Summary

- WH Smith's total revenue declined by 57 percent year on year in July 2020. The cash burn was in between £15 million and £20 million in July 2020.

- Sales in the US Travel store are expected to bounce back earlier than the other regions.

- Greencore reported revenue of £240.6million in Q3 FY2020. The Food to go segment revenue declined, whereas the Convenience food segment revenue improved during the quarter.

- The Northampton manufacturing facility is temporarily closed due to the covid-19 outbreak.

WH Smith PLC (LON:SMWH) & Greencore Group PLC (LON:GNC) are two FTSE 250 listed consumer stocks. Based on 1-year performance shares of SMWH and GNC were down by close to 41.27 percent and 42.40 percent, respectively. Shares of SMWH and GNC were down by around 2.80 percent and 4.14 percent, respectively from the previous closing price (as on 1 September 2020, before the market close at 10:15 AM GMT+1).

WH Smith PLC (LON:SMWH) - Company would undergo a restructuring that would include job loss

WH Smith PLC is a UK based company that is engaged in the retail business. The Company operates stores at airports, stations and high street and it runs close to 1,700 stores in the UK and in the international market. WH Smith categorizes the business under International travel retail, UK travel retail and UK High Street. It is included in the FTSE-250 index.

Trading update as reported on 5 August 2020

(Source: Company website)

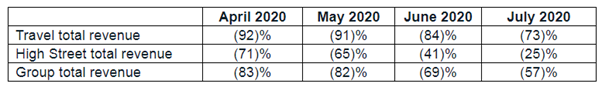

The total revenue on year on year basis in April, May, June, and July declined by 83 percent, 82 percent, 69 percent, and 57 percent, respectively. The overall revenue of the Company was affected due to the closure of the stores. WH Smith has highlighted that it would undergo a restructuring that would lead to the removal of close to 1,500 positions. The restructuring cost would be around £15million to £19million. As on 4 August 2020, WH Smith had cash of £63 million in addition to the undrawn credit facility and committed bank facility of £200 million and £120 million, respectively. The Company secured the funding under the government's covid-19 scheme. The cash burn of the Company was in between £15million and £20million in July 2020.

Travel segment

The Travel segment revenue on year on year basis in April, May, June, and July was down by 92 percent, 91 percent, 84 percent, and 73 percent, respectively. The Company started phased reopening of Travel stores at airports and railway stations in the UK. It has reopened 246 stores that contribute close to 75 percent of the Travel segment revenue and about 53 percent of the Travel stores in the UK. WH Smith has reopened 147 stores in the US; however, the sales at these stores remain down by 50 percent. The recovery in the US business is expected earlier than other regions as 85 percent of the customers are domestic. The Company would complete the integration of the InMotion head office into MRG by the end of the year. WH Smith has reopened 153 stores in the Rest of the World. The focus of the Company is to increase the average transaction value at the Travel stores.

High street segment

The High street segment revenue on year on year basis in April, May, June, and July was down by 71 percent, 65 percent, 41 percent, and 25 percent, respectively. The Company's 203 stores at the High street were operational during the lockdown. These stores are at the Post Offices that provide banking and postal service to the local people. The Company reopened the stores that were temporarily closed without significant challenge. WH Smith is currently operating 575 stores in the High street segment, but customer footfall remains low.

Share Price Performance Analysis

1-Year Chart as on September-1-2020, before the market close (Source: Refinitiv, Thomson Reuters)

WH Smith PLC's shares were trading at GBX 1,144.00 and were down by close to 2.80 percent against the previous closing price (as on 1 September 2020, before the market close at 10:15 AM GMT+1). SMWH's 52-week High and Low were GBX 2,660.00 and GBX 584.04, respectively. WH Smith had a market capitalization of around £1.54 billion.

Business Outlook

The Company highlighted that it witnessed slight recovery after an ease in lockdown although the sales remain subdued. WH Smith expects the Travel store business in the US to recover earlier than other regions as the majority of the customers are local. The Company is confident about the strength of the balance sheet, and it took the support of the government schemes. WH Smith witnessed some development in the High Street business, but it remains affected by the low footfall. It is hopeful of the future business given its diverse business model.

Greencore Group PLC (LON:GNC) - Sale of molasses business to United Molasses Limited

Greencore Group PLC is a UK based company that manufactures convenience food. The Company supplies food to convenience stores in the UK. Greencore manufactures sandwiches, salads, sushi, sauces, soups, and pickles. Greencore is listed in the FTSE 250 index.

Covid-19 update as reported on 21 August 2020

Greencore reported that it had closed the manufacturing facility at the Northampton due to the covid-19 outbreak at the site. The Company closed the facility after consulting with the Department of Health & Social Care, Public Health England. The decision was taken to prevent the health and safety of the colleagues. It has moved a portion of the manufacturing to the other facilities of the Company. Greencore is in discussion with its customer for the loss of the production. It is engaged with the government bodies to mitigate the impact of the covid-19. The affected people at the site are in isolation, and the Company plans to bring back the manufacturing to full capacity within 14 days of the start.

Q3 FY2020 trading update (ended 26 June 2020) as reported on 28 July 2020

(Source: Company website)

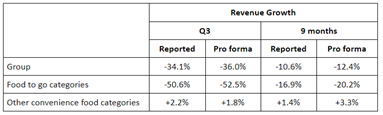

The total revenue fell by 34.1 percent year on year to £240.6 million in Q3 FY20. In Q3 FY20, Food to go segment revenue fell by 50.6 percent year on year to £123.8 million. Other convenience food segment revenue increased by 2.2 percent year on year to £116.8 million in Q3 FY20. From July 2020 to the date of the report, the revenue was down by 26 percent year on year. A slight recovery in the Food to go category witnessed from Q3 FY20 to Q4 FY20. Greencore has started the manufacturing facility at Bow, Atherstone and Heathrow. It reached an agreement with its lenders to waive off the net debt to EBITDA covenant conditions for September 2020 and March 2021 test. The Company signed a conditional deal to sell the molasses trading business to United Molasses Marketing Limited.

Share Price Performance Analysis

1-Year Chart as on September-1-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Greencore Group PLC's shares were trading at GBX 120.50 and were down by close to 4.14 percent against the previous closing price (as on 1 September 2020, before the market close at 10:15 AM GMT+1). GNC's 52-week High and Low were GBX 282.80 and GBX 83.40, respectively. Greencore had a market capitalization of around £560.82 million.

Business Outlook

The Company expects the current shutdown at the Northampton facility to be temporary, and it would not have a significant impact on the adjusted EBITDA for FY20. Given the current volatility in the market, the Company has suspended the financial guidance for FY20.