Galliford Try Plc

Galliford Try Plc (GFRD) is a United Kingdom based residential housing and construction company. The company came into being in the year 2000, with the merger of Try Group Plc a British company founded in London in 1908 and Galliford Plc another British company founded in 1916.

Since its inception, the company has expanded rapidly both organically and inorganically. The company acquired Gerald Wood Homes in 2001, Chartdale in January 2006, Morrison Construction from AWG Plc in March 2006, Kendall Cross in November 2007, Linden Homes in February 2008, Rosemullion homes in December 2009, Miller Construction from Miller Homes in July 2014 and Shephard Homes in May 2015.

The company later reorganized its business into three verticals 1. Linden Homes 2. Galliford Try Partnerships 3. Investments and Construction.

The companyâs shares were listed on the London Stock Exchange on 27 March 1972; there they trade with the ticker name GFRD. The shares of the company are also constituents of the FTSE 250 index.

Performance Update - GFRD

The company got into financial trouble in February 2018, when Carillion one of its joint venture partners on the Aberdeen Western Peripheral Route project collapsed. The company had expected a cost over-run in excess of £150 million for the project which cast a deep dent on its balance sheet. The company though managed to raise £157.6 million through a rights issue in March 2018.

Since May of 2019, the company has received many offers for its profitable businesses; Linden Homes and Galliford Try partnerships but were all rejected by the management. The company for the full year 2018-19 had given positive guidance and in July 2019 reaffirmed that they would be able to meet the guidance goals.

However, on 10 September 2019, the company admitted that it is in talks to sell its housing and partnership verticals, just a day ahead of its annual results. The result statement filed by the company thus becomes critical in terms of what they reveal about the current status of the company.

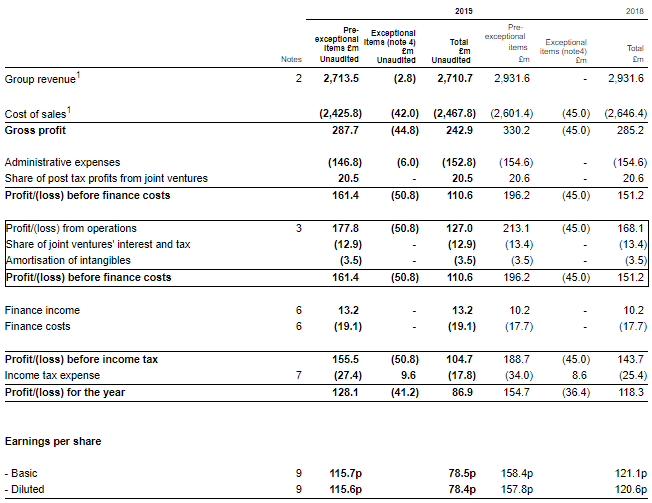

Insights from Financial Results published on 11 September 2019 - GFRD

- The company has underperformed on all parameters during the year compared to its last yearâs performance, though it is in line with the guidance. Pre-exceptional profit before tax of the company stood at £155.5 million for the year ended 30 June 2019 compared to £188.7 million for the year ended 30 June 2018.

- On the brighter side, the average net debt of the company was reported at £186 million on 30 June 2019 down from £227 million of average net debt as on 30 June 2018.

- Linden Homes completed 3,229 homes in the year compared to 3,442 homes it completed in 2018.

- Partnerships & Regeneration vertical performed better this year with revenue of £192 million, from 1,178 completion for year ended 30 June 2019 which is higher by 55 per cent to £124 million revenue from 751 completions recorded for the previous year ended 30 June 2018.

Source â Companyâs Annual report published on 11 September 2019

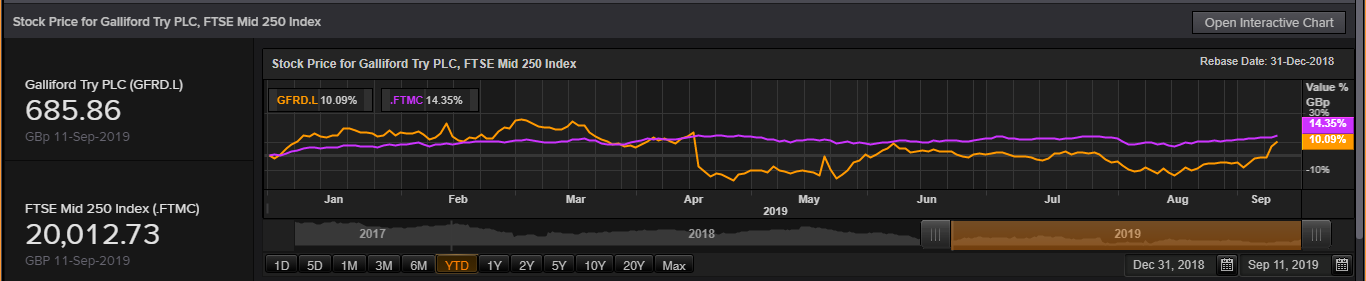

Stock Price performance at the London stock exchange (YTD) - GFRD

(Comparative chart of GFRD and the FTSE 250 index, Source â Thomson Reuters)

Stock performance at the London stock exchange over the past five daysÂ

Price Chart as on 11 September 2019, before the market close (Source: Thomson Reuters)

On 11 September 2019, at the time of writing the report (before the market close, GMT 11.00 AM), GFRD shares were trading on the London Stock Exchange at GBX 685.8.

The stock has a 52-week High of GBX 1117.00 and a 52-week low of GBX 499.60. The total market capitalization of the company was £737.20 million.

Outlook - GFRD

Graham Prothero, the Chief Executive of the company in his comments on the results, stated that the business had delivered a good performance this year despite the challenges it faced. On the speculation about the possible sale of their business verticals to Bovis Homes Group PLC he stated that the potential combination of its  Linden Homes and Partnerships businesses verticals with Bovis Homes represents an excellent opportunity to enhance the prospects for all three of its  business verticals to thrive in a strategically focused way with well-financed operations and excellent opportunities for future growth. The transaction will allow the  Construction vertical to continue to trade as a standalone well-capitalized vertical. The statement of the CEO confirms that the sale in very well on the cards.

UK Oil & Gas Plc

UK Oil & Gas Plc (UKOG) is a United Kingdom domiciled oil and gas exploration company. Its operations are all based in and around the United Kingdom with the company owning 7 oil and gas assets around the country. The companyâs assets are Horse Hill, its flagship asset and Broadford Bridge both located at the Weald Basin. Arreton-3 near Isle of Wight, Markwells Wood near South Downs National Park, 40 per cent interest in the Holmwood prospect, which is operated by Europa (Oil & Gas Company), 10 per cent interest in Horndean prospect and 5 per cent interest in Avington prospect both operated by IGas Energy.

The companyâs shares are listed on the AIM segment of the London stock exchange where they trade with the ticker name UKOG.

News Update - UKOG

The company on 11 September 2019 announced that Horse Hill Oil Field, one of its license assets has been granted Long-term Production consent from the Surrey County Council. The Horse Hill Oil Field is the companyâs flagship license assets near the Gatwick Airport in West Sussex.

The company has a significant and controlling interest of 85.635 per cent in the field and the highly prospective surrounding licensesâ of  PEDL137 and PEDL246. The field is operated by one of the company's subsidiaries, the Horse Hill Developments Ltd in which UK Oil & Gas Plc is the parent holding a 77.9 per cent of the controlling interest.

With the latest approval, the UK Oil & Gas Plc can produce 3,500 barrels of oil per day from this asset over a period of 25 years from a total of six drilled wells within the Portland & Kimmeridge oil pools, including the existing Horse Hill-One and the forthcoming Horse Hill-two straight wells.

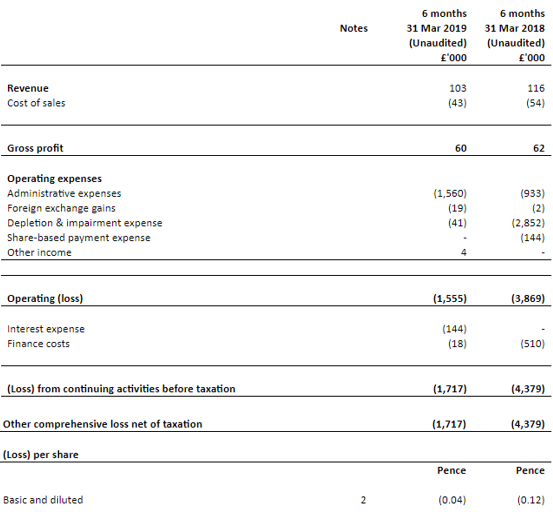

Insights from Financial Results published on 28 June 2019 - UKOG

The company on 28 June 2019 came out with its half-yearly results for the period ending on 31 March 2019.

- The companyâs operating loss for the six-month period ending 31 March 2019 was £1.56 million in contrast to £3.87 million for the six-month period ending on 31 March 2018. The decline in operating loss was because of significantly lower impairment and depletion costs. Within the ambit of its operating expenditure, the companyâs administrative expenditure rose from £0.93 million to reach £1.56 million largely due to an upheaval in employee costs.

- The Net cash outflow from operations rose to £3.45 million, which was a substantial increment from the value reported for the same period last year when it stood at £1.76 million. The increase is attributable to the group reducing its trade payables, increment in abandonment expense and increment in administrative expenses.

- The companyâs expenditures on exploration & evaluation of assets diminished to £3.31 million for the six-month period ending 31 March 2019 whereas for the six-month period ending 31 March 2018 it was £4.95 million. Over and above, the company had a £1.62 million revenue receipts from the sale of test crude yields, which helped it bring down its net cash outflow further from investing activities from £5.02 million for the half-year period ending March 2018 to £1.69 million in the half-year period ending March 2019.

Source â Companyâs half-yearly report published on 28 June 2019.

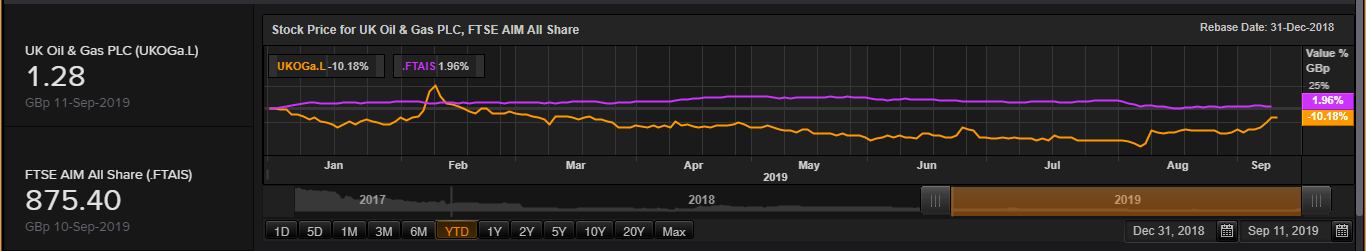

Stock Price performance at the London stock exchange (YTD) - UKOG

(Comparative chart of UKOG and the AIM Allshare index, Source â Thomson Reuters)

Stock performance at the London stock exchange over the past five daysÂ

Price Chart as on 11 September 2019, before the market close (Source: Thomson Reuters)

On 11 September 2019, at the time of writing the report (before the market close, GMT 2.40 PM), UKOG shares were trading on the London Stock Exchange at GBX 1.286.

The stock has a 52-week High of GBX 2.25 and a 52-week low of GBX 0.80. The total market capitalization of the company was £77.56 million.

Outlook - UKOG

The company during the next six-month period plans to start production from its Horse Hill asset, which will see the company transform from a purely oil and gas exploration company to an oil and gas production company.

In this regard, it is worth mentioning that at the Horse Hill oil field the extended well tests of Horse Hill-1 well achieved a number of highly significant milestones, ending in an average total test production of more than 54,000 barrels of light, sweet, dry crude oil product. The companyâs production during the test phase, till date, stands at more than  29,000 barrels of crude from the Portland and over 25,000 barrels of crude from Kimmeridge. In excess of 250 tankers of this test crude oil has been sold out to Perenco at the current Brent oil prices and has already been transported for onward shipment to Esso's Fawleyâs crude Refinery near Southampton, United Kingdom.