UK Market: The UK stock market turned lower on Monday, with the blue-chip FTSE100 index losing over 1.5%, hitting its lowest level in over a month. This happened after the Office for National Statistics (ONS) released the GDP monthly estimate for April 2022. According to the data, UK’s GDP declined by 0.3% in April, after dropping by 0.1% in March. For the first time since January last year, all major sectors, including services, production, and construction, contributed negatively to the monthly GDP estimate.

Antofagasta plc (LON: ANTO): The shares of the Chilean mining business, Antofagasta plc, were down by 5.09%, with a day’s low of GBX 1,355.50. Recently, the company announced that its operations at the Los Pelambres deposit in Coquimbo were hampered due to a pipeline leak.

J Sainsbury plc (LON: SBRY): The shares of the second biggest chain of supermarkets in the UK, J Sainsbury plc, were down by 3.61%, with a day’s low of GBX 204.90. Recently, the salary of the company’s CEO has tripled while the UK households are struggling with rising food and fuel bills.

United Utilities Group plc (LON: UU.): The shares of the water and wastewater firm, United Utilities Group plc, were up by 0.67%, with a day’s high of GBX 1,056.00. In the year ended 31 March 2022, the company’s revenue surged by 3%. However, the company said that rising costs might offset its future growth.

US Markets: The US market is likely to get a dismal start, as indicated by the futures indices. S&P 500 future was down by 94.75 points or 2.43% at 3,804.25, while the Dow Jones 30 future was down by 1.93% or 605 points at 30,778.00. The technology-heavy index Nasdaq Composite future was also down by 3.16% or 374.25 points, at 11,465.75. (At the time of writing – 8:30 AM ET).

The shares of the online cryptocurrency platform, Coinbase (COIN), were down by over 14% in the premarket trading session. This happened after the prices of digital assets significantly plunged over the weekend, with bitcoin hitting its 18-month low level.

The shares of the global tech firm Amazon (AMZN), were down by almost 4% in the premarket trading session, becoming one of the worst mega-cap performers. The shares of the company plunged as investors prepared for a broad sell-off.

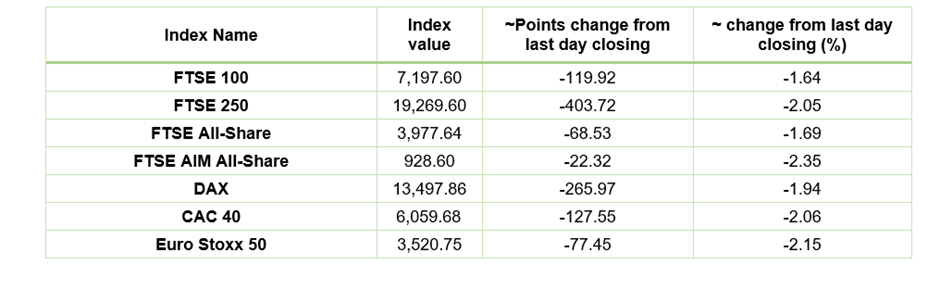

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 13 June 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone (VOD), BP plc (BP.)

Top 3 Sectors traded in red*: Consumer Cyclicals (-2.85%), Basic Materials (-2.46%), Real Estate (-2.13%)

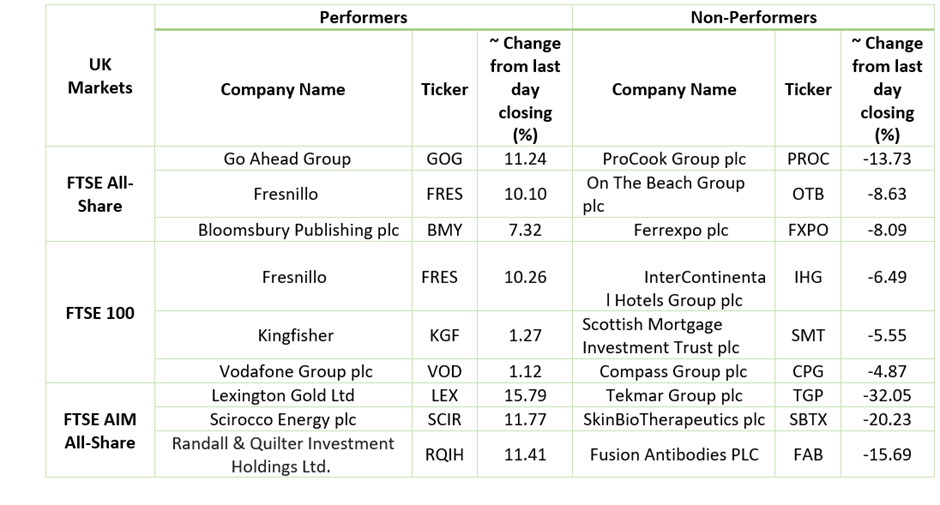

London Stock Exchange: Stocks Performance (at the time of writing):

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $120.56/barrel and $119.05/barrel, respectively.

Gold Price*: Gold price was hovering at around US$ 1,838.20 per ounce, down by 1.98% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.2182; EUR to USD: 1.0450.

Bond Yields*: US 10-Year Treasury yield: 3.287%; UK 10-Year Government Bond yield: 2.4805%.

*At the time of writing