US Markets: Wall Street started on a positive note on Thursday, 28 October, with Dow Industrials and S&P 500 scaling nearing their respective record highs. Of the three, Nasdaq Composite led the gains with the tech barometer surging more than 1% to hit a fresh all-time high as the heavyweight shares of Apple, Amazon, Tesla, Facebook, Nvidia, ASML, and Netflix contributed major positive points to the market index.

Following a market-wide buying, Wall Street has comprehensively recovered from the partial losses incurred on Wednesday as market participants capitalised on the better-than-expected corporate earnings.

Meanwhile, the American economy expanded at a lower-than-anticipated rate in the July-September quarter as the national GDP grew at an annualised rate of 2%, registering a sharp drop from second quarter’s expansion of 6.7%. The dismal growth rate for the national economy has failed to unnerve the investors as they align their respective trade setups according to earnings growth.

Global Markets moved toward record highs

This has been the weakest growth rate during the pandemic era as the economy rebounds from the elongated hardships of Covid-19. The actively rising Covid-19 cases during the preceding quarter, faltering supply chain systems and inadequacy of enterprises to operate at full scale have collectively taken a toll on overall consumption, as well the production.

The number of US citizens seeking unemployment benefits in the week ending 23 October slid to a new 19-month low of 281,000, productively augmented the confidence as the American labour market continues to improve gradually, reclaiming the pre-Covid level of employment. Nonetheless, the number of people filing new claims still stands well above the pre-pandemic reading of 212,000, recorded in early weeks of March 2020, the time just before the Washington administration announced the first national lockdown.

The NYSE-controlled Dow Jones Industrial Average rose 186.89 points, or 0.53% to 35,677.58 from the previous close of 35,490.69, the broader market index S&P 500 jumped 38.86 points, or 0.85% to 4,590.54, from the last close of 4,551.68, while the tech counterpart Nasdaq Composite advanced as much as 182.13 points, or 1.19% to a new lifetime peak of 15,417.97, from the previous mark of 15,235.84.

US Market News: Shares of heavyweight corporation Ford Motors rallied 9% on a higher-than-expected quarterly performance. The stocks of Merck & Co, Caterpillar, Apple, Travelers Companies, Nike and JPMorgan Chase emerged as the lead gainers, while the shares of American Express, Visa and Boeing remained the biggest losers among the 30 constituents of Dow Industrials.

The July-September performance of Caterpillar, Merck & Co, Carlyle Group and Comcast has surpassed the street estimates, effectively supplementing the market-wide buying. Major corporations including Apple, Amazon and Starbucks are slated to release their respective report cards after the market hours.

UK Market: London equities failed to bounce back in the positive territory as the domestic benchmark index FTSE 100 oscillated in the red throughout the day. However, the index partly recouped the losses in the terminal trade, tracking the upbeat Wall Street. FTSE 100 shed 3.80 points, or 0.05% to end at 7,249.47, after hitting an intraday bottom of 7,219.71.

FTSE 100 (28 October)

Source: REFINITIV

The blue-chip shares of Royal Dutch Shell, BP, Rio Tinto, British American Tobacco, Glencore, London Stock Exchange Group, HSBC Holdings and Vodafone Group were the biggest negative point contributors to the index with the stock of Shell falling more than 3%.

The moderate-to-high uptick in the shares of market capitalisation leader AstraZeneca, Unilever, GlaxoSmithKline, Reckitt Benckiser, Lloyds Banking Group and National Grid failed to counterbalance the index on Thursday.

The mid-cap indicator FTSE 250 managed a marginal gain in the closing deals with the index concluding at 23,207.71, up 35.67 points, or 0.15% from the previous close of 23,172.04.

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, Royal Dutch Shell and Vodafone Group

Top 3 sectoral indices: Industrial Transportation, Medicine and Biotech and Personal Goods

Bottom 3 sectoral indices: Automotive, Fossil Fuels and Telecommunications

Crude oil prices: Brent crude down 0.91% at $83.11/barrel; US WTI crude down 0.70% at $82.08/barrel

Gold prices: An ounce of gold traded at $1,805.75, up 0.38%

Exchange rate: GBP vs USD - 1.3811, up 0.47% | GBP vs EUR - 1.1815, down 0.24%

Bond yields: US 10-Year Treasury yield - 1.550% | UK 10-Year Government Bond yield - 0.9985%

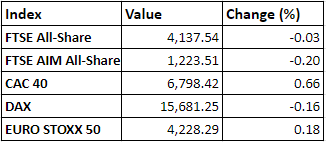

Markets @ 16:30 BST