Summary

- Keywords Studios expects revenue close to €173.5 million in H1 FY20.

- Keywords Studios plans to launch the next-generation game consoles in H2 FY20.

- Keywords Studios placed new shares to raise close £100 million in May 2020.

- First Derivatives entered into a partnership with TCS for development and deployment of the solution based on Kx technology.

- First Derivatives reported revenue of £237.8 million for FY2020, up by 9 percent year on year.

- First Derivatives’ Kx segment reported revenue of £148.4 million in FY2020.

Keywords Studios PLC (LON:KWS) & First Derivatives PLC (LON:FDP) are the FTSE AIM UK 50 index listed companies. The 1-year return of KWS and FDP stocks were ~47.89 percent and ~36.02 percent, respectively (as on 18 August 2020, before the market close at 1:55 PM GMT+1). It is noteworthy that both KWS and FDP touched their 52- week high on 18 August 2020.

Keywords Studios PLC (LON:KWS) – Acquired Coconut Lizard in May 2020

Keywords Studios PLC provides technical and creative services to the video game industry. The Company has operations in 21 countries located across the Americas, Asia and Europe that house creative, marketing, software, and testing teams. Keywords Studios is included in the FTSE AIM UK 50 index.

Recent Events

- On 14 August 2020, Keywords Studios issued 198,576 new shares for the vendors of Gobo as a part of the acquisition of Gobo. Studio Gobo Ltd and Electric Square Ltd together form Gobo.

- On 26 June 2020, Keywords Studios acquired Coconut Lizard for close to £2 million. Coconut Lizard is based in Gateshead, UK, and it provides game development services and has intensive experience in Unreal Engine, a video game development engine. The Company generated revenue of close to £1.5 million and adjusted EBITDA of £0.35 million for the year ended 31 March 2020.

Six months trading update (ended 30 June 2020) as reported on 4 August 2020

In H1 FY20, the Company expects the revenue to be close to €173.5 million, which would increase by 13 percent year on year from €153.2 million in H1 FY19. The organic revenue growth in H1 FY20 was about 8 percent year on year that is much lower than the organic growth of 17.3 percent in H1 FY19. Adjusted EBITDA increased by 19 percent year on year to €30.8 million in H1 FY20 from €25.8 million a year ago. Adjusted profit before tax was €21.7 million during the reported period up by close to 18 percent year on year from €18.4 million in H1 FY19. The business activity was in line with expectation; however, Testing & Audio business was disrupted due to the covid-19. Keywords Studios reopened the Audio studio in June 2020 and the Testing studio in July 2020. Keywords Studios faced few challenges in hiring new talent at the entry-level for the testing operations in the Americas. In May 2020, the Company placed 6,900,000 new shares at 1,450 pence per share to raise close £100 million. As on 30 June 2020, Keywords Studios had net cash of €101 million and an undrawn credit facility of €100 million.

Share Price Performance

1-Year Chart as on August-18-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Keywords Studios PLC’s shares were down by close to 0.54 percent and trading at GBX 2,214.00 per share (as on 18 August 2020, before the market close at 1:55 PM GMT+1). KWS’s 52-week High and Low were GBX 2,246.00 and GBX 1,069.00, respectively. Keywords Studios had a market capitalization of £1.61 billion.

Business Outlook

The Company stated that the performance was steady during the unprecedented times, but it has moved some of the content production to the H2 FY20. It highlights that the demand for the video game sector was resilient during the pandemic, and thus the addressable market size for its clients have increased. Keywords Studios raised funding through the placement of shares that would be used for the Company’s M&A strategy and would help in maintaining the liquidity headroom. The Company would launch the next generation game consoles in H2 FY20, and it would develop new streaming platforms.

First Derivatives PLC (LON:FDP) – Expects performance in FY2021 to be steady

First Derivatives is a UK based technology company that provides services to finance, automotive, manufacturing and energy sector. The Company’s Kx technology platform is streaming analytics and operational intelligence platform that has a kdb and time-series database. It is headquartered in Newry, and it has offices at 15 locations in North America, Europe and the Asia Pacific.

Recent Events

- On 31 July 2020, the Company issued 29,000 new shares as a few employees exercised their share options. The new shares would be listed on AIM and Euronext Growth.

- On 20 July 2020, First Derivatives appointed Alan Coad as Chief Revenue Officer for Kx. It is the Company’s streaming analytics platform.

- On 19 May 2020, the Company entered into a partnership with Tata Consultancy Services (TCS) for development and deployment of the solution for TCS based on Kx technology. TCS is a global IT and Consulting firm.

FY2020 Annual results (ended 29 February 2020) as reported on 19 May 2020

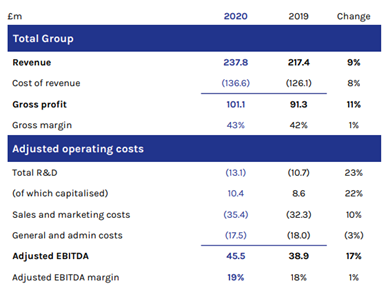

(Source: Company website)

In FY20, the Company reported revenue of £237.8 million that was up by 9 percent year on year from £217.4 million in FY19. Managed Services & Consulting division reported revenue of £89.4 million and Kx revenue was £148.4 million in FY20. The gross profit and adjusted EBITDA were £101.1 million and £45.5 million, respectively in FY20. Adjusted EBITDA increased by 17 percent year on year in FY20. The Company reported profit before tax of £18.3 million and the diluted earnings per share of 54.2 pence. Based on business activity, Fintech revenue was £178.8 million, MarTech was £47.3 million, and Industry was £11.7 million. As on 29 February 2020, First Derivatives had net debt of £49.4 million. To lower the effect of the pandemic, the Company did not announce a final dividend for FY20, but it paid the interim dividend of 8.5 pence per share for FY20. In March 2020, the Company withdrew £35 million from the financing facility, and it has £15 million of undrawn credit facilities. During the financial year, the Company had a few new contracts wins.

Share Price Performance

1-Year Chart as on August-18-2020, before the market close (Source: Refinitiv, Thomson Reuters)

First Derivatives PLC’s shares were up by close to 1.17 percent and trading at GBX 3,035.00 per share (as on 18 August 2020, before the market close at 1:55 PM GMT+1). FDP’s 52-week High and Low were GBX 3,115.00 and GBX 1,700.00, respectively. FDP had a market capitalization of £809.31 million.

Business Outlook

The Company stated that it entered FY21 on a strong note and expects it to continue. It did not have any material impact on the business when the Company announced the FY20 results as the recurring revenue over the short-term underpinned the performance. The sales cycles have moved forward. It stated that it would sustain the uncertain conditions given the strength of the balance sheet.