Summary

- MJ Hudson Group Plc had reported a 22% surge in its underlying revenue during FY20.

- The Company had made a total of three acquisitions during FY20.

- The revenue of Data & Analytics business segment had delivered an exceptional growth of 88% during FY20.

- The Company is looking forward to paying a dividend for the first time in FY21.

MJ Hudson Group Plc is the FTSE AIM All-Share listed company, which is the international asset management consultancy providing legal services, outsourcing, analytics and advisory services to a wide range of fund managers and investors around the globe. The Company had a team of 180 employees.

MJ Hudson Group Plc (LON:MJH) is the LSE listed financial stock. Based on its 1-year performance, shares of MJH have generated a negative return of 17.80%. Shares of MJH last traded at GBX 48.50 (as on 30 December 2020).

Business Model

The Company has four reportable business segments – Advisory, Business Outsourcing, Data & Analytics and Organic Investments.

- Advisory – It encapsulates Law and Investment advisory business units.

- Business Outsourcing – This segment encapsulates business support for fund managers through fund management solutions, international administration and reporting business units.

- Data & Analytics – This segment comprises its benchmarking business, as the Company is the specialist provider of operational benchmarking services tailored to the needs of institutional investors.

- Organic Investments – This segment includes three investments reaching its maturity levels.

Recent News

On 30 December 2020, the Company had announced that it would acquire PERACS Group for €6.0 million through a blend of cash and shares basis. The Company will pay €1.4 million by the issue of 586,016 new ordinary shares in MJ Hudson. The remaining €4.6 million will be paid over the three-year period with subject to achievement of specific key performance measures. PERACS Group is the fund manager analytics specialist offering a wide range of services to investors in the alternative assets industry. It has generated revenues of €1.0 million and EBITDA of €0.1 million during FY19 ended on 31 December 2019.

On 14 October 2020, the Company had announced regarding its acquisition of Bridge Group for €12.0 million through a mixed deal on cash and shares basis. The Company will pay €2.0 million initially by cash, and €10.0 million will be paid over two-years period consisting of cash and new ordinary shares in MJ Hudson representing approximately 20% of the total. Bridge Group is a well-known provider of specialist support services to the fund’s sector. It has generated revenues of €4.0 million and EBITDA of €0.5 million during FY20 ended on 30 September 2020.

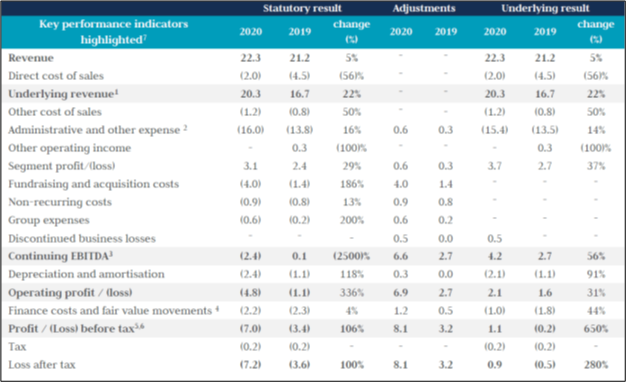

FY20 Financial Highlights (ended on 30 June 2020 as on 14 October 2020)

(Source: Company result)

- The underlying revenue of the Company was surged by 22% to £20.3 million for FY20 ended on 30 June 2020.

- Similarly, the underlying EBITDA also grew by 56% from £2.7 million during FY19 to £4.2 million during FY20.

- June 2020 remained the strongest revenue month for the Company.

- The statutory net cash flow generated from operating activities was negative £4.7 million during FY20, while it was negative £1.6 million during FY20.

- The underlying earning per share was 0.6 pence during FY20.

- With regards to its financial position, the net debt of the Company was reduced by £22 million to £10 million during FY20 ended on 30 June 2020. The Company had a cash balance of £13.4 million as of 30 June 2020.

- The Company is looking forward to paying a dividend for the first time in FY21.

- The Company had made a total of three acquisitions during FY20 -

- Spring Associates – The Company had completed the Acquisition of ESG Business in July 2019.

- Anglo Saxon Trust – The Company had received regulatory approval for the acquisition in January 2020.

- Meylar LLC – The Company had announced the acquisition in March 2020. It is North American marketing services and analytics-based Company having its clients base in alternative assets.

Segmental Business Performance (for 12 months ended on 30 June 2020 as on 14 October 2020)

(Source: Company result)

- The advisory business segment represented almost 50% of total revenue, and the revenue of this segment went down by 7% due to a reduction of 22% in Law revenues during the second half of the financial year. The underlying EBITDA margin was reduced to 14% in FY20 from 17% during FY19.

- The Business outsourcing segment had demonstrated 49% growth of revenues during FY20 driven by the acquisition of Anglo Saxon Trust Limited Jersey administration business on 31 January 2020. The underlying EBITDA margin also jumped to 45% during FY20.

- The revenue of Data & Analytics business segment had delivered an exceptional growth of 88% during FY20 driven by the acquisition of Spring Associates in July 2019 and Meylar LLC in March 2020. The underlying EBITDA margin was reduced to 33% during FY20.

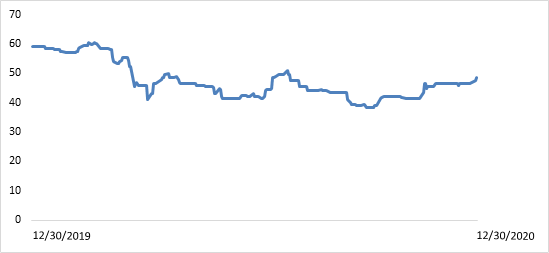

Share Price Performance Analysis of MJ Hudson Group Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of MJ Hudson Group Plc last traded at GBX 48.50 (as on 30 December 2020). MJH’s 52-week High and Low were GBX 61.63 and GBX 38.00, respectively. MJ Hudson Group Plc had a market capitalization of around £81.45 million.

Business Outlook

The Company is encouraged by its resilient performance across its three business divisions. The Company is well-positioned financially to make lucrative investments in the financial sector, bringing further synergy aligning with the strategic needs of the Company. The Company had made recent announcements regarding the acquisition of PERACS Group and Bridge Group. The Company had hinted that it would continue to track all the risk factors associated with Covid-19 pandemic, which would impact global stock markets to a certain extent. The Company remained cautiously confident regarding its trading conditions in alternative markets industry, and it will sustain well for the long term.