UK Market: The UK stock market extended the gains on Thursday, with the blue-chip FTSE100 index gaining around half a per cent. Initially, the flagship index was struggling to move up amid a stronger pound and warnings from China over the weak state of their economy. But later, the index rallied as the UK Government announced a new £15bn support package for households struggling with rising bills. The pound reached a two-week high of 1.2619 on Thursday, moving up from Wednesday’s closing of 1.2547 against the US dollar.

BT Group plc (LON: BT.A): The shares of the British telecommunications firm BT Group plc were down by 3.37%, with a day’s low of GBX 183.50. This happened after the UK business secretary asked for a probe regarding the increased shareholding of Patrick Drahi in the UK’s internet backbone, raising issues of National security.

United Utilities Group plc (LON: UU.): The shares of the British water company, United Utilities Group plc, were down by 3.96%, with a day’s low of GBX 1,068.50. This happened after the company declared lower-than-expected profits for the fiscal year 2022 and alerted about rising costs for the year ending March 2023.

SSE plc (LON: SSE): The shares of the British energy firm SSE plc were down by 3.80%, with a day’s low of GBX 1,796.50. The company declared a 23% hike in its annual profits yesterday. The pre-tax profits of the group have surged from £948.9mn to £1.16bn.

US Markets: The US market is likely to get a positive start, as indicated by the futures indices. S&P 500 future was up by 19.50 points or 0.49% at 3,995.50, while the Dow Jones 30 future was up by 0.57% or 183 points at 32,258.00. The technology-heavy index Nasdaq Composite future was also up by 0.10% or 12 points, at 11,952.75. (At the time of writing – 9:45 AM ET).

The shares of the department store chain Macy’s (M) were up by 15% in the premarket trading session. This happened after the company declared higher-than-expected revenues and profits for the first quarter of 2022, owing to increased apparel demand as people are gradually returning to their workplaces. The company has also boosted its annual earnings forecast.

The shares of the variety store firm Dollar General (DG) were up by over 10% in the premarket trading session. This happened after the company declared that its first-quarter results were ahead of the Wall Street forecasts. The company has raised its forecast for same-store sales as inflation is pushing shoppers towards discount stores.

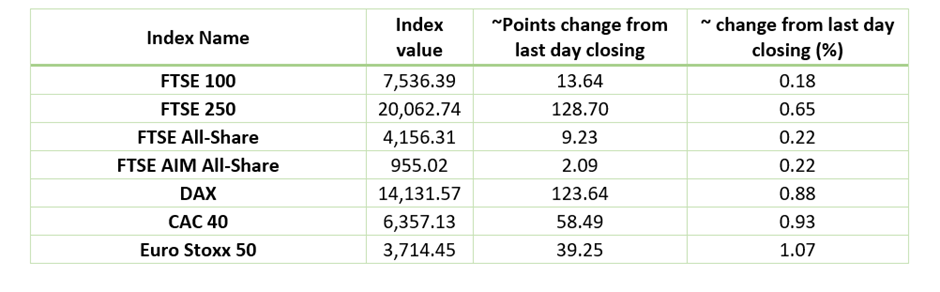

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 26 May 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), JD Sports Fashion plc (JD.), Barclays plc (BARC)

Top 3 Sectors traded in green*: Consumer Cyclicals (2.10%), Energy (1.15%), Real Estate (0.84%)

Top 3 sectors traded in red*: Utilities (-3.01%), Technology (-0.18%), Healthcare (-0.11%)

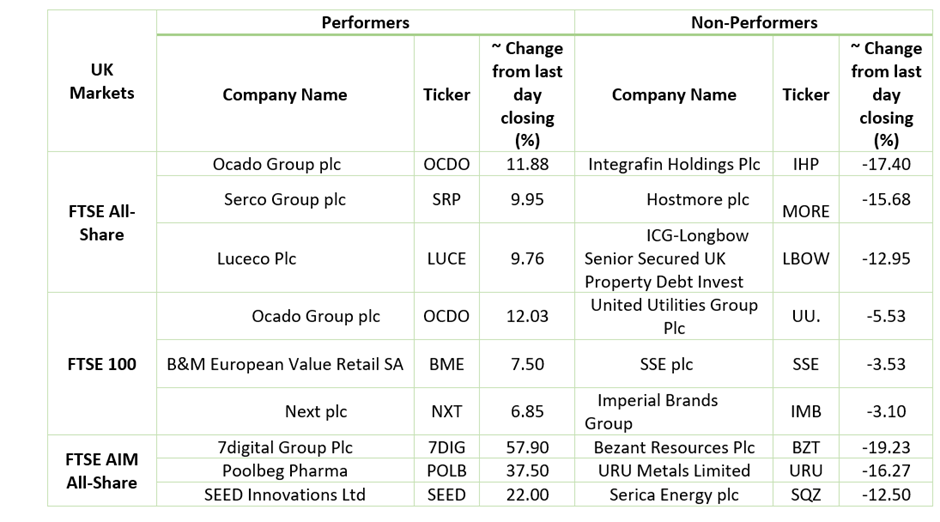

London Stock Exchange: Stocks Performance (at the time of writing):

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $112.72/barrel and $112.84/barrel, respectively.

Gold Price*: Gold price was quoted at US$ 1,847.38 per ounce at the time of reporting, up by 0.06% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.2579; EUR to USD: 1.0717.

Bond Yields*: US 10-Year Treasury yield: 2.742%; UK 10-Year Government Bond yield: 1.9470%.

*At the time of writing