Summary

- Pets at Home Group Plc has reported total revenue growth of 5.1% during H1 FY21.

- The omnichannel division has witnessed revenue growth of 65.8% to £77.1 million.

- The number of subscription customers has increased by 22% year on year to 970,000 for H1 FY21.

- The Company is expecting its FY21 underlying pre-tax profit to be around £93.5 million.

Pets at Home Group Plc (LON:PETS) is the LSE listed consumer stock. The Company is a well-established player from the pet care industry. Shares of PETS were down by close to 1.62% from the last closing price (as on 26 November 2020, before the market close at 03:07 PM GMT).

Pets at Home Group Plc is the FTSE 250 listed company, which is the leading UK-based player of the pet care business. The Company has a total of 450 stores as well as five specialist referral centres. The Company has two reportable business segments as retail and veterinary operations.

Pet care industry overview

The global pet care market is at an evolving stage and is growing due to the rise in the adoption of pets and growing demand for premium care products. The industry is segmented as per the type of animals. On the basis of type, Dogs held the largest market share owing to an increase in the adoption of dogs and health benefits associated with them. Cats segment is anticipated to witness lucrative growth soon as it requires less training and helps in reducing anxiety levels. There are various categories of business associated with this industry - Pet Food, Veterinary Care, Boarding/Grooming and Live Animal purchase.

The Covid-19 pandemic has a dampening impact on the economy as well as impacting pet humanization. The financially impacted pet owners are letting go of their pets for adoption. The foster care homes for pets are witnessing an increased inflow of abandoned animals. The government restrictions have also resulted in short supplies of premium pet care products forcing consumers to step down to cheaper brands. Veterinary care segment will continue to perform well and remain a vital aspect of the pet care industry.

H1 FY21 results (ended 08 October 2020) as reported on 24 November 2020

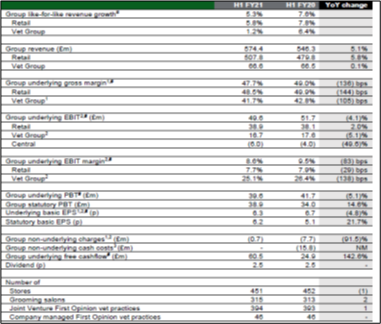

(Source: Company result)

- The Company has shown total revenue growth of 5.1% year-on-year from £546.3 million in H1 FY20 to £574.4 million in H1 FY21 ended on 08 October 2020 boosted by increasing demand during the second quarter of FY21.

- The underlying EBIT of the Company has seen a marginal drop of 4.1% to £49.6 million during H1 FY21 ended on 08 October 2020

- Regarding the financial position, the Company had a liquidity headroom of £348.0 million including £297.1 million of revolving credit facility (RCF) as of 08 October 2020. The net debt to EBITDA ratio stood at 0.4x. The net debt of the Company stood at £50.9 million.

- The Company has an underlying free cash flow of £60.5 million, driven by good cash generation from the First Opinion veterinary practices post recalibration.

- The Company has maintained the same amount of interim dividend of 2.5 pence per share for H1 FY21 as well.

Segmental Analysis

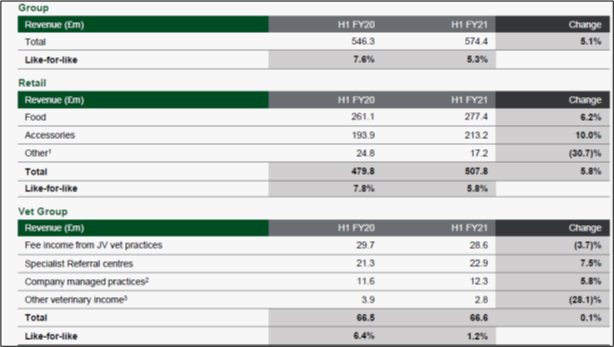

(Source: Company result)

Retail Segment - The operations of the Retail reporting segment comprise the retailing of pet products purchased online and in-store, pet sales, grooming services and insurance products. The LFL revenue growth of 5.8% is driven by resilient growth of 6.2% and 10%, in the Food and Accessories segment, respectively. The omnichannel part has witnessed revenue growth of 65.8% to £77.1 million driven by the rising number of pet owners shifting online, representing 15.2% of total Retail revenue in H1 FY21 while it was 10% during FY20. Grooming revenues have declined by 36.4% during H1 FY21, reflecting restrictions as a result of COVID-19.

Vet Group - This reporting segment comprises First Opinion practices and Specialist Referral centres. The revenue has remained flat as it got impacted by lockdown persisted during the first quarter of the year however the second quarter has shown resilient performance reflecting strong demand recovery post the easing of regulatory restrictions, good growth in new clients through the Puppy & Kitten Club, and an increase in new client registrations.

Key Performance Measures

- The number of VIPs purchasing both product and service continued to grow year-on-year, despite restrictions on the provision of services during Q1. The number of VIP customers has surged by 15% year-on-year to 6.0 million, and customers who are shopping through multi-channel grew by 20% year-on-year during H1 FY21 ended on 08 October 2020.

- The number of subscription customers has increased by 22% year on year to 970,000 for H1 FY21.

- The members of the Puppy and Kitten Club grew by 25% year-on-year during H1 FY21.

Recent News

On 02 October, the Company updated that Sharon Flood, a Non-Executive Director and Chair of the Remuneration Committee has been appointed to the Board of Getlink SE.

Share Price Performance Analysis of Pets at Home Group Plc

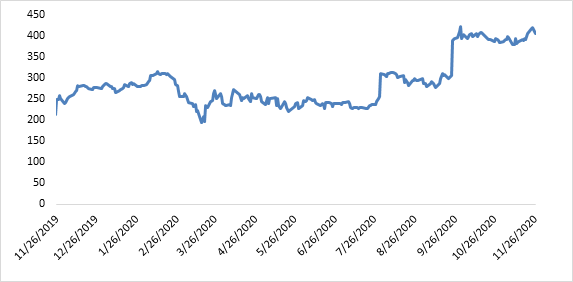

(Source: Refinitiv, chart created by Kalkine group)

Shares of Pets at Home Group Plc were trading at GBX 402.20 and were down by close to 0.99% against the previous closing price as on 26 November 2020, (before the market close at 08:05 AM GMT). PETS's 52-week High and Low were GBX 427.20 and GBX 174.90, respectively. Pets at Home Group Plc had a market capitalization of around £2.09 billion.

Business Outlook

The Company has witnessed a sustainable business performance in the second quarter of this financial year across both business segments, and it is hoping to carry the positive momentum in the third quarter as well. However, Covid-19 pandemic will create several headwinds and material uncertainties around the growth trajectory. The Group has adapted the operations rapidly post the onset of the pandemic, and the focus has shifted on customer acquisition. The Company is expecting market share gains across all channels and strong growth in the VIP and Puppy and Kitten Club.

The Company is anticipating FY21 underlying pre-tax profit to be in the range of FY20 (£93.5 million), with the adverse financial impact of the pandemic not completely neutralized by this year's business rates relief.