Highlights

- FTSE 100 listed companies, Auto Trader Group Plc, Land Securities Group Plc, Diageo Plc, are among the many going Ex-dividend today, and the decline in the stock prices is mainly because of that.

- To be eligible for dividend payment, investors need to purchase shares of the company before the ex-dividend date.

When a company declares the dividend amount, along with that it also mentions the ex-dividend date and record date. To be eligible for the dividend payment, investors need to purchase the shares before the ex-dividend date, which usually occurs one day before the record date.

On the ex-dividend date, the stock price generally goes down by the amount of dividend paid as new investors in the stock after the ex-dividend date should not pay the premium price to buy the share as they won’t be eligible for the declared dividend payment.

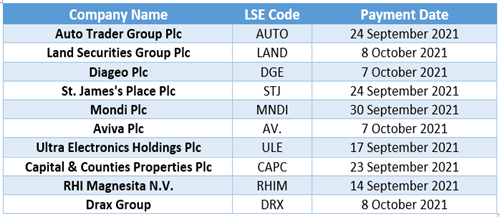

Let us look at 10 FTSE-listed stocks that are going ex-dividend today:

Auto Trader Group Plc (LON:AUTO)

The company is a prominent player in the digital automotive marketplace. The company sells its products to retailers, home traders and logistics firms.

Auto Trader Group Plc declared a final dividend of 5p per share on 10 June 2021, which will be paid on 24 September 2021.

The company reported £262.8 million in revenue, while its profit before tax was £157.4 million in the financial year ended 31 March 2021. The current dividend yield of the company stands at 0.8% as of 26 August 2021.

Land Securities Group Plc (LON:LAND)

The company deals into high-quality commercial as well as residential properties. It is one of the largest real estate companies in Europe, with an £10.8 billion of property under management.

The company declared a first-quarter dividend of 7p per share, which will be paid on 8 October 2021, while its dividend yield stands at 3.8% as of 26 August 2021.

The company reported revenue of £251 million and paid a total dividend of 27p per share in the financial year ended 31 March 2021.

Diageo Plc (LON:DGE)

The company, along with its subsidiary, engage in the production and sales of alcoholic beverages globally.

The company declared a final dividend of 44.59p per share to be paid on 7 October 2021. The company reported net sales of £12.7 billion and an operating profit of £3.7 billion during the entire year ended 30 June 2021. As a result, the company paid a total dividend of 72.55p per share during the year, a rise of 5% compared to 2020. Its current dividend yield stands at 2.1% as of 26 August 2021.

St. James's Place Plc (LON:STJ)

The company is a publicly-traded wealth management firm that manages its client’s equity and debt mutual fund.

The company has declared an interim dividend of 11.55p per share which will be paid on 24 September to the eligible shareholder.

The company reported a gross inflow of £9.2 billion and IFRS profit after tax of £120.9 million during the six months ended 30 June 2021. The company has a dividend yield of 3.2% as of 26 August 2021.

Mondi Plc (LON:MNDI)

The company is into the business of containers and packaging. It provides different kinds of packaging solutions, that are sold in more than 30 countries across the globe.

Mondi Plc will be paying an interim dividend of 20-euro cent per ordinary share on 30 September 2021.

The company reported group revenue of €3,627 million and an underlying EBITDA of €709 million with a margin of 19.5% in the first six months of 2021. As of 26 August 2021, the dividend yield of Mondi Plc is at 3.3%.

Aviva Plc (LON: AV.)

The company provides various insurance and savings products in the United Kingdom and in global markets.

The company declared an interim dividend of 7.35p per share, a rise of 5% compared to last year. The dividend will be paid on 7 October 2021 to eligible shareholders.

The life insurance company has also undertaken a share buyback program with maximum consideration of £750 million. The purpose of the buyback program is to reduce share capital and is expected to be complete by 17 February 2022. Aviva Plc, current dividend yield stands at 5.3% as of 26 August 2021.

Ultra Electronics Holdings Plc (LON:ULE)

The company provides engineering solutions in critical segments like defence and security.

The company declared a 5.2% rise in interim dividend at 16.2p per share, which will be paid on 17 September 2021.

The company’s current order book stands at £1,270 million, while its revenue is £404.5 million in the six months period ended 2 July. As a result, the company has a dividend yield of 1.9% as of 26 August 2021.

Capital & Counties Properties Plc (LON:CAPC)

The company engages in the development and management of properties in the United Kingdom.

The company has declared an interim dividend of 0.5p per share, to be paid on 23 September 2021.

The company reported a net rental income of £21 million, and the total value of the property stands at £1.8 billion during the six months ended 30 June 2021. As of 26 August 2021, the dividend yield of the company is at 0.9%.

RHI Magnesita N.V. (LON:RHIM)

The company is into the business of production, selling and installation of refractory products and systems used in industrial high-temperature processes across the world.

The company has declared an interim dividend of €0.5 per share to be paid on 14 September 2021.

The company reported revenue of €1,200 million and an adjusted EBITA of €128 million in the six months ended 30 June 2021. The current dividend yield of the company stands at 4.4% as of 26 August 2021.

Drax Group (LON:DRX)

The company is into the generation and distribution of renewable and low carbon electricity in the United Kingdom.

The company declared a dividend of 7.5p per share to be paid on 8 October 2021.

The company reported an adjusted EBITDA of £186 million and an operating profit of £84 million. The company has a strong liquidity and balance sheet. The current dividend yield of the company stands at 4.5% as of 26 August 2021.

.jpg)