Summary

- FTSE 100 is likely to start on a softer note as the Asian peers mostly traded in red, and the US markets snapped the session in negative terrain.

- Oil prices have ticked higher though the trade is likely to remain range bound.

- Traders will be eyeing GDP data for further cues.

The benchmark index of London, FTSE 100, is likely to have a soft start tailing the weakness in the Asian peers and decline in the US markets, which remain impacted by the US$ 20 billion margin call of Archegos Capital. The FTSE 100 futures were also trading in red, down by 0.32 per cent at 0734 HRS GMT this morning.

The FTSE 100 index though had managed a positive close in last session, moving up by 0.53 per cent 6,772.12 on Tuesday, led by financial firms like Barclays and Lloyds. The index was at its best in last two weeks as the trades were encouraged by the positive sentiments around Europe with a focus on a resilient recovery.

(Source: Refinitiv, Thomson Reuters)

Asian peers in red

Asian indices were mostly in red on Wednesday, though there was news of strong economic recovery in China as its factory activity rebounded in March. Sentiments across the region were weighed down by the coronavirus pandemic and its lingering impact.

China’s Shanghai Composite Index was down by 0.59 per cent. Hong Kong’s Hang Seng index was down by 0.33 per cent, Japan’s Nikkei 225 was down by 0.46 per cent, South Korean index Kospi Composite was down by 0.09 per cent. However, Australia’s ASX 200 ended higher by 0.78 per cent, on Wednesday.

Oil

Oil futures have moved higher as the traders, though the trade is likely to remain rangebound, traders were waiting for fresh catalysts from the upcoming OPEC+ meeting.

Brent crude oil June 2021 futures contract was at US$64.46, up by 0.45 per cent at 07:16 AM GMT, while West Texas Intermediate crude oil May futures were at USD 60.87 per barrel, up by 0.55 per cent.

US Markets

The US markets ended lower on Tuesday, with traders remaining concerned about the rise in bond yield, which led to strength in the dollar and weighed on equities. The yield on the 10-year Treasury note traded above 1.77% during intraday trade for the first time since January 2020, though it finally managed a flat closing near 1.72%.

The Dow Jones Industrial Average index last closed down by 0.31 per cent, the S&P 500 index was down by 0.32 per cent, while the tech heavy Nasdaq Composite index ended lower by 0.11 per cent.

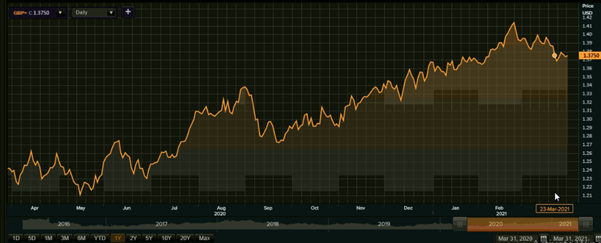

Sterling strengthens

(Source: Refinitiv, Thomson Reuters)

The British pound has witnessed a volatile trade in the last session and GBP/EUR hit a new 13 months high during the day. The GBP/USD currency pair was up by 0.018 per cent, trading at 1.3728 at around 0530 AM GMT on Wednesday. The pair’s previous close was at 1.3725, and it started the day’s trade at 1.3739. The pair’s trading range was between a low of 1.3721 and a high of 1.3754, during the session so far.

Meanwhile, the UK central bank’s reference spot exchange rate was fixed at 1.3772 USD and 1.1707 EUR against 1 GBP, on 29 March.

Upcoming cues

On the domestic front, traders would be eyeing the monthly GDP data for the month of January and Q4 numbers. The Office for National Statistics (ONS) has confirmed the UK economy grew modestly in the Q4 2020. Meanwhile, the Bank of England estimates a contraction of 4 per cent for Q1. House building stocks will be in focus as the Nationwide Housing Prices will be released today.

On the global front, investors will be eyeing US President Joe Biden’s infrastructure plan set to be announced later in the day. The plan is expected to cost as much as $3 trillion to $4 trillion.