Summary

- JTC Plc had shown an increase of 15.2% in its revenue during H1 FY20.

- JTC would acquire INDOS for around £12.5

- JTC had a cash conversion ratio of 108% as of 30 June 2020.

- JTC had expected to deliver 8%-10% revenue growth during FY20.

JTC Plc (LON:JTC) is the LSE listed financial stock. JTC’s shares have generated a return of about 46.47% in the last 12 months. It is listed on the FTSE 250 Index.

On 13 April 2021, JTC will announce its full-year FY20 results.

Business Model

JTC is the award-winning provider of fund, corporate and private client services. The Company was founded in 1987 and currently employs around 900 people.

(Source: Company website)

Recent News

On 15 February 2021, JTC had announced that it would acquire INDOS for around £12.5 million. The transaction included cash consideration of £10 million and JTC equity of £1 million. INDOS had delivered revenues of around £3.70 million for the financial year ended on 31 December 2020.

On 10 December 2020, JTC had updated regarding the acquisition of RBC CEES Limited, strengthening the corporate services business line by enhancing its scale. The consideration of this acquisition constituted £20.0 million of cash from already existing facilities.

FY20 Trading Update (as of 25 January 2021)

- JTC had demonstrated a 20% growth in its annualized new business during FY20 to £17.9 million driven by resilient performance during Q4 FY20.

- The Private Client Services (PCS) division had shown strong business performance during FY20.

- JTC had implemented organizational restructuring within Institutional Client Services("ICS") Division during the period.

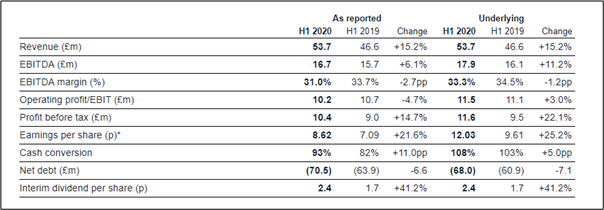

Financial Highlights (for six months ended on 30 June 2020 as on 15 September 2020)

(Source: Company result)

- The revenue of the Company surged by 15.2% to £53.7 million, driven by 5.1% growth of acquisitions made during H1 FY20.

- The underlying EBITDA and underlying PBT were increased by 11.2% and 22.1%, respectively during H1 FY20.

- The underlying EPS had increased by 25.2% to 12.03 pence per share during H1 FY20 ended on 30 June 2020.

- With regards to its financial position, the underlying net debt of the Company has increased from £60.9 million during H1 FY19 to £68.0 million during H1 FY20.

- JTC had raised its interim dividend for H1 FY20 by 41.2% to 2.4 pence per share.

- The underlying cash conversion ratio stood at 108% as of 30 June 2020.

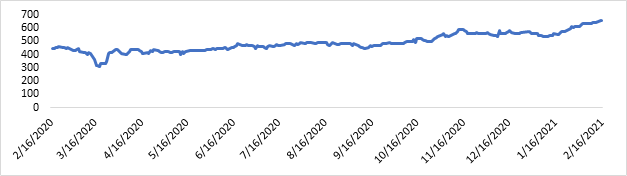

Share Price Performance Analysis of JTC Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of JTC Plc were trading at GBX 656.00 and were up by close to 0.31% against the previous closing price as on 16 February 2021, (before the market close at 11:11 AM GMT). JTC's 52-week Low and High were GBX 280.00 and GBX 660.00, respectively. JTC Plc had a market capitalization of around £801.29 million.

Business Outlook

JTC had successfully completed the acquisition of NESF and Sanne. Furthermore, the Company will acquire CEES from RBC and will take advantage of its client book of over 430 corporate relationships with assets under administration of £11 billion. JTC had anticipated its FY20 results to meet management expectations. The Company is expecting a cash conversion ratio in the range of 85.0% to 90.0% during FY20. Moreover, JTC expects to deliver revenue growth ranging from 8% to 10% during FY20, with an underlying EBITDA margin ranging from 33% to 38%. The Company had forecasted positive inorganic growth driven by impressive pipeline with an objective to expand its global base and enhance its product offerings.

Overall, JTC has a positive outlook as it would continue to seek lucrative opportunities for organic and inorganic growth in several geographic areas and across key product lines.