There has been sense of extreme volatility in the stock markets since the outbreak of the pandemic and different twists and turns related to contain it. However, there has been a buzz in the LSE market with a report that original epicentre of the Coronavirus, China since of late has been advising its local companies to look at the listing in London. Reportedly, the major purpose of this is to revitalise deals under a Stock Connect scheme and reinforce external links in the wake of the coronavirus crisis. Meanwhile, FTSE 100 after around 4 per cent gain in the last session was consolidating a bit and was down by just over half a per cent on 19 May 2020 at the time of writing.

Here we are discussing the latest earning of four London Stock Exchange-listed companies, Avon Rubber Plc, First Derivatives Plc, Georgia Healthcare Group Plc and Hardide Plc.

Overview of Avon Rubber Plc

Avon Rubber Plc (LON:AVON) is an advanced technology group, which produces and design niche products and services to increase the performance and abilities of its consumers. The company specialise in life-critical personal protection systems, as well as milking point solutions via two businesses, i.e. Avon Protection and milkrite | InterPuls.

AVON – Financial Highlights

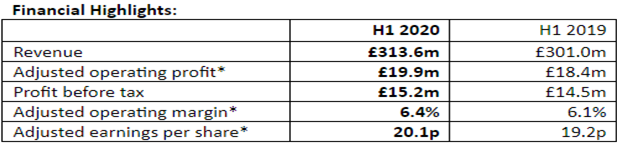

On 19th May 2020, the company announced its half-year results for the period ended 31st March 2020.

(Source: Company Website)

- Adjusted operating profit increased by 8 per cent to £19.9 million (2019: £18.4 million) in H1 2020.

- At 31st March 2020, the Group reported net debt of £16.1 million (2019: £17.2 million) as the company focused on cash generation and adopted a conservative approach to gearing.

- Investment in joint venture decreased significantly to £39 million as compared to £123 million as at 31st March 2019.

- Inventories increased marginally to £1.675 million as compared to £1.624 million as at 31st March 2019.

- During the novel coronavirus crisis, around 80 per cent of the company’s activities remains active.

- The company has received an additional revolving credit facility from HSBC and NatWest of £44.2 million during the H1 FY2020, which will expire in the year 2024.

AVON – Share Price Performance

The stock price of Avon Rubber Plc increased by 4.42 per cent or 125.00 points as compared to the previous day closing price to GBX 2,955.00 as on 19th May 2020 (at around 16:23 PM GMT). At the time of writing, the company’s Market Capitalisation was reported to be at £877.96 million, and the beta stood at 0.45, which shows the lower volatility as compared to the benchmark.

Overview of First Derivatives Plc

First Derivatives plc (LON:FDP) is a services and software company with top-class intellectual property in ultra-high-performance analytics, and it possesses widespread knowledge of its domain and holds capabilities in equity markets systems and technology. The company is operating through 15 locations and four continents across the globe. The company employs more than 2,400 personnel.

FDP – Financial Highlights

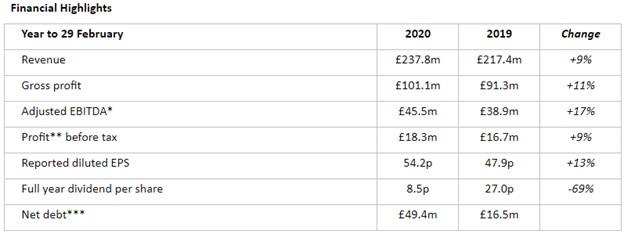

On 19th May 2020, the company announced its full-year audited results for the year ended 29th February 2020.

(Source: company website)

- Due to 23 per cent growth in recurring software license revenue, Software revenue increased by 13 per cent to £148.4 million (2019: £130.9 million) for the period ended 29th February 2020.

- There was good progress in the execution of strategy, because of which the company’s revenue increased by 9 per cent to £237.8 million and adjusted EBITDA increased by 17 per cent to £45.5 million for the period ended 29th February 2020.

- Deferred revenue at 29th February 2020 increased by 11 per cent at £21.8 million (2019: £19.5 million) due to the continued emphasis on the growth of recurring revenue.

- Reported profit after tax improved by 13 per cent to £14.9 million (2019: £13.2 million) and reported diluted earnings per share also increased by 13 per cent to 54.2 pence per share (2019: 47.9p) for the year ended 29th February 2020.

FDP – Share Price Performance

The stock price of First Derivatives Plc declined by 14.06 per cent or 405.00 points as compared to the previous day closing price to GBX 2,475.00 as on 19th May 2020 (at around 16:29 PM GMT). At the time of writing, the company’s Market Capitalisation was reported to be at £787.25 million, and the beta stood at 19.2, which shows the higher volatility as compared to the benchmark.

Overview of Georgia Healthcare Group Plc

Georgia Healthcare Group Plc (LON:GHG) is one of the prominent and largest healthcare services providers in the Georgian healthcare system. The company also operates the most important distribution and pharmacy operations. It is also the primary insurance provider for healthcare in the country.

GHG – Financial Highlights

On 19th May 2020, the company announced its first-quarter result for the year 2020.

- The company informed that due to novel coronavirus epidemic, the company is facing a significant impact on Hospital and Clinics Businesses.

- The robust organic revenue progress in the Distribution and Pharmacy segment was counterbalanced by low incomes in the Hospitals operations in the first quarter of 2020.

- The Group continued to increase gross profit while its gross margin decreased by 1.9 percentage points to 30.5 per cent in the first quarter of 2020 as compared to the same quarter the prior year.

- The Group's adjusted profit and Earnings per Share in the reported quarter totalled GEL 14.3 million.

- The ROIC ratio decreased by 0.5 percentage points to 11.8 per cent during the first quarter of the year 2020 as compared to 12.3 per cent in the prior year.

- As at 31st March 2020, the available cash and bank deposits reported to GEL 68.2 million, which is an increase of 147 per cent on year on year basis.

GHG – Share Price Performance

The stock price of Georgia Healthcare Group Plc declined by 0.79 per cent or 0.70 points as compared to the previous day closing price to GBX 88.00 as on 19th May 2020 (at around 16:16 PM GMT). At the time of writing, the company’s Market Capitalisation was reported to be at £115.69 million, and the beta stood at 0.84, which shows the lower volatility as compared to the benchmark.

Overview of Hardide Plc

Hardide Plc (LON:HDD) is one of the prominent international innovator and supplier of modern tungsten carbide/tungsten metal matrix coatings. The company was incorporated in the year 2000 by the team of Venture Capitalist of the United Kingdom. The company is listed on the London Stock Exchange and trade under the Alternative Investment Market.

HDD – Financial highlights

On 19th May 2020, the company declared its Interim Results for the six months ended 31st March 2020.

- The Gross profit of the company increased by 58 per cent to £1.66 million versus the prior year. The increase was mainly due to an increase in sales, along with a robust product mix.

- Due to recruitment and increased employee’s expenses, equipment and building expenses and an adverse exchange rate on the revaluation and translation of cash balances, the overheads cost of the company increased to £1.63 million for the six months ended 31st March 2020 as compared to the prior year.

- During the six-month ended 31st March 2020, the company repaid the Virginia Tobacco Commission grant of $116,000 and released the provision of $170,000, which ensued a special credit of £42,000 to operating income.

- EBITDA for H1 2020 was reported at positive £0.03 million. For comparison, EBITDA before the IFRS16 adjustment reported a loss of £0.11 million, which consists of £0.14 million of expenses with regards to the new site.

HDD – Share Price Performance

The stock price of Hardide Plc increased by 47.17 per cent or 12.50 points as compared to the previous day closing price to GBX 39.00 as on 19th May 2020 (at around 16:29 PM GMT). At the time of writing, the company’s Market Capitalisation was reported to be at £14.09 million, and the beta stood at 1.49, which shows the higher volatility as compared to the benchmark.