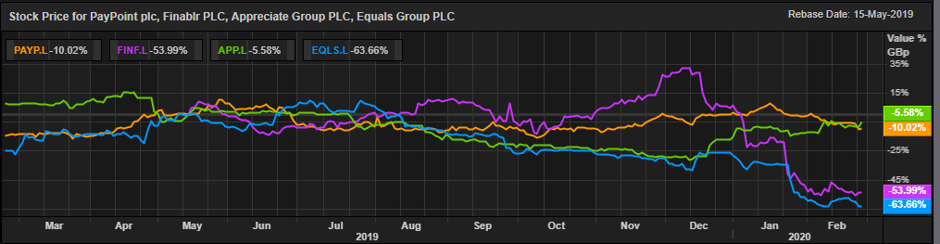

Comparative Share Price Chart of PAY, FIN, APP and EQLS

(Source: Thomson Reuters) Daily Chart as on 25-February-20, before the closing of the LSE Market