Summary

- Games Workshop Group's revenue increased by 15.3 percent year on year for three months ended in August 2020.

- Online sales underpinned the growth while the store sales are yet to recover.

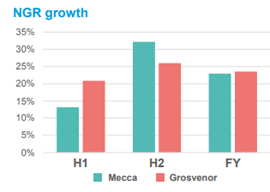

- Rank Group's net gambling revenue (NGR) fell by 8 percent year on year in FY2020 due closure of casinos.

- Digital sales grew by 23 percent year on year in FY2020.

The revenue of Games Workshop Group PLC (LON:GAW) grew at a CAGR of around 22.9 percent, whereas the revenue of Rank Group PLC (LON:RNK) grew at around -2.5 percent in between FY2016 and FY2020. Shares of both GAW and RNK were up by close to 4.55 percent and 0.80 percent, respectively (as on 11 September 2020, before the market close at 1:00 PM GMT+1). It is mindful to note that GAW touched its 52-week high of GBX 10,470.00 on 10 September 2020.

Games Workshop Group PLC (LON:GAW) - Earnings per share of 218.7 pence in FY2020

Games Workshop Group PLC is a UK based toy company that designs, manufactures and sells fantasy miniatures. The Company has its headquarter and manufacturing facility in Nottingham, UK. The signature products of the Company include Warhammer, Middle Earth and Black Library. Games Workshop is included in the FTSE-250 index.

Trading update as reported on 10 September 2020

The sales of the Company during three months ended 30 August 2020 was close to £90 million, which increased by 15.3 percent year on year from £78 million a year ago. The operating profit before royalty income increased from £28 million in 2019 to £45 million for three months in 2020. The royalty income was £3 million during the reported period. Online sales underpinned the growth in revenue. Games Workshop announced dividend payout of 50 pence per share that would be paid in October 2020.

FY2020 results (ended 31 May 2020) as reported on 28 July 2020

In FY20, the Company reported revenue of £269.7 million, which increased by 5.1 percent year on year from £256.6 million in FY19. The royalty income increased by £6.0 million to £17.0 million in FY20. The operating profit increased by 10.8 percent year on year to £90.0 million in FY20 from £81.2 million a year ago. The profit before tax was £89.4 million, and earnings per share were 218.7 pence in FY20. As on 31 May 2020, Games Workshop had net cash of £52.9 million. The Company paid a dividend of 145 pence per share in FY20.

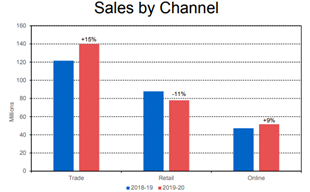

Performance by segment in FY2020

(Source: Company website)

By segment, Trade reported sales of £139.0 million, which was close to 52 percent of the total sales. Trade sales grew by 14.4 percent year on year in FY20. Retail division generated sales of £77.6 million in FY20, which declined by 11.6 percent year on year from £87.8 million in FY19. Online sales grew by 9.3 percent year on year to £57.1 million in FY20. As on 31 May 2020, Games Workshop was operating 531 stores across the UK, North America, Europe, Australia and Asia.

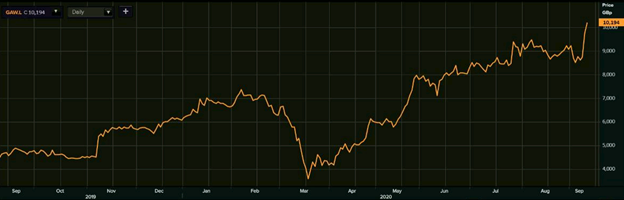

Share Price Performance Analysis

1-Year Chart as on September-11-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Games Workshop Group PLC's shares were trading at GBX 10,194.00 and were up by close to 4.55 percent against the previous closing price (as on 11 September 2020, before the market close at 1:00 PM GMT+1). GAW's 52-week High and Low were GBX 10,420.00 and GBX 3,564.00, respectively. Games Workshop Group had a market capitalization of around £3.19 billion.

Business Outlook

The Company highlighted that it is generating sales via online channels in the current situation, whereas the store sales are yet to recover. The long-term outlook of the business remains uncertain. Games Workshop would invest in increasing the warehouse capacity in Nottingham and Memphis. It has halted its new store opening plans for FY21, and plans to grow intellectual property while working along with the finest brands.

Rank Group PLC (LON:RNK) - Expects to generate positive cash flow if venues remain operational

Rank Group PLC is a UK based company that operates in the gambling sector. The Company has brands such as Grosvenor Casinos, Mecca and Enracha under its portfolio. Grosvenor Casinos operates online and mobile casinos, Mecca operates community gaming, and Enracha operates casinos in the Spanish market. Rank Group is included on the FTSE-200 index.

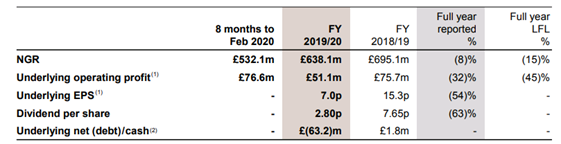

FY2020 results (ended 30 June 2020) as reported on 10 September 2020

(Source: Company website)

In FY20, Rank Group reported net gambling revenue (NGR) of £638.1 million, which fell by 8 percent year on year from £695.1 million in FY19. The performance of the Company was robust before lockdown as it generated NGR of £532.1 million in eight months ended in February 2020. The operating profit declined by 32 percent to £51.1 million in FY20 from £75.7 million in FY19. The profit after tax from continued operations was £9.4 million in FY20. Rank Group had a net cash outflow of £65.0 million and net debt of £63.2 million in FY20. No dividend will be paid for FY20.

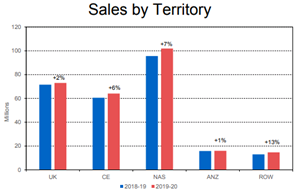

Digital Revenue Growth in FY2020

Source: Company website)

Rank Group reported digital net gambling revenue of £145.3 million in FY20, which increased by 23 percent year on year from £118.5 million in FY19. The digital brands of the Company performed well and digital sales were driven during the lockdown. Mecca and Grosvenor generated revenue of £76.5 million and £52.4 million from the digital channel in FY20.

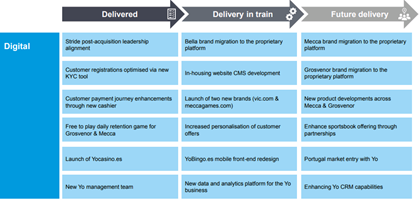

Focus on Digital Transformation

(Source: Company website)

Reopening of venues and early demand

Enracha reopened in phases in June 2020, and all the casinos under the Enracha brand are operational but with reduced capacity. Mecca reopened on 4 July 2020 in England, and except five venues all the sites have reopened. Grosvenor reopened on 15 August 2020 in England. The like for like revenue for Mecca is at 70 percent of last year's level from reopening until 6 September 2020. Spend-per visit has increased by 15 percent year on year. Grosvenor revenue is at 60 percent of the 2019 level between reopening and 6 September 2020. The fear of coronavirus has impacted the visits of older customers.

Share Price Performance Analysis

1-Year Chart as on September-11-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Rank Group PLC's shares were trading at GBX 126.00 and were up by close to 0.80 percent against the previous closing price (as on 11 September 2020, before the market close at 1:00 PM GMT+1). RNK's 52-week High and Low were GBX 328.79 and GBX 78.20, respectively. Rank Group had a market capitalization of around £488.35 million.

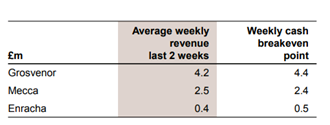

Business Outlook

(Source: Company website)

The Company is confident that it would have a positive cash flow if the venues remain operational. Customer confidence will boost once the social distancing norms are relaxed. Rank Group plans a capital expenditure of around £30.0 million in FY21. The Company highlighted that the average weekly revenue for the last two weeks before the report release at Grosvenor was £4.2 million, and the weekly cash breakeven point is £4.4 million. Similarly, the average weekly revenue for Mecca and Enracha was £2.5 million and £0.4 million, whereas the cash breakeven point is £2.4 million and £0.5 million, respectively.