Summary

- Informa PLC reported revenue of £814.4 million in H1 FY2020, which was declined by 42.1 percent year on year.

- The business performance was impacted due to the cancellation of the physical events.

- Pearson PLC reported revenue of £1,492 million in H1 FY2020, down by 17 percent year on year.

- Closure of test centres, bookstores and schools impacted the sales. Global Online Learning business division witnessed growth in H1 FY2020.

Informa PLC (LON:INF) and Pearson PLC (LON:PSON) are two FTSE-100 listed companies. Based on 1-year performance, shares of INF and PSON were down by around 53.42 percent and 42.31 percent, respectively. Shares of INF and PSON were down by about 2.05 percent and 2.50 percent, respectively from the last closing price (as on 21 September 2020, before the market close at 1:00 PM GMT+1).

Informa PLC (LON:INF) - FY2020 revenue to be around £1.7 billion

Informa PLC is a UK based group that is engaged in the business of publishing, business intelligence and research. The Group has business divisions that include, Informa Connect, Informa Intelligence, Informa Markets, Informa Tech and Taylor & Francis. It setups in-person and digital events and exhibitions, and it caters to an extensive range of clients. Informa is included on the FTSE-100 index.

H1 FY2020 results (ended 30 June 2020) as reported on 21 September 2020

(Source: Group website)

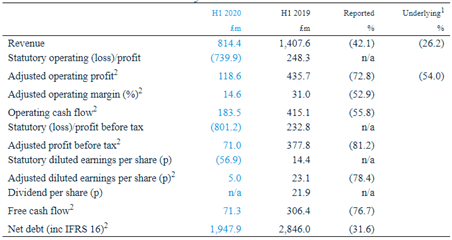

The Group revenue stood at £814.4 million in H1 FY20, which declined by 42.1 percent year on year from £1,407.6 million in H1 FY19. The adjusted operating profit fell to £118.6 million in H1 FY20 from £435.7 million in H1 FY19. The adjusted profit before tax was £71.0 million in H1 FY20, which declined from £377.8 million in H1 FY19. The diluted earnings per share were 5 pence in H1 FY20 against 23.1 pence in H1 FY19. The free cash flow during the reported period was £71.3 million and as on 30 June 2020, it had net debt of £1,947.9 million. Informa did not announce the interim dividend for H1 FY20.

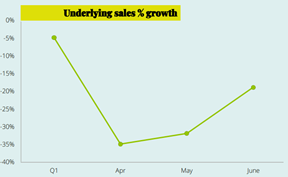

The Group incurred a non-cash impairment charge of £592.9 million related to goodwill in H1 FY20. It has put in place the Covid-19 Action Plan to cut the expenditure and strengthen the balance sheet, which has been extended until late 2021. The performance in the first half of the year was impacted due to the pandemic as the Group was not able to organize physical events. The business has started to show subtle cues of recovery after the conduct of physical business events in Mainland China.

Performance by Segment in H1 FY2020

Informa Markets generated revenue of £284.7 million in H1 FY20, which declined by 60.6 percent year on year from £722.0 million a year ago. Informa Connect revenue fell by 53.7 percent year on year to £65.5 million in H1 FY20. Informa Tech and Informa Intelligence generated revenue of £59.8 million and £147.9 million, respectively. Taylor & Francis was the only business division that reported growth in the performance, as it grew by 1.9 percent year on year to £256.5 million in H1 FY20.

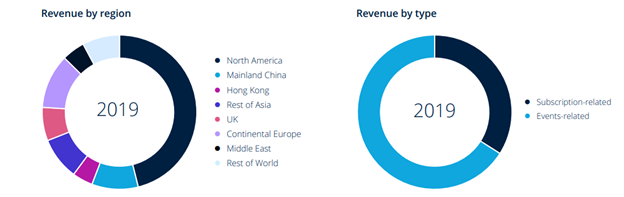

Portfolio Strength in FY2019

(Source: Group website)

Share Price Performance Analysis

1-Year Chart as on September-21-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Informa PLC's shares were trading at GBX 372.80 and were down by close to 2.05 percent against the previous closing price (as on 21 September 2020, before the market close at 1:00 PM GMT+1). INF's 52-week High and Low were GBX 875.40 and GBX 326.70, respectively. Informa had a market capitalization of around £5.72 billion.

Business Outlook

The Group witnessed disruption in the business performance in H1 FY20, and it has seen a loss in revenue of more than £1 billion due to the cancellation of the physical events. However, there are business segments such as special knowledge and information that has shown resilience, and there is good visibility for digital events, marketing and media services and subscription-based business. The Group is hopeful over its business model that offers services to diverse clients worldwide. Informa expects the FY20 revenue to be around £1.7 billion and the saving of around £600 million on the operating income.

Pearson PLC (LON:PSON) - Andy Bird appointed as the new CEO

Pearson PLC is a UK based group that provides content, assessment and digital services to educational institutions, government and corporate clients. The Group operates in over 70 countries and employs close to 22,500 people. Pearson categorizes the business under Global Online Learning, Global Assessment, North American Courseware and International.

Appointment of CEO

On 24 August 2020, Pearson announced the appointment of Andy Bird as the new CEO of the Group starting from 19 October 2020, who will take over the position from John Fallon. Andy Bird's annual base salary would be USD 1.25 million along with other incentive plans.

H1 FY2020 results (ended 30 June 2020) as reported on 24 July 2020

(Source: Group website)

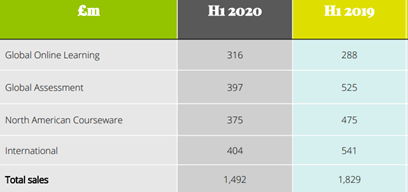

Pearson reported revenue of £1,492 million in H1 FY20, which declined by 17 percent year on year from £1,829 million in H1 FY19. The Group reported an adjusted operating loss of £23 million in H1 FY20 against a profit of £144 million in H1 FY19. In H1 FY20, the operating cash outflow was £214 million, and free cash flow was £251 million. As on 30 June 2020, Pearson had net debt of £982 million. The performance in H1 FY20 was severely impacted due to closedown of the test centres, schools and bookstores, which contribute a significant portion of the sales. However, there have been strong signals of a pickup in Global Online Learning.

Performance by Segment in H1 FY2020

(Source: Group website)

Global Online business revenue grew by 5 percent year on year to £316 million in H1 FY20 from £288 million a year ago. The performance was driven by new school launches and enrollment in current schools with a higher retention rate. Global Assessment revenue stood at £397 million, which fell by 27 percent year on year. The closedown of test centres and cancellation of a contract impacted the revenue; however, the business division won two new contracts. North American Courseware and International revenue declined by 14 percent and 23 percent year on year to £375 million and £404 million, respectively in H1 FY20. The sales were impacted due to the closure of campus book stores and the cancellation of exams.

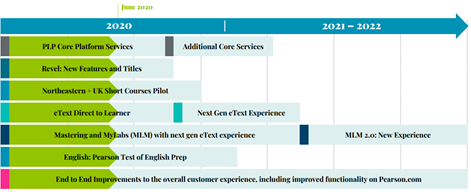

Digital Roadmap

(Source: Group website)

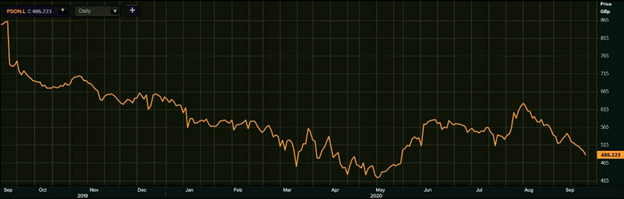

Share Price Performance Analysis

1-Year Chart as on September-21-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Pearson PLC's shares were trading at GBX 486.22 and were down by close to 2.50 percent against the previous closing price (as on 21 September 2020, before the market close at 1:00 PM GMT+1). PSON's 52-week High and Low were GBX 863.60 and GBX 412.08, respectively. Pearson had a market capitalization of around £3.76 billion.

Business Outlook

The Group expects the sales to improve in H2 FY20 as the schools and bookstores reopen, and there would be recovery based on the reopening of the test centres. It expects higher enrollment in virtual schools. There would be a decline in the print and unbundling of packages in the US Higher Education Courseware, and the business activity is expected to be close to that in 2019, but digital sales are expected to perform well.