Summary

- Imperial Brands Plc has reported a 0.8% surge in revenues during FY20.

- The Company has completed the sale of worldwide premium cigar businesses for €1,225 million.

- Focusrite Plc has shown an increase in revenues of 53.7% during FY20.

- The Company has repaid the net debt taken to buy Martin Audio in less than eight months.

Imperial Brands Plc (LON:IMB) and Focusrite Plc (LON:TUNE) are consumer discretionary stocks. Shares of IMB and shares of TUNE were down by 0.13% and 0.22%, respectively, from their last closing price (as on 18 November 2020, before the market close at 08:05 AM GMT).

Why is the NGP segment of Imperial Brands Plc making significant losses?

Imperial Brands Plc is the FTSE 100 listed fast-moving consumer goods company, which operates through two business segments: Tobacco and NGP (Next Generation Products). The broad geographic segments are Europe, the America and AAA (Asia, Africa and Australasia).

Key Brands

(Source: Company website)

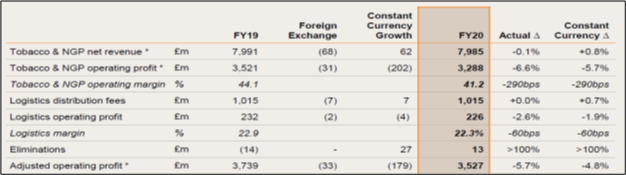

FY20 financial highlights (ended 30 September 2020) as reported on 17 November 2020

(Source: Company presentation)

- The adjusted revenue of the Company has increased by 0.8% to £7,985 million during FY20 ended on 30 September 2020 driven by growth in Tobacco segment partially offset by the disappointing performance of NGP segment.

- Adjusted EPS of the Company has declined by 5.6% from 272.3 pence in FY19 to 254.4 pence in FY20.

- The Company has declared an annual dividend of 137.7 pence per share.

- Regarding the financial position, the Company has witnessed a significant increase in cash conversion, and it stood at 127% as of 30 September 2020 in comparison to 95% during FY19. The growth is due to positive working capital movement and low capital expenditure made during the period.

Segmental Analysis

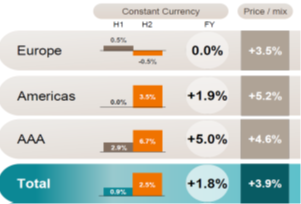

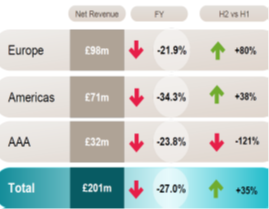

Tobacco Net Revenue NGP Net Revenue

(Source: Company presentation)

- Tobacco net revenues grew by 1.8% during FY20 despite a decline of 2.1% in volumes. The volumes have declined due to the change in consumer behaviour during Covid-19 pandemic. The cigarette market share was increased by ten basis point in the US.

- NGP segment has witnessed a decline of 27% in the revenues due to the destocking of trade inventory in H1 FY20 and lower investment levels.

- The profitability of both business segments went down as Tobacco fell by 3.1% and NGP dropped by 34.4% during FY20.

Recent News

- On 02 November 2020, the Company has confirmed that Bob Kunze-Concewitzhas joined the Board as a Non-Executive Director.

- On 29 October 2020, the Company has updated that it has completed the sale of worldwide premium cigar businesses for €1.225 billion, of which net cash proceeds of €1.1 billion will be used to reduce debt.

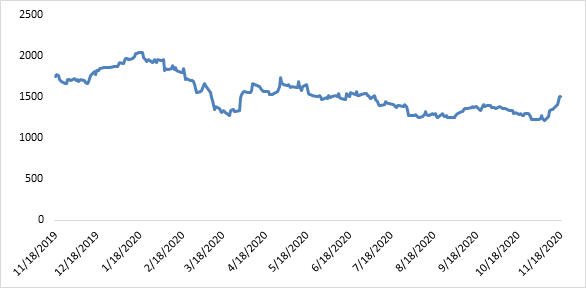

Share Price Performance Analysis of Imperial Brands Plc

(Source: Refinitiv, chart created by Kalkine Group)

Shares of Imperial Brands Plc were trading at GBX 1,503.50 and were down by close to 0.13% against the previous closing price (as on 18 November 2020, before the market close at 08:05 AM GMT). IMB's 52-week High and Low were GBX 2,072.00 and GBX 1,203.00, respectively. Imperial Brands Plc had a market capitalization of around £12.76 billion.

Business Outlook

The Company is expecting to show strong financial performance during FY21 despite ongoing uncertainties and expecting low to mid-single-digit growth in organic adjusted operating profit by excluding the impact of the Premium Cigar sale. Tobacco price is expected to remain strong with lower stock profits. Operating costs will continue to soar high due to manufacturing inefficiencies caused by Covid-19 pandemic. The Company has reduced net operating loss of NGP business segment during H2 FY20, and it will continue to minimize the loss in FY21.

Would Focusrite Plc get benefit from the acquisition of Martin Audio?

Focusrite Plc is the FTSE AIM 100 Index listed Company that supplies hardware and software audio products to musicians. The Company operates under six established brands: Focusrite, Focusrite Pro, Novation, Ampify, ADAM Audio and Martin Audio. The market size for all six business segments is shown below -

(Source: Company presentation)

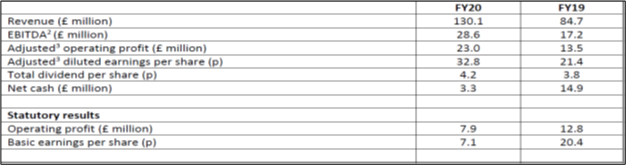

FY20 financial highlights (ended 31 August 2020) as reported on 17 November 2020

(Source: Company result)

- The sales during FY20 ended on 31 August 2020 grew by 53.7% to £130.1 million driven by growth in demand for music and recording products. Similarly, adjusted EBITDA increased by 66.1% to £28.6 million during the period.

- The Company has witnessed significant growth in revenue across major geographical regions. In North America the revenue grew by 39.9%, Europe, Middle East, and Africa by 65.9%; and the Rest of World by 59.7%.

- Regarding the financial position, the Company has a year-end net cash balance of £3.30 million due to the acquisition of Martin Audio completed in December 2019 for £35.3 million. The Company has repaid the net debt taken to buy Martin Audio in less than eight months.

- The Company has proposed a final dividend of 2.9 pence per share for FY20, which is better than the final dividend of 2.6 pence paid in FY20. On successful payment of the proposed dividend, the total FY20 dividend would be 4.2 pence per share.

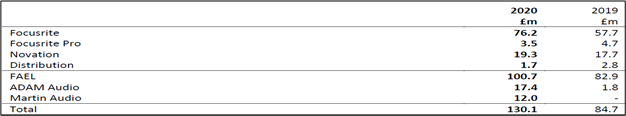

Segmental Performance

(Source: Company result)

- The revenues for Focusrite segment have increased by 32.2% to £76.2 million due to increased demand for the new, third generation of the Scarlett range.

- Focusrite Pro revenues are adversely impacted by Covid-19 as this segment caters to post-production houses, live and broadcast stages, and education establishments. The revenues have contracted by 25.8% to £3.5 million.

- Novation segment has shown a surge in revenue of 9.4% due to the rising demand for Launchpad grid controllers and Launchkey keyboard controllers.

- The demand for ADAM Audio products has similar drivers to that of Focusrite, and the business of both business segments got boosted by Covid-19 pandemic. ADAM Audio was acquired in July 2019, and the revenue during FY20 stood at £17.4 million.

- Martin Audio was acquired in December 2019 and has reported a revenue of £12.0 million during FY20.

Recent News

On 01 September 2020, The Company announced Sally McKone as the new Chief Financial Officer and an Executive Director of the Board. The date of his joining is not announced yet.

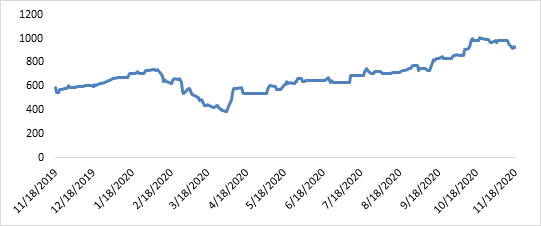

Share Price Performance Analysis of Focusrite Plc

(Source: Refinitiv, chart created by Kalkine Group)

Shares of Focusrite Plc were trading at GBX 930.00 and were down by around 0.22% against the previous closing price (as on 18 November 2020, before the market close at 08:05 AM GMT). TUNE's 52-week High and Low were GBX 1,020.00 and GBX 335.00, respectively. Focusrite Plc had a market capitalization of around £572.40 million.

Business Outlook

The Company has witnessed excellent trading performance during FY20 due to high level of demand achieved for most of its products and reported higher revenues than the pre-Covid-19 period of the prior year. The acquisition of Martin Audio has proven to be successful, and it has made a significant contribution to the Company's revenue.

Despite the growth, the Company is highly conscious of several obstacles lying ahead like COVID-19, Brexit, and US tariffs, which would adversely affect the business. The Company has two key acquisitions in its pipeline and still seeking for more lucrative business opportunities which aligns with the Group's strategy.