Summary

- Burberry Group Plc has reported a 31% decline in revenues during H1 FY21.

- More than 10% of retail stores are closed due to lockdowns in Europe.

- National Express Group Plc has achieved 70% of last year's monthly revenue in October 2020.

- It expects EBITDA to range between £170 million to £190 million for FY20.

Burberry Group Plc (LON:BRBY) and National Express Group Plc (LON:NEX) are consumer discretionary stocks. Shares of BRBY were down by 0.59% and shares of NEX were up by 1.23%, respectively, from their last closing price (as on 16 November 2020, before the market close at 08:22 AM GMT).

Would Burberry Group Plc get affected by the closure of stores?

Burberry Group Plc is the FTSE 100 listed company, which is a manufacturer, wholesaler and retailer of luxury goods. The various product segments are Women, Men and Children apparel, accessories, and beauty (which includes fragrance and make-up).

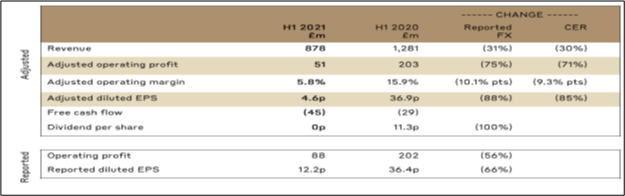

H1 FY21 financial highlights (ended 26 September 2020) as reported on 12 November 2020

(Source: Company presentation)

- The revenue of the Company declined by 31% year-on-year for H1 FY21 ended on 26 September 2020 to £878 million. Similarly adjusted profit has plunged by 75% year-on-year to £51 million due to the closure of stores for a significant period.

- The Company had net debt of £550 million as at 26 September 2020, and free cash outflow of £45 million during H1 FY21 ended on 26 September 2020. The Net Debt/Adjusted EBITDA stood at 0.9x.

- The Company has not declared any interim dividend due to weak trading performance.

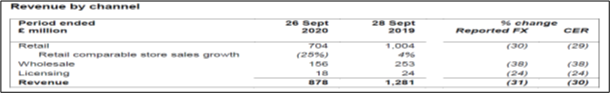

Segmental Analysis

(Source: Company result)

All three business channels have witnessed a decline in sales, mainly during the first quarter of the financial year. Retail, Wholesale and Licensing division has fallen by 30%, 38% and 24% year-on-year, respectively during H1 FY21.

Recent News

On 15 September 2020, the Company announced final terms of inaugural, medium-term, sustainability bond. The absolute terms of a sustainability bond are to raise £300 million at 1.125% due for 21 September 2025. The funds will be utilized to finance eligible sustainable projects as described by Burberry's Sustainability Bond Framework. Moody's Investors Services has given Baa2 rating indicating stable outlook.

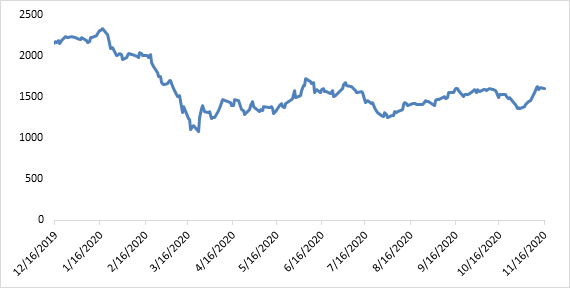

Share Price Performance Analysis of Burberry Group Plc

(Source: Refinitiv, chart created by Kalkine Group)

Shares of Burberry Group Plc were trading at GBX 1,602.50 and were down by close to 0.59% against the previous closing price (as on 16 November 2020, before the market close at 08:22 AM GMT). BRBY's 52-week High and Low were GBX 2,340.00 and GBX 1,017.00, respectively. Burberry Group Plc had a market capitalization of around £6.53 billion.

Business Outlook

The Company is highly conscious of the uncertainties caused in the consumer market due to Covid-19 disruptions. Currently, more than 10% of stores are closed due to lockdowns in Europe. The Company has already experienced the significant impact of the closure of stores in its trading performance during Q1 FY21. The Company has decreased markdowns and faced revenue headwind in Q2 FY21 because of it, but it will be beneficial from the long term prospects. The Company is expecting space growth to be approximately 3% in H2 FY21. The year-on-year exchange rate movements as of 30 October 2020 would generate an increase of £5 million on adjusted operating profit and an increase of £16 million on revenue for the full year.

Is National Express Group Plc well-prepared for recovery?

National Express Group Plc is the FTSE 250 listed Company that operates through various business segments like UK Bus, UK Coach, German Rail, North America, Spain and Morocco and Central functions.

FY2020 trading update as reported on 12 November 2020

The Company has performed well in October 2020, showing an improved trend as approximately 70% of last year's revenue was achieved in October compared to around 60% of previous year achieved in August. The Company has generated positive EBITDA in FY20, and it has recorded the highest EBITDA during October 2020. Fitch has given BBB investment rating and maintained its negative outlook on the Company and entire Transport sector as well.

Divisional Operating highlights

- The Company has witnessed a bounce back in the number of passengers in four of the six contracts while in Casablanca and Rabat, the patronage is running higher than the same period last year.

- The Company has provisionally received a seven-year contract to operate 200 urban buses in Porto, and it will generate over £112 million in revenue.

- The Company is currently operating services on 75% of school bus routes through full traditional and hybrid arrangements in North America.

- In the UK, the Company has temporarily reduced the UK coach network to around 9% of prior year's service on 9 November 2020 due to restrictions imposed by England's second lockdown.

Recent News

On 12 October 2020, The Company announced that Jose Ignacio Garat has been appointed as a Group Chief Executive with effect from 1 November 2020.

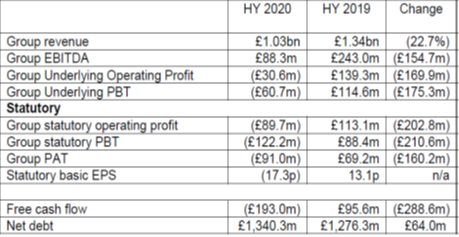

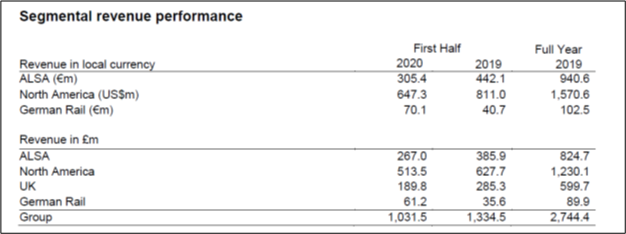

H1 FY2020 financial highlights (ended 30 June 2020) as reported on 13 August 2020

(Source: Company result)

The sales during H1 FY20 ended on 30 June 2020 declined by 22.7% to £1.03 billion while operating loss stood at £30.6 million during H1 FY20.

Regarding the financial position, the Company has a negative free cash flow of £193.0 million as in H1 FY20. The net debt of the Company has increased by £64.0 million and stood at £1,340.3 million as of 30 June 2020.

(Source: Company result)

The Company has shown a decline in its top-line across all business segments except the German Rail segment, where the revenue has seen significant growth.

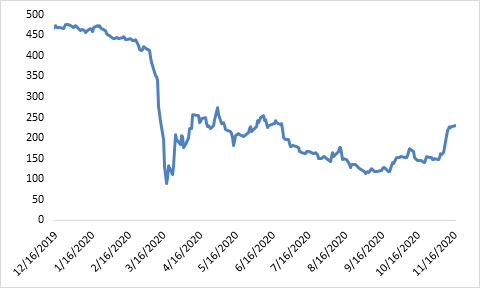

Share Price Performance Analysis of National Express Group Plc

(Source: Refinitiv, chart created by Kalkine Group)

Shares of National Express Group Plc were trading at GBX 230.20 and were up by around 1.23% against the previous closing price (as on 16 November 2020, before the market close at 08:22 AM GMT). NEX's 52-week High and Low were GBX 485.00 and GBX 66.30, respectively. National Express Group Plc had a market capitalization of around £1.34 billion.

Business Outlook

The Company has estimated EBITDA to be ranging from £170 million to £190 million for FY20. The Company has robust liquidity and expects to have £1.5 billion in cash and undrawn credit committed facilities by 31 December 2020. The Company has won several contracts in the UK and Portugal which will boost up the trading performance in the near future. The second wave of Covid-19 pandemic and corresponding lockdowns will hit the business, and the pace of recovery is quite uncertain. The adverse impact will offset the positive progress made by the Company during FY20.