Summary

- Tritax Big Box reported net rental income of £78.8 million, which increased by 13.9 percent year on year in H1 FY2020. The income was supported due to the substantial rent collection.

- The adjusted earnings per share were 3.26 pence in H1 FY2020.

- Warehouse REIT received 94 percent of the rent for the quarter ended June 2020. It has agreed on an advanced monthly payment of the rent.

- The Company sold seven non-core assets in July 2020, and it is focusing on improving the income from the existing portfolio.

Tritax Big Box REIT PLC (LON:BBOX) has a dividend yield of around 4.33 percent, and Warehouse REIT PLC (LON:WHR) had a dividend yield of close to 5.41 percent. Shares of BBOX were down by close to 0.48 percent, and shares of WHR were up by around 0.44 percent from the previous closing price (as on 4 September 2020, before the market close at 11:20 AM GMT+1).

Tritax Big Box REIT PLC (LON:BBOX) - Declared the interim dividend of 3.125 pence per share

Tritax Big Box REIT PLC is a UK based company that invests in warehouses. The Company targets large warehouses all well-located. It has 61 assets with a portfolio value of close to £4.18 billion. Tritax Big Box is included on the FTSE-250 index.

Sale of Chesterfield Asset as reported on 3 September 2020

On 3 September 2020, the Company reported that it sold the Chesterfield asset for £57.3 million to Warehouse REIT. Tritax Big Box bought the asset in 2014, and it was leased to Tesco at that time. In 2018, the Company entered into a 15-year lease with Amazon. Given the premium price it was receiving on the asset it decided to sell the property and realized an annual IRR of 18.5 percent on the book value of the asset as on 30 June 2020.

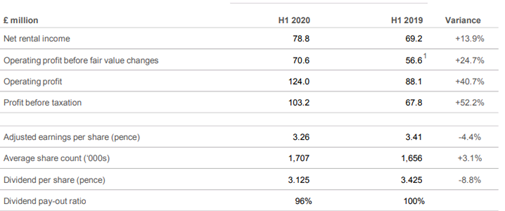

Result for H1 FY2020 (ended 30 June 2020) as reported on 6 August 2020

(Source: Company website)

Tritax Big Box generated a net rental income of £78.8 million in H1 FY20, which was up by 13.9 percent year on year from £69.2 million in H1 FY19. The demand for major logistics assets was strong during the period, and the rent collection was 97 percent for Q2 FY20. The adjusted operating profit increased by 24.7 percent year on year to £70.6 million in H1 FY20. The adjusted earnings per share were 3.26 pence, which fell from 3.41 pence in H1 FY19. As on 30 June 2020, Tritax Big Box had contract annual rent roll of £178.9 million for 61 assets, and it also includes the rent related to pre-let assets under construction. The total property value of the Company that includes let and pre-let assets increased by 6.1 percent year on year from £3.94 billion in H1 FY19 to £4.18 billion in H1 FY20. Tritax Big Box declared the interim dividend of 3.125 pence per share for H1 FY20. As on 30 June 2020, Tritax Big Box had net debt of £1,256.5 million, and it had undrawn committed borrowing facility of £317 million. The Company highlighted that it would receive 99 percent of the rent for Q3 FY20 by end of August.

Share Price Performance Analysis

1-Year Chart as on September-4-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Tritax Big Box REIT PLC's shares were trading at GBX 154.56 and were down by close to 0.48 percent against the previous closing price (as on 4 September 2020, before the market close at 11:20 AM GMT+1). BBOX's 52-week High and Low were GBX 162.40 and GBX 79.00, respectively. Tritax Big Box REIT had a market capitalization of around £2.64 billion.

Business Outlook

The Company expects earnings to be resilient in H2 FY20 based on the development activity that would be partly offset by the asset sale. During the first half of the year, the demand from the online channels supported the logistics real estate. The project development at Littlebrook and Dartford are on track. The Company is confident of its asset portfolio, and it is working on the future pipeline for letting and development of assets.

Warehouse REIT PLC (LON:WHR) - Purchased two logistic properties for £82 million

Warehouse REIT PLC is a UK based company that owns and operates warehouses. The warehouses are let-out to e-commerce businesses. Warehouse REIT is included in the FTSE AIM UK 50 index.

Acquisition of Two Logistics Businesses

On 3 September 2020, Warehouse REIT announced the acquisition of two single-let assets. The warehouses are pre-occupied by Amazon and Wincanton and are situated in the East Midlands and Cheshire, respectively. The total cost of the asset acquisition was around £82 million. The assets have a net initial yield of 5.4 percent and a weighted average unexpired lease term (WAULT) of 9 years. The East Midland property is a 500,000 sq feet fulfilment centre that is rented to Amazon, and it has close to 13 years of remaining lease. The asset was bought from Tritax Big Box REIT at £57 million. The property at Cheshire is a 374,000 sq feet warehouse that is currently occupied by Wincanton Holdings, and it has 3.5 years of remaining lease. The property was purchased for £25 million, and it is presently rent out at £5 per sq feet.

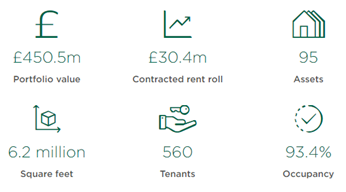

Business Update as reported on 6 August 2020

(Source: Company website)

As on 30 July 2020, the Company received 94 percent of the rent for the quarter ended June 2020, and the Company is actively discussing with the tenants over the collection of the remaining rent. The Company has consulted for the monthly advance payment of the rent. As on 30 July 2020, Warehouse REIT had cash of £111 million and an undrawn credit facility of £63 million. The Company is prudently taking care of the liquidity. At a net initial yield of 6.1 percent, the Company decided to sell seven non-core assets in July 2020. The Company received a payment of £9.9 million from the sale of assets. The Company has submitted the application for the development of the property at Radway Green along with the adjoining owner. The conclusion on the application would be determined in Q4 FY20. Warehouse REIT would pay a dividend of 1.55 pence per share for the first quarter in October 2020.

Share Price Performance Analysis

1-Year Chart as on September-4-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Warehouse REIT PLC's shares were trading at GBX 115.00 and were up by close to 0.44 percent against the previous closing price (as on 4 September 2020, before the market close at 11:20 AM GMT+1). WHR's 52-week High and Low were GBX 121.51 and GBX 68.77, respectively. Warehouse REIT had a market capitalization of around £434.35 million.

Business Outlook

The Company highlighted that the funds raised in July 2020 had been used for recent acquisition and it would continue with the other identified opportunities. The focus would be to integrate the recent addition with the existing portfolio and reap on the synergy. Amazon has become the largest tenant of the Company from the purchase of the property in the East Midlands. The Company is confident over the future of the UK's e-commerce market and it would focus on improving the portfolio income.