Global Markets: Shares at the Wallstreet were hovering in red zone, with the broader index S&P 500 fell off 8.9 points or 0.28% against yesterdayâs close and standing at 2,996.0, the Dow Jones Industrial Average Index declined by 50.21 points or 0.18% in dayâs session and trading at 27,285.42 and the technology benchmark index Nasdaq Composite slumped by 7.93 points or 0.10% and quoting at 8,214.15 respectively, at the time of writing.

Global News: Amid the US earnings season and growing concerns of the trade dispute, stocks declined for a second straight session and S&P 500 fell back below 3,000 mark. A report from the Commerce Department on Wednesday also showed the US homebuilding fell by 0.9 per cent in June, declining for the 2nd consecutive month, and permits dropped to a two-year low. Weakness in housing marker led to a fall in Treasury yields as demand for haven assets increased. Facebook, in its latest round of questioning by US lawmakers, faced criticism and was told the company could not be trusted.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 41.74 points or 0.55% lower at 7,535.46, the FTSE 250 index snapped 41.85 points or 0.21% lower at 19,614.20, and the FTSE All-Share Index ended 19.92 points or 0.48% lower at 4,110.44 respectively. Another European benchmark index STOXX 600 ended 1.44 points or 0.37% lower at 387.66 respectively.

European News: The outgoing Prime Minister Theresa May on Wednesday urged the incoming prime minister to follow a path which is sustainable for the long term and said she was worried about the state of politics. Official data showed inflation hit the 2 per cent target for a second month running in June and house prices in London declined at the fastest pace in almost ten years in May, sliding by 4.4 per cent in annual terms. As investors continued to worry about a no-deal Brexit, Sterling fell below $1.24 on Wednesday, with market experts forecasting $1.10 in case of no-deal Brexit outcome.

London Stock Exchange (LSE)

Top Performers Stocks: SAGA PLC (SAGA), REACH PLC (RCH), and GOODWIN PLC (GDWN) surged by 13.71 per cent, 9.02 per cent and 6.59 per cent respectively.

Top Laggards Stocks: KIER GROUP PLC (KIE), PENDRAGON PLC (PDG), and THOMAS COOK GROUP PLC (TCG) decreased by 9.76 per cent, 7.21 per cent and 5.96 per cent respectively.

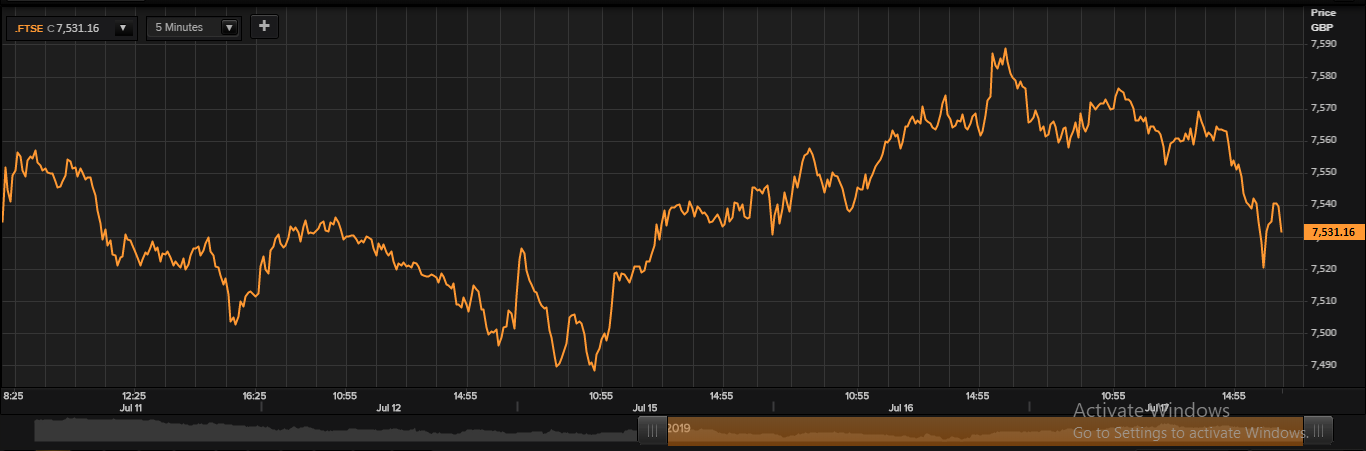

FTSE 100 Index

FTSE100 Index: 5-days Price Chart (as on July 17, 2019), after the market closed. (Source: Thomson Reuters)

Top Risers Stocks: BURBERRY GROUP PLC (BRBY), IMPERIAL BRANDS PLC (IMB) and AVEVA GROUP PLC (AVV) rose by 2.99 per cent, 2.22 per cent and 1.51 per cent respectively.

Top Fallers Stocks: JOHNSON MATTHEY PLC (JMAT), RSA INSURANCE GROUP PLC (RSA) and ITV PLC (ITV) reduced by 5.40 per cent, 4.36 per cent and 3.14 per cent respectively.

Top Active Volume Leaders: LLOYDS BANKING GROUP PLC, VODAFONE GROUP PLC, and BP PLC.

Top Risers Sectors: Technology (+0.38%), Healthcare (+0.10%) and Industrials (+0.10%).

Top Fallers Sectors: Energy (-1.69%), Telecommunications Services (-1.02%) and Financials (-0.75%).

Foreign Exchange and Fixed Income

FX Rates*: GBP/USD and EUR/GBP were exchanging at 1.2435 and 0.9025 respectively.

10-Year Bond Yields*: US 10Y Treasury and UK 10Y Bond yields were trading at 2.063% and 0.753% respectively.Â

*At the time of writing