Global Markets: Benchmark equity indices in the United States were trading in green, with the Dow Jones Industrial Average was quoting at 26,500.06 and added 34.52 points or 0.13% against the previous closing session, the S&P 500 index was trading marginally higher at 2,922.73 and the technology benchmark index Nasdaq Composite was hovering slightly higher at 7,956.61, at the time of writing.

Global News:Â The Federal Reserve in its latest policy meeting kept the interest rates unchanged and hinted towards a more dovish stance as driven by slowing inflation and uncertain global economic growth. The FOMC (Federal Open Market Committee) kept the funds rate in between 2.25 per cent to 2.5 per cent. China and the United States have agreed to revive trade talks, though it is unclear when the formal trade negotiations will restart. Chinese President Xi Jinping and US President Donald Trump are set to meet during next week's G20 summit in Japan.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 39.50 points or 0.53% lower at 7,403.54, the FTSE 250 index snapped 66.33 points or 0.34% lower at 19,245.46, and the FTSE All-Share Index ended 19.70 points or 0.48% lower at 4,040.93 respectively. European benchmark index STOXX 600 ended 0.01 points lower at 384.77 respectively.

European News: The Confederation of British Industry on Wednesday said that manufacturing output in the second quarter looked on course for the weakest performance in three years and British factory orders slid in June against a backdrop of Brexit uncertainty. British opposition Labour leader Jeremy Corbyn said on Wednesday that any referendum should offer real choices for both leave and remain voters and reiterated that it was right to demand a second referendum on any deal to leave the European Union.

London Stock Exchange (LSE)

Top Performers Stocks: GOCO GROUP PLC (GOCO), ARROW GLOBAL GROUP PLC (ARW), and CLIPPER LOGISTICS PLC (CLG) surged by 12.07 per cent, 8.72 per cent and 7.44 per cent respectively.

Top Laggards Stocks: SAGA PLC (SAGA), TED BAKER PLC (TED), and LOW & BONAR PLC (LWB) decreased by 12.07 per cent, 8.94 per cent and 8.06 per cent respectively.

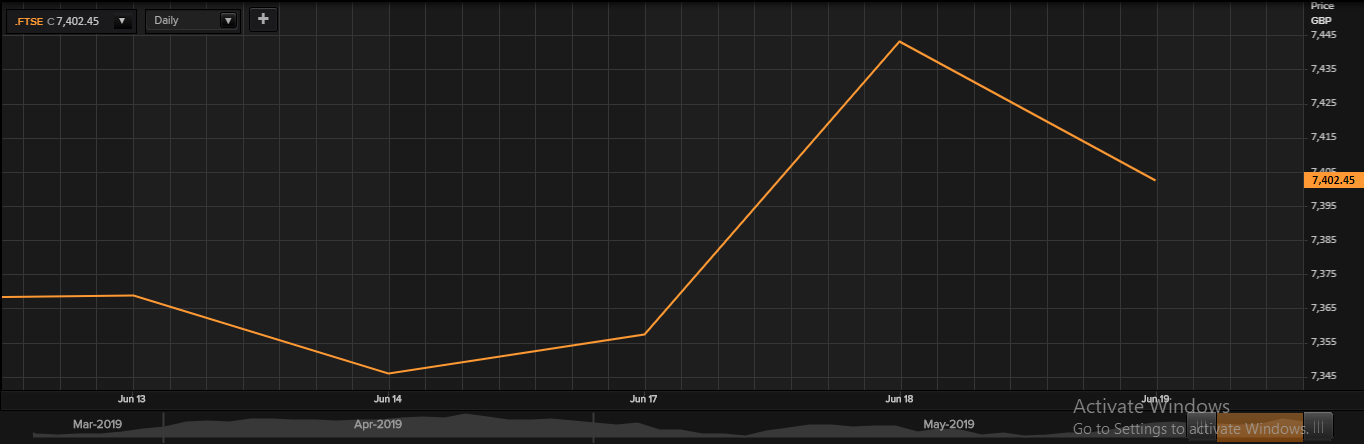

FTSE 100 Index

FTSE100 Index: 5-days Price Chart as on June 19, 2019. (Source: Thomson Reuters)

Top Risers Stocks: ROYAL BANK OF SCOTLAND GROUP PLC (RBS), SMITH (DS) PLC (SMDS) and MELROSE INDUSTRIES PLC (MRO) rose by 3.49 per cent, 2.58 per cent and 2.31 per cent respectively.

Top Fallers Stocks: OCADO GROUP PLC (OCDO), RIO TINTO PLC (RIO) and MARKS AND SPENCER GROUP PLC (MKS) reduced by 5.64 per cent, 4.68 per cent and 4.55 per cent respectively.

Top Active Volume Leaders: LLOYDS BANKING GROUP PLC, VODAFONE GROUP PLC, and TESCO PLC.

Top Risers Sectors: Healthcare (+0.55%) and Financials (+0.48%).

Top Fallers Sectors: Basic Materials (-2.46%), Technology (-1.58%) and Telecommunications Services (-1.37%).

Foreign Exchange and Fixed Income

FX Rates*: GBP/USD and EUR/GBP were exchanging at 1.2655 and 0.8879 respectively.

10-Year Bond Yields*: US 10Y Treasury and UK 10Y Bond yields were trading at 2.027% and 0.866% respectively.Â

*At the time of writing