Highlights

- The Renewables Infrastructure Group announced of entering a contract to take over a 100% stake in four solar PV sites in Cadiz, Spain.

- Greencoat UK Wind Plc announced total dividends of 3.59 pence per share to shareholders for the half-year period ended 30 June 2021.

The UK introduced a £160 million ($220 million) fund to aid developers of floating offshore wind technology to address the climate and renewable energy generation targets. The funding is a part of the £1.4 billion Global Britain Investment Fund announced during the Budget 2021. The announcement is expected to boost the country’s green credentials in the United Nations' COP 26 climate summit in Glasgow. The UK targets to produce about 40 gigawatts (GW) of electricity from offshore wind energy projects by 2030, representing an increase from the current 10 GW.

Floating wind farms are a relatively new technology and are associated with higher costs than plants fixed to the seabed. The prices are expected to decrease as more and more projects are commissioned.

Crown Estate, based in Scotland, rolled out a tender for seabed licences for around 10 GW and is expected to attract bids from oil giants and renewable energy firms. Crown Estate for Wales, Northern Ireland and England have also announced leasing rounds for floating wind projects. Let us discuss the investment prospect in two FTSE 250 listed renewable energy stocks - The Renewables Infrastructure Group Limited and Greencoat UK Wind Plc.

(Data source: Refinitiv and company release)

The Renewables Infrastructure Group Limited (LON:TRIG)

The Renewables Infrastructure Group is an FTSE 250 listed investment trust that invests in assets generating electricity from renewable energy sources. The company invested in more than 75 solar, wind and battery storage projects with a total generating capacity of more than 1.9GW, displacing carbon emissions of about 1.3 million tonnes per year.

In September 2021, The Renewables Infrastructure Group announced the inking of contracts to take over a 100% stake in four solar PV sites in Cadiz, Spain. The total capacity of the project stands at 234MW.

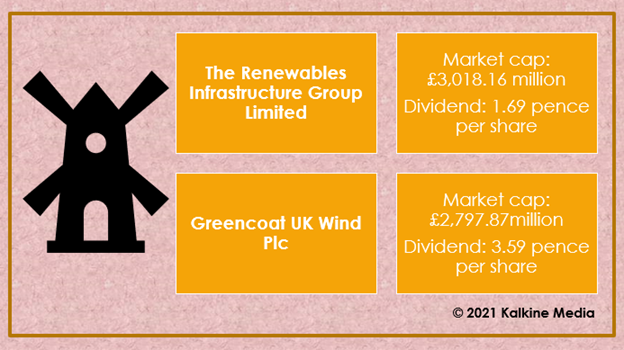

The shares of The Renewables Infrastructure Group closed at GBX 132.40, down by 0.60% on Friday, 29 October 2021. The market cap of the company stands at £3,018.16 million.

The Renewables Infrastructure Group’s profit before tax for the half-year ended 30 June 2021 was £36.8 million. The Renewables Infrastructure Group announced an interim dividend of 1.69 pence per ordinary share to shareholders for the quarterly period ended 30 June 2021.

Greencoat UK Wind Plc (LON:UKW)

Greencoat UK Wind is a UK-based investment firm engaged in investing in wind farms based in London. Greencoat UK Wind’s investments produced 1,476GWh of carbon-free electricity.

In September, Greencoat UK Wind completed the commissioning of the 45MW Douglas West wind farm. The addition of the Douglas West will increase the company’s total generating capacity to 1,289MW. It also signed an agreement to acquire Andershaw wind farm from Statkraft UK Limited for £121 million.

The shares of Greencoat UK Wind Plc closed at GBX 142.60, up by 0.71% on Friday, 29 October 2021. The market cap of the company stands at £2,797.87 million.

Greencoat UK Wind Plc announced total dividends of 3.59 pence per share to shareholders for the half-year period ended 30 June 2021. It also announced a dividend of 1.795 pence per share for the quarterly period from 1 April to 30 June 2021.