US Markets: Broader indexes in the United States were trading in green, with the S&P 500 index traded 9.22 points or 0.29% higher at 3,240.00, Dow Jones Industrial Average Index accelerated by 128.95 points or 0.45% and quoting at 28,667.39 and the technology benchmark index Nasdaq Composite traded higher at 9,022.13 and was up by 49.53 points or 0.55% against its previous day close (at the time of writing, before the U.S market close at ET 10:20 AM).

US News: On 2nd January 2020, the first day of the new year, the stock market opened in the green, moving ahead with the 2019 Q4 gains, as U.S. President Donald Trump announced that a trade pact with China would be signed on January 15, 2019, giving the investors a lot of confidence and hope for the rest of the year. Airbus American Depository Receipts (ADRs) were up by 2.9 per cent after reports suggested that the company will beat its target of 860 aircraft deliveries in 2019. Altria was up by 0.5 per cent after the FDA was likely to spare its menthol flavour from the vaping ban. Tesla stock also opened higher by 2.2 per cent, after an analyst upgraded the stock. Pacific Gas and Electric Co stock was up by 0.3 per cent, after a court ruled in its favour for exemption on a few liabilities to bondholders. Anixter International stock rose by 1 per cent after a Private Equity firm improved its acquisition offer for the company to US $93.50 per share, making the investors happy.

S&P 500 (SPX)

Top Performers*: Westrock Co, Western Digital Corp, and Freeport-McMoRan Inc are top gainers and increased by 3.17%, 2.64% and 2.52% respectively.

Worst Performers*: Franklin Resources Inc, Edison International, and Illumina Inc are the top three laggards and decreased by 1.35%, 1.13% and 1.05% respectively.

NASDAQ Composite (IXIC)

Top Performers*: Pulmatrix Inc, Synthesis Energy Systems Inc, and Inpixon are top gainers and increased by 82.56%, 62.63% and 40.83% respectively.

Worst Performers*: DURECT Corp, Neovasc Inc, and Viveve Medical Inc are the top three laggards and decreased by 43.68%, 23.29% and 11.90% respectively.

Top Performing Sectors*: Technology (up 0.91%), Consumer Cyclicals (up 0.91%), and Energy (up 0.71%).

Dow Jones Industrial Average (DJI)

Top Performers*: Intel Corp, Wallgreens Boots Alliance Inc, and Exxon Mobil Corp are top gainers and increased by 1.07%, 1.02% and 0.96% respectively.

Worst Performers*: Proctor & Gamble Co, and Johnson & Johnson are the top two laggards and decreased by 0.39%, and 0.01% respectively.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 61.86 points or 0.82% higher at 7,604.30, the FTSE 250 index snapped 224.87 points or 1.03% higher at 22,108.29, and the FTSE All-Share Index ended 35.19 points or 0.84% higher at 4,231.66 respectively. Another European equity benchmark index STOXX 600 ended at 419.72, up by 3.88 points or 0.93 per cent.

European News: In economic news, the British factory output has hit its lowest since 2012, on account of a weak global demand outlook as reported by IHS Markit. The Manufacturing Purchasing Managers Index (PMI) dropped to 45.6 from 49.1 in November (IHS Markit/CIPS UK). In other news, BoE (Bank of England) survey has showed that British Business Buoyant after the Boris Johnson win of the General elections and are more hopeful of the future through concerns still exist on the Brexit outcome of 31 January 2020. In business news, the transport ministry of Britain has announced that it will end the Northern Rail franchise run by Deutsche Bahnâs Arriva on account of its unacceptably poor performance. The franchise has been suffering from high levels of delays and cancellations lately.

London Stock Exchange

Elite Performers of the Day*: LINDSELL TRAIN INVESTMENT TRUST PLC (LTI), SENIOR PLC (SNR) and GEORGIA HEALTHCARE GROUP PLC (GHG) were on the bright spot and up by 6%, 5.50% and 5.29% respectively.

Worst Performers of the Day*: TULLOW OIL PLC (TLW), MEDICA GROUP PLC (MGP) and HELIOS TOWERS PLC (HTWS) are the top laggards and down by 6.38%, 5.85% and 4.75% respectively.

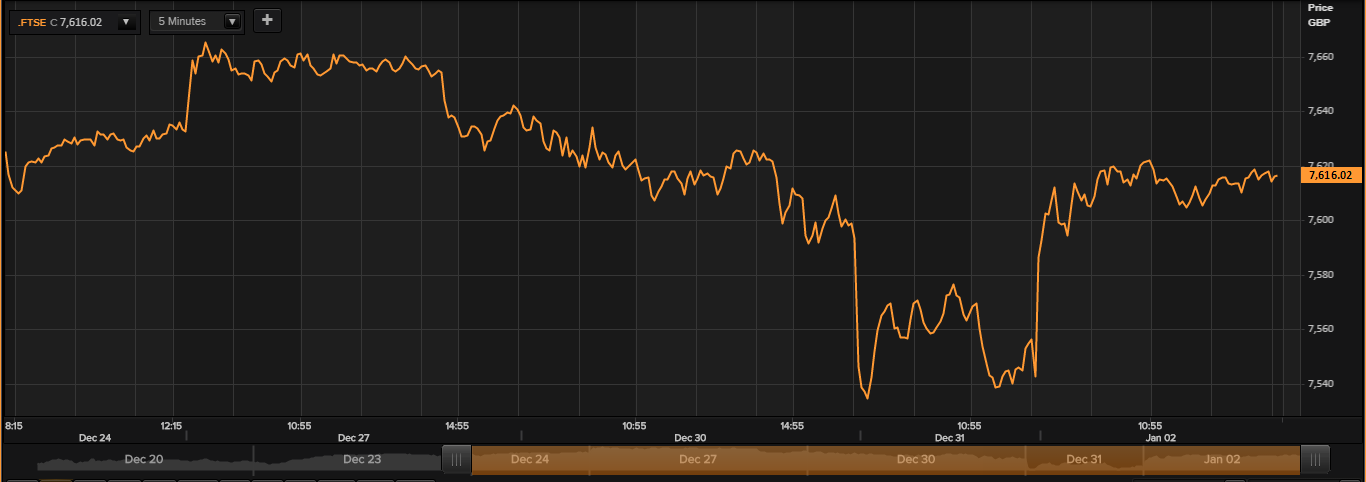

FTSE 100 Index

FTSE-100: Shares price performance in last 5 days (as on January 02, 2020), before the market closed. (Source: Thomson Reuters (TR))

Performers of the Day*: PEARSON PLC (PSON), M&G PLC (MNG), and GLENCORE PLC (GLEN) were in the bright spot and leapt up by 3.30%, 3.29% and 2.97% respectively.

Laggards of the Day*: BRITISH LAND CO PLC (BLND), NMC HEALTH PLC (NMC), and JD SPORTS FASHION PLC (JD.) were the beaten down stocks at the broader equity benchmark index FTSE 100 and decelerated by 1.38%, 0.82% and 0.72% respectively.

Top Volume Gainers of the Day*: LLOYDS BANKING GROUP PLC (LLOY), BARCLAYS PLC (BARC), and VODAFONE GROUP PLC (VOD).

Best Performing Sector of the Day*: Energy (up 1.52%), Financials (up 1.29%), and Utilities (up 1.22%).

Forex Rates*: GBP/USD and EUR/GBP were hovering at 1.3142 and 0.8502, respectively.

10-Year US and UK Bond Yields*: U.S 10-Year Treasuries yield was quoting at 1.882%, and the UK 10-Year Government Bond yield was trading at 0.806%, respectively.

Â

*At the time of writing