US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 5.19 points or 0.12 per cent lower at 4,158.10, Dow Jones Industrial Average Index dipped by 82.93 points or 0.24 per cent lower at 34,244.86, and the technology benchmark index Nasdaq Composite traded higher at 13,431.27, up by 52.22 points or 0.39 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note due to the sharp decline in the telecom stocks. Among the gaining stocks, Fisker (FSR) shares jumped by about 10.25% after the Company had made a less-than-expected loss during the first quarter. Walmart (WMT) shares went up by about 2.17% after the Company had raised its second-quarter and full-year outlook. Macy’s (M) shares rose by around 0.73% after the Company had reported earnings of 39 cents per share for the first quarter. Among the declining stocks, HomeDepot (HD) shares went down by about 0.19%, even after the Company’s reported first-quarter earnings came out to be more than the consensus estimates.

UK Market News: The London markets traded in a green zone driven by the positive investor sentiments built by better-than-expected UK jobs data. Moreover, Britain’s unemployment rate had dropped to 4.80% for the three months ended 31 March 2021.

Drinks Maker Britvic shares surged by about 3.86% after the Company had resumed dividend payments despite a drop in the top-line business and bottom-line business during the first half of FY21.

Tobacco Company Imperial Brands had anticipated delivering full-year results in line with the guidance after reporting a jump in the first-half profitability. Moreover, the shares went up by around 1.76%.

Oxford BioMedica shares climbed by around 11.58% after the Company had lifted full-year earnings guidance by more than 100% as AstraZeneca ordered more Covid-19 vaccines.

FTSE 100 listed Vodafone Group shares went down by about 8.36% after the Company had reported lower-than-expected adjusted core earnings as roaming revenues got adversely impacted by the travel restrictions.

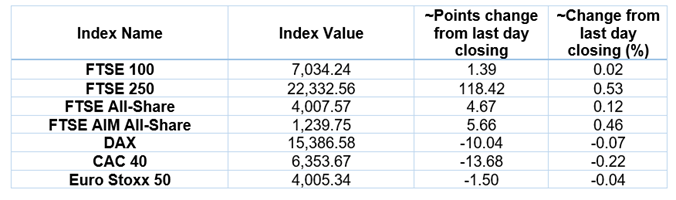

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 18 May 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Vodafone Group Plc (VOD); Lloyds Banking Group Plc (LLOY); BP Plc (BP.).

Top 3 Sectors traded in green*: Financials (+0.74%), Consumer Cyclicals (+0.57%) and Energy (+0.50%).

Top 3 Sectors traded in red*: Technology (-2.20%), Consumer Non-Cyclicals (-0.39%) and Basic Materials (-0.14%).

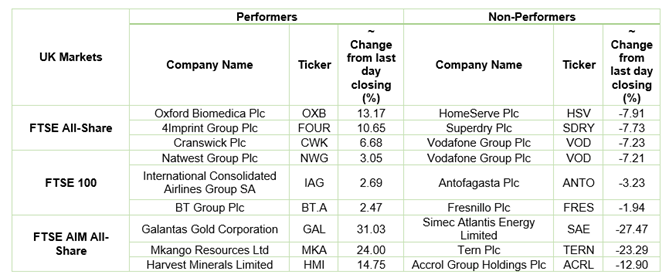

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $68.53/barrel and $65.33/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,868.25 per ounce, up by 0.03% against the prior day closing.

Currency Rates*: GBP to USD: 1.4196; EUR to GBP: 0.8612.

Bond Yields*: US 10-Year Treasury yield: 1.647%; UK 10-Year Government Bond yield: 0.8650%.

*At the time of writing