US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 72.52 points or 1.93 per cent higher at 3,823.29, Dow Jones Industrial Average Index expanded by 544.69 points or 1.80 per cent higher at 30,847.86, and the technology benchmark index Nasdaq Composite traded higher at 13,466.49, up by 195.89 points or 1.48 per cent against the previous day close (at the time of writing, before the US market close at 1:15 PM ET).

US Market News: The major indices of Wall Street traded in the green territory due to rising investor confidence regarding GDP and jobless claims data. The Commerce Department had estimated US GDP to grow at a 4% annualized rate during Q4 FY20 compared to an increase at a 33.4% annualized rate during Q3 FY20. Among the gaining stocks, shares of Comcast Corp grew by 4.19% after it posted a strong quarterly result and raised its dividend. Shares of Facebook went up by 1.00% after it had reported the quarterly revenue more than the estimates. Shares of McDonald’s Corp went up by 0.26% although it fell short of its earnings and revenue forecast. Among the declining stocks, shares of Tesla dropped by 4.76% after the company was unable to provide a vehicle delivery target for 2021. Shares of Apple went down by 1.86% after it did not give any specific forward guidance.

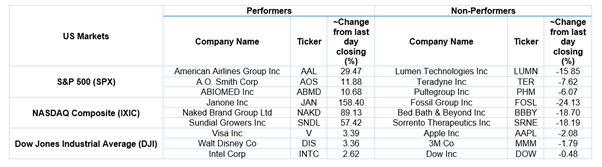

US Stocks Performance*

European News: The London and European markets traded in the mixed territory reflecting weak investor sentiments around vaccine rollout and ongoing worries regarding Covid-19 pandemic. According to the Office for National Statistics, the UK businesses reported 17% of their staff were on furlough between 28 December 2020 and 10 January 2021. Among the gaining stocks, Tate & Lyle shares jumped by 4.30% after it had shown strong third-quarter performance. Easyjet shares jumped by 3.25% although it had reported a revenue decline of almost 90% during the last three months of 2020. Diageo shares grew by 3.07% after the company increased its interim dividend. Shares of Fresnillo had raised the most on FTSE 100 after witnessing the slump during the previous trading session. Among the decliners, ITM Power shares went down by 3.57% although it had reported an increase of electrolysis tender opportunities. Victrex shares went down by 2.49% after the company went ex-dividend. Britvic shares dropped by 0.66% after it reported a first-quarter revenue drop.

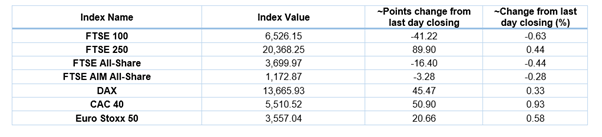

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 28 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); Rolls-Royce Holdings Plc (RR.).

Top 2 Sectors traded in green*: Basic Materials (+0.95%) and Industrials (+0.29%).

Top 3 Sectors traded in red*: Real Estate (-1.83%), Healthcare (-1.72%) and Technology (-1.49%).

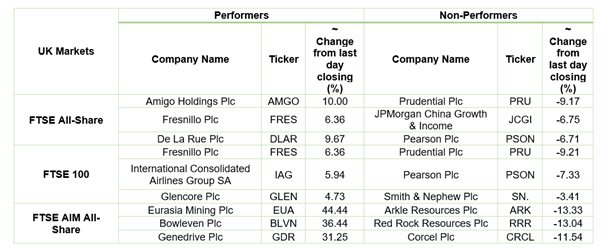

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $55.19/barrel and $52.36/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,838.55 per ounce, down by 0.56% against the prior day closing.

Currency Rates*: GBP to USD: 1.3728; EUR to GBP: 0.8833.

Bond Yields*: US 10-Year Treasury yield: 1.055%; UK 10-Year Government Bond yield: 0.291%.

*At the time of writing