The global gambling industry is worth over USD 300 billion, wherein only 12 per cent comes from online; however, the growth in the online market is outpacing the retail market gradually. Moreover, the coronavirus led restrictions sowing the seeds of further demand in online channels.

Meanwhile, the London markets jumped today (as on 23rd June 2020, before the market close) as Prime Minister Boris Johnson is expected to ease the lockdown restrictions further. Adjacently, FTSE 100 gained over 1 per cent and was trading around 6,341.36 (before the market close at 12.50 PM GMT).

The critical triggers for the day were:

- According to IHS Markit, the purchasing managers’ index expanded in June to 47.6 from 30.0 in May.

- The British grocery sales jumped around 18.9 per cent in the four weeks to 14th June 2020, while the online sales rose 91.0 per cent over the four weeks year-on-year.

- US President Trump stated that the US-China trade deal is fully intact, which bolstered investor sentiments further.

Considering the ongoing market conditions, we are going to analyse two LSE listed stocks operating in the Consumer Services sector - GVC Holdings PLC (LON:GVC) and William Hill PLC (LON:WMH). As on 23rd June 2020 (before the market close at 12.51 PM GMT+1), GVC gained over 0.54 per cent whereas WMH’s price dipped around 3.26 per cent. Let us walk through the financial and operational position of both the Companies to gauge upon the stock price movements.

GVC Holdings PLC (LON:GVC) – Operates with Diversified Portfolio by Market & Product to Stay Resilient

GVC Holdings PLC is a FTSE 100 listed Gaming and Sports-betting Company, which operates through both retail and online sector. It has a broad portfolio of brands, such as

- Gaming brands includes Foxy Bingo, PartyCasino, CasinoClub, Gala, partypoker, among others.

- Sports brands includes Eurobet, Sportingbet, Coral, bwin, Neds, and Ladbrokes.

The Company owns proprietary technology for its core products. It has also been exploring opportunities in the US after signing a joint venture with MGM Resorts. The Group has licenses across 5 continents, in over 20 countries.

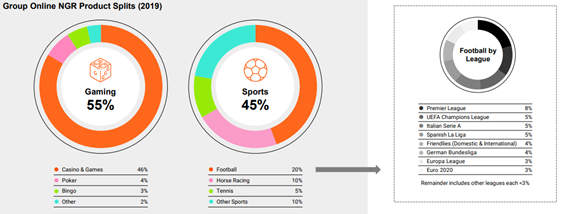

(Source: Presentation, Company Website)

Recent Mitigating Action for COVID-19 Crisis

28th April 2020: The GVC Holdings PLC agreed to a new revolving credit facility for GBP 535 million with existing lending banks, which will provide the financial flexibility for pursuing growth opportunities and other corporate expenses during the pandemic.

6th April 2020: The Group stated it was exploring an opportunity to save GBP 50 million per month in cost to mitigate the financial impact of COVID-19.

Q1 Trading Update - Strengthen the Financial Position, Maintain a Compelling Customer Offer, and Limit Cash Outflow.

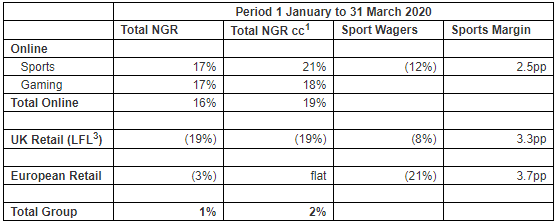

On 6th April 2020, the Group provided a trading update for the period from 1st January to 31st March 2020 and an update on the impact of COVID-19 along with mitigating effective steps being taken. The Group has started the year 2020 well, with an increase in Group NGR of 1 per cent at a constant currency basis in Q1 FY20 and Online NGR (net gaming revenue) of 19 per cent (driven by robust growth in all major territories). Other major highlights of the update were as follows:

- On a like-for-like (LfL) basis, the UK retail reduced by 19 per cent in the first quarter of 2020.

- In the period 1st January 2020 to 15th March 2020, mostly all division of the Group has placed well, supported by favourable sports margins.

- Led by the closure of retail outlets partially offset by the COVID-19 impact and the cancellation of sports events, the Group’s revenue significantly reduced from mid-March 2020.

- GVC anticipated that the cancellation and closure would result in a decrease in EBITDA of approximately GBP 100 million per month before any mitigating actions.

- The Group expects to decline this EBITDA impact to approximately GBP 50 million per month.

- The financial position stays healthy, and the management has taken the prudent step to withdraw the second interim dividend.

(Source: Company Website)

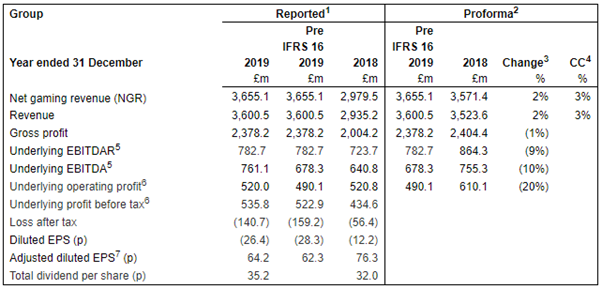

Quick Glance at the financial performance for the FY2019 Period

- The Company witnessed a robust operational momentum and financial performance, with Group proforma NGR increased by 2 per cent (up 3 per cent at constant currency basis), Online NGR up 13 per cent, European NGR up 4 per cent, and UK Retail NGR down 15 per cent.

- Group underlying proforma EBITDA stood at GBP 678 million (pre-IFRS 16), a decline of 10 per cent YoY though GBP 50 million ahead of original consensus.

- Online NGR continued double-digit progress with market share gains in all key territories.

(Source: Company Website)

Share Price Performance

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 23rd, 2020, before the market close

GVC’s shares were quoting at GBX 794.40 on 23rd June 2020 (before the market close at 3:32 PM GMT+1). Stock's 52 weeks High is GBX 956.80 and Low is GBX 292.70. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 4.47 billion.

Outlook

From its online business, the Company is targeting double-digit revenue growth in the medium-term period through underlying market growth and M&A (merger and acquisition) activity. The integration pertinent to Coral, Ladbrokes and Gala Bingo brands is projected to accomplish by the end of H1 FY20. The Company’s online business has been performing resiliently. In order to curb the impact of COVID-19, the Group has taken several decisive actions to preserve liquidity.

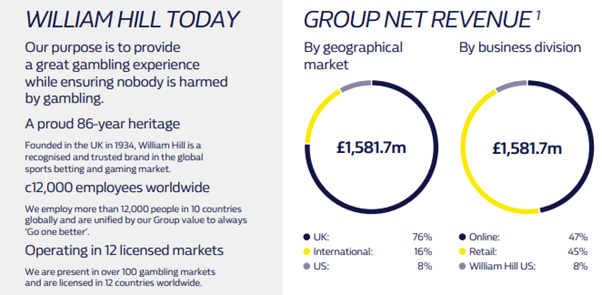

William Hill PLC (LON:WMH) – Getting a Boost Post Equity Placing

William Hill PLC is a FTSE 250 listed Gambling Company, which operates through three divisions – Online, Retail, and the US. The Company is involved in sports betting, poker, and other gaming products. It was founded in 1934, and presently, it employs over 12,000 people. The Company derives most of its revenue from the United Kingdom. The Company completed the acquisition of Mr Green & Co AB in January 2019, and since then, it is licensed online in 10 countries.

(Source: Annual Report, Company Website)

Synopsis of Recent Regulatory Updates

17th June 2020: The Company issued 174,872,457 new ordinary shares to raise GBP 224 million in gross proceeds.

9th June 2020: The Group affirmed that lockdown easing has yielded better than expected recovery in business, while the Company is expecting to receive a material refund in the second half of 2020.

Trading Update – Decent Recovery in the Recent Weeks

On 16th June 2020, the Group provided a trading update for the unaudited six weeks to June 9, 2020, with robust recovery as the progressive return of sporting events, following the easing of lockdown measures across the globe. Additional Highlights are stated below:

- Over the 23 weeks to 9 June 2020, the Group’s net revenue decreased by 32 per cent year-on-year, though the Company said 10 weeks occurred before COVID-19 lockdowns. Over those ten weeks, the net revenue was down 5 per cent annually.

- The net revenue tumbled 57 per cent between weeks 11 and 17 of the period, with 85 per cent retail like-for-like fall and a 21 per cent fall in online.

- Online was down by 3 per cent during the period (week 18 to 23).

- The Company now have unrestricted liquidity in excess of GBP 500 million and a line of sight to generating positive cash flow from the operations in the second half of the year.

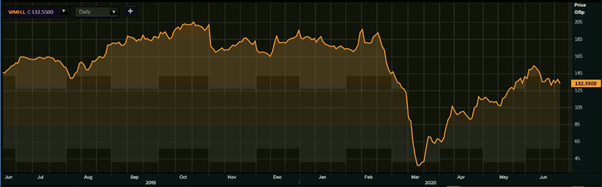

Share Price Performance

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 23rd, 2020, before the market close

WMH’s shares were quoting at GBX 132.55 on 23rd June 2020 (before the market close at 3:35 PM GMT+1). Stock's 52 weeks High is GBX 206.80 and Low is GBX 28.63. Total outstanding M-Cap. (market capitalization) stood at GBP 1.44 billion.

Outlook

The Group stays cognisant that retail footfall and sports betting activity are expected to stay uncertain throughout the rest of 2020 and into 2021. Due to COVID-19, they postponed or cancelled sporting events and closed US casino will reduce the upcoming revenue and profit. In the future, environmental regulations, foreign exchange risks and expansion by competitors could affect its business operations. Moreover, the Group has a decent balance sheet with adequate liquidity to tackle the challenging situation.