US Markets: Wall Street started the new month with all the three major stock indices hitting a record high on Monday, 1 November, following the marginal gain from last week’s record closing. However, the indices slipped into the negative region soon after hitting fresh all-time highs in the wee hours of trading.

Earnings momentum has been consequential for US equities in the present quarter so far with the Dow Industrials surpassing the psychological mark of 36,000 for the first time ever, the broader share indicator S&P 500 and the tech leader Nasdaq composite strengthening over their respective value of 4,600 and 15,500, respectively.

Shares of Tesla provided substantial support to the American equities on Monday with the stock registering a rise of more than 4%, led by the better-than-expected quarterly performance. Shares of Dow, Amgen, McDonald’s, Walgreens Boots Alliance, Boeing, Caterpillar, Visa and Intel emerged as the lead gainers among the 30 components of Dow Jones Industrial Average, while the stock of Microsoft, UnitedHealthGroup, Home Depot, Nike, Apple and Cisco Systems stood as the biggest laggards on Monday.

Global Market touches record highs on Monday

Investors’ confidence was partly hit after the IHS Markit slightly revised the final reading for the US Manufacturing PMI to 58.4 for October of 2021 from the preliminary estimate of 59.2. Earlier in September 2021, the IHS Markit Manufacturing PMI for the US came in at 60.7. The latest figures indicate the weakest pace of expansion in the last 10 months as limitedness of raw materials and supply side constraints continue to hurt the manufacturing industry.

Following the persistent pressure of higher input price inflation, the output charge inflation has registered a fresh high as corporations are increasingly passing the effect of higher input prices to the customers. The data detailing the changes in the employment activity in October will be unveiled today with the investors turning their focus to the US Federal Reserve’s interest rate decision due on Wednesday, 3 November 2021.

The Federal Open Market Committee is likely to announce the prospective tapering to the US Fed’s bond buying programme. Market participants are also awaiting for any hint on upcoming rate hikes in the next year by the Committee as the worries of central banks escalate with the continuously rising rate of inflation.

US Market News: Nasdaq Composite was largely uplifted by the upswing in shares of Tesla, Facebook and Nvidia. The cumulative positive points supplied by these corporations were effectively counterbalanced by the considerable fall in the shares of Apple, Amazon, Microsoft, Alphabet, ASML, Adobe Systems, Netflix and Paypal.

Ahead of Tesla, the stocks of NetEase, JD.com, Pinduoduo, and Baidu spearheaded the gains with the shares rising more than 4.5% each. The benchmark index rose to a record high of 15,556, up 59.39 points, or 0.82% from the previous close of 15,498.39.

The wider share barometer S&P 500 wobbled under the pressure of mixed trade as investors rejig their respective trade setups before the FOMC begins its meeting on the interest rate action.

The S&P 500 traded largely flat at 4,604.61, whereas the NYSE-controlled Dow Jones Industrial Average hovered 35.73 points, or 0.10% higher at 35,855.29, from the last close of 35,819.56. During the day so far, the index registered a fresh lifetime peak of 36,009.74, while S&P hit a record high of 4,620.34.

UK Markets: London equities were on a roll today with the domestic benchmark FTSE 100 reclaiming the level of 7,300, for the first time in over 20 months. The continued support from the heavyweight shares have supported the headline index as the markets return to Greenwich Meridian Time (GMT) from British Summer Time (BST).

According to the latest data available with the London Stock Exchange, FTSE 100 advanced as much as 63.66 points, or 0.88% to 7,301.23, from the previous closing of 7,237.57 on Monday, 1 November.

FTSE 100 (1 November)

Source: REFINITIV

This has been the highest level since 24 February, 2020, the day when the market index recorded a slump of more than 3% following the industry-wide panic with regard to the coronavirus pandemic. Meanwhile, the mid-cap heavy index FTSE 250 added 140.54 points, or 0.61% to 23,247.15, from the previous close of 23,106.61.

Notably, the FTSE 100 components cumulatively topped an unusual equity volume of more than 1 billion. Shares of AstraZeneca, HSBC Holdings, Unilever, Diageo, GlaxoSmithKline and BP contributed majorly to the index today. On the other hand, shares of Darktrace emerged as the biggest losers among the 101 constituents of the benchmark index, followed by the stocks of Barratt Developments, Taylor Wimpey, Berkeley Group Holdings and Barclays.

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, Barclays and Vodafone Group

Top 3 sectoral indices: Medical Services, Electricity Generation and Distribution, and Health Care and Related Services

Bottom 3 sectoral indices: Household Goods, Real Estate Trusts and Software and Computing

Crude oil prices: Brent crude up 1.23% at $84.75/barrel; US WTI crude up 0.91% at $84.33/barrel

Gold prices: An ounce of gold traded at $1,791.75, up 0.44%

Exchange rate: GBP vs USD - 1.3676, down 0.11% | GBP vs EUR - 1.3676, down 0.29%

Bond yields: US 10-Year Treasury yield - 1.591% | UK 10-Year Government Bond yield - 1.0780%

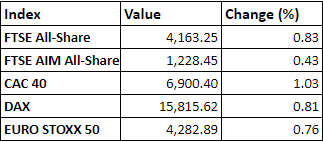

Markets @ 16:30 GMT