Centamin PLC

Centamin Plc (LON:CEY) is a dual-listed company, with listings on the London stock exchange and Toronto Stock Exchange. The company is involved in exploration, development and mining. The companyâs principal asset the Sukari Gold Mine, started its production in the year of 2009 in Egypt. The company produces 500,000 ounces of gold per annum, with the ability to surpass this level. The companyâs financial health, growth expectations and domain knowledge in operations provide a major benefit in acquiring and developing other gold projects. There are four essential resources behind the successful operations of the company. These are natural resources, expert workforce and supervision team, robust financial management and all-encompassing relationships with key stakeholders.

Financial highlights

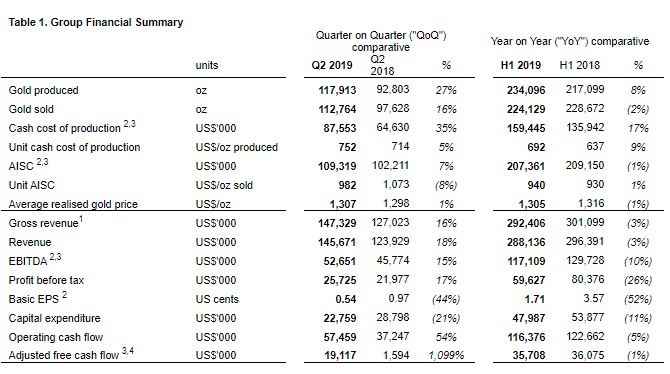

On 31st July 2019, the company announced its half-yearly financial report for the period ended 30 June 2019, through a press release. The company reported that the gross revenue decreased from US$301.1 million in the first half of prior year to US$292.4 million in the first half of the current year. The company reported that the revenue decreased from US$296.4 million in the first half of prior year to US$288.1 million in the first half of the current year. The company reported a decline in the reported EBITDA from US$129.7 million for the same period ended on 30th June 2018 to US$117.1 million in the current period ended on 30th June 2019. The profit before tax also declined as compared to the same period in the previous year to US$59.6 million.

The basic earnings per share of the company stood at 1.71US cents in the first half of the fiscal year 2019 versus 3.57 US cents in H1 FY2018, a decrease of 52 per cent. However, the capital expenditure of the company stood at US$47.9 million in the first half of the fiscal year 2019 versus US$53.8 million in H1 FY2018, a decrease of 11%.

(Sources: LSE)

Share Price Performance

On 9th December 2019, at 08:20 A.M GMT, while writing, CEY share price was reported to be trading at GBX 123.40 per share on the LSE, an increase of 4.09 per cent or GBX 4.85 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 118.55 per share.

On 28th August 2019, the shares of CEY have touched a new peak of GBX 154.75 and reached the lowest price level of GBX 79.14 on 18th April 2019 in the last 52 weeks range. The companyâs shares were trading at 20.25 per cent lower from the 52-week high price mark and 55.92 per cent higher than the 52-week low price mark at the current trading level. The companyâs market capitalisation (M-Cap) was reportedly valued to be at GBP 1.37 billion concerning the shareâs current market price.

The share outstanding of the CEY share has been reported to be at 1.16 billion, and the average volume has been 5.96 million at the time of writing.

The beta of the CEY share was reported to be at 1.0213. This means that the companyâs share price movement is more volatile in its trend, as compared to the benchmark market indexâs movement.

Rockfire Resources PLC

Rockfire Resources Plc (LON:ROCK) is a UK based company which engaged in copper and gold exploration with mineral assets in Queensland, Australia. It has three near-surface, medium-grade gold prospects. These are located within multi-million-ounce gold deposits. The company has several chances for discovery within its broad scope of well-focused projects. The company is working on three projects in Australia, which are Lighthouse, Marengo and Copperhead. The fourth project is under construction, i.e. Copper Dome in Queensland.

Financial highlights

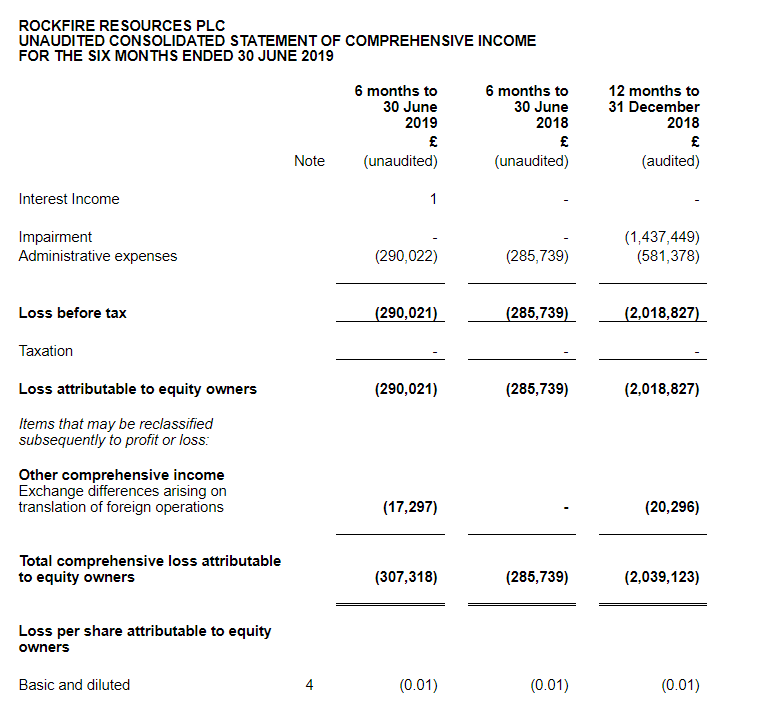

On 2nd September 2019, the company announced its six months ended 30 June 2019 through a press release. The company reported that the interest income increased from â0â in the first half of last year to £1 in the first half of the current year. The company reported that the loss before tax increased from £285,739 in the first half of last year to £290,021 in the first half of the current year. The company reported an increase in the reported Total comprehensive loss attributable to equity owners from £285,739 for the same period ended on 30th June 2018 to £307,318 in the current period ended on 30th June 2019.

The loss of per share attributable to equity owners of the company remained the same at 0.01pence the first half of the fiscal year 2019 compared to the first half of the fiscal year 2018. Additionally, the company incurred exploration expenditure of £208,738 during the period whereas cash and cash equivalents were at £181,097 as at 30 June 2019 as compared to £294,596 as at 31 December 2018.

Source: Company Reports

Source: Company Reports

Share Price Performance

On 9th December 2019, at 12:53 PM GMT, while writing, ROCK share price was reported to be trading at GBX 1.83 per share on the LSE, a decrease of 6.15 per cent or GBX 0.12 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 1.95 per share.

On 04th December 2019, the shares of ROCK have touched a new peak of GBX 2.35 and reached the lowest price level of GBX 0.25 on 14th October 2019 in the last 52 weeks range. The companyâs shares were trading at 22.13 per cent lower from the 52-week high price mark and 632.0 per cent higher than the 52-week low price mark at the current trading level. The companyâs market capitalisation (M-Cap) was reportedly valued to be at GBP 10.77 million concerning the shareâs current market price.

The share outstanding of the ROCK share has been reported to be at 552.55 million, and the average volume has been 111.45 million at the time of writing.

The beta of the ROCK share was reported to be at 0.7956. This means that the companyâs share price volatility is lower as compared to the benchmark market indexâs movement.

Outlook

In May 2019, the company announced that soil and rock sampling at part of the Lighthouse tenement in Queensland, Australia came back with strong gold anomalism. This results successfully extended the surface demonstration of the gold deposit by a further one KM in the direction of the west.