Summary

- An individual can take a sizable position in a stock in the present market plot as a large number of dividend-paying stocks are trading well below their respective 52-week highs

- Shares of BAE Systems, the Farnborough-headquartered defence, and aerospace service provider, have been trading below 500 pence from last month

- The stock of Rolls-Royce Holdings touched a 17-year bottom of GBX 100.80 before closing at GBX 113.60 on 2 October 2020

Stock market investment has always been driven by a number of factors including the sources of earnings, market prices of the shares, individual risk-taking capacities, ongoing volatility in the markets, geo-political reasons, widespread investment sentiments, natural calamities, interest rates, and foreign exchange rate variation. The capital markets across the world have been under heavy turmoil since the onset coronavirus pandemic and the fatal aftermath of the highly communicable disease.

The headline index FTSE 100 crashed nearly 35 per cent in the brief period of just 2 months eroding billions of pounds from the shareholders’ wealth. The FTSE 100 had dropped 2,680.67 points or 34.93 per cent to hit a yearly closing low of 4,993.89 on 23 March from a yearly closing high level of 7,674.56 achieved on 17 January 2020. A range of small-to-large-cap stocks bled in red in the corresponding time losing a considerable chunk of their respective market capitalisation. The FTSE 100 has partly recovered from the yearly bottom, but the market still remains highly susceptible to the unwarranted volatility due to the existing number of Covid-19 positive cases and the sensitive business environment.

The section of people who are readily willing to invest in the stock market at the moment can consider dividend-paying stocks. FTSE dividend-paying stocks can be a preferred investment choice as a bunch of such high dividend yield stocks offer regular dividends along with the capital gains on the market price. Most importantly, an individual can take a sizable position in a stock in the present market plot as a large number of dividend-paying stocks are trading well below their respective 52-week highs.

With the dividend-paying stocks in focus, we take a look at five FTSE dividend-paying shares priced below 500 pence that can be considered for long-term investment.

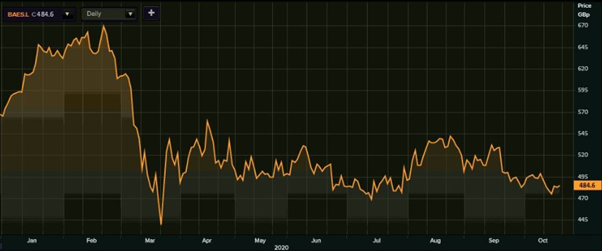

BAE Systems Plc (LON: BA.)

Shares of BAE Systems, the Farnborough-headquartered defence and aerospace service provider, have been trading below £500 from last month. The stock of BAE Systems had plunged more than 30 per cent in less than 22 trading days in the February-March period of the present calendar year after the outcome of the coronavirus pandemic started affecting business activity.

Stock Performance: BAE Systems Plc

Source: Thomson Reuters

BAE Systems share price slipped 34.39 per cent to a yearly closing low of GBX 438.90 on 23 March from a stock price level of GBX 669 as on 21 February 2020. With the much beaten down market prices, an investor can realise a relatively better dividend yield by taking a position in the stock at the current market price of GBX 482.10 on 19 October 2020, down 28.34 per cent from the 52-week high share price of GBX 672.80. BAE Systems, with a present dividend yield of 4.9 per cent, is scheduled to pay an interim dividend on 30 November 2020.

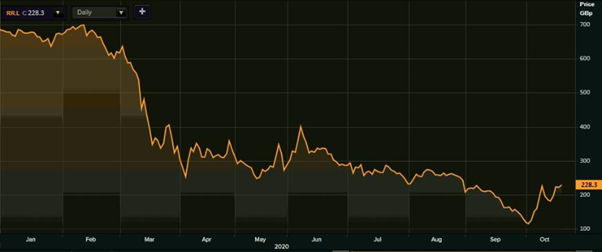

Rolls-Royce Holdings Plc (LON: RR.)

Shares of Rolls-Royce Holdings, the London-headquartered automaker and engineering firm, have lost more than 65 per cent of the market value year-to-date (YTD) on the back of Covid-19-led depression. Despite a few upswings, the Rolls-Royce share price has been largely falling in the present calendar year. The stock of Rolls-Royce Holdings touched a 17-year bottom of GBX 100.80 before closing at GBX 113.60 on 2 October 2020.

Stock Performance: Rolls-Royce Holdings Plc

Source: Thomson Reuters

However, Rolls-Royce Holdings share price recovered very sharply, nearly doubling the investors’ wealth in a week’s time after the firm announced the fundraising plans to the tune of £5 billion.

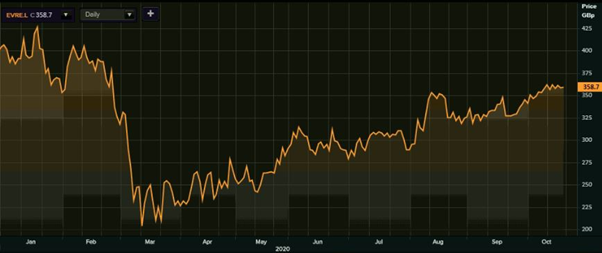

Evraz Plc (LON:EVR)

Shares of Evraz, the London-based steelmaker and miner, have shown a significant improvement after the slump occurred due to the coronavirus pandemic. Evraz share price plummeted as much as 52.3 per cent to a 3-year closing low of GBX 203.40 (12 March 2020) from a market price of GBX 426.20 as on 20 January 2020.

Stock Performance: Evraz Plc

Source: Thomson Reuters

The stock of Evraz has bounced up more than 75 per cent from the 3-year closing low with a series of regular and small gains in the meantime. Evraz shares have jumped 75.96 per cent to GBX 357.90 on 19 October in a period of the nearly seven-and-half months from GBX 203.40.

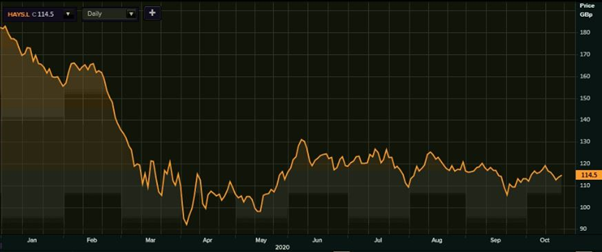

Hays Plc (LON:HAS)

The stock price of Hays, the London-headquartered recruitment and human resource services provider, has not seen a favourable uptick after the Covid-19-steered plunge. Hays share price had tumbled 49.67 per cent to a multi-year closing low of GBX 92 (3 April) from a market price of GBX 182.80 as on 2 January 2020.

Stock Performance: Hays Plc

Source: Thomson Reuters

Recently, Hays said the group’s fees went down by 29 per cent in the third quarter ended 30 September reiterating confidence to return with the growth trajectory.

ConvaTec Group Plc (LON:CTEC)

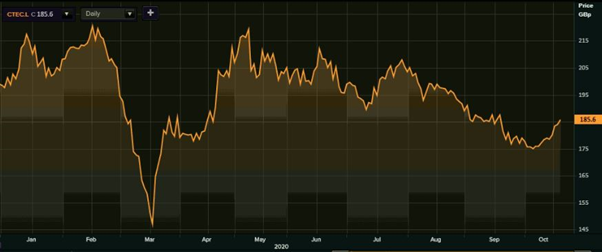

Shares of ConvaTec Group, the Deeside-headquartered medical products maker, have posted a v-shaped recovery after sliding down nearly 33 per cent to a yearly closing low of GBX 147 on 18 March 2020. ConvaTec share price dipped 33.30 per cent to the yearly bottom from a share price level of GBX 220.40 as on 17 February 2020. ConvaTec has recently paid a dividend on 15 October 2020.

Stock Performance: ConvaTec Group Plc

Source: Thomson Reuters

The company stock closed at a value of £183.80 on 19 October 2020.