US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 2.78 points or 0.07 per cent lower at 4,229.82, Dow Jones Industrial Average Index surged by 274.85 points or 0.79 per cent higher at 35,052.61, and the technology benchmark index Nasdaq Composite traded lower at 13,540.02, down by 212.22 points or 1.54 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note after the major US pipeline network had driven energy prices higher. Among the gaining stocks, BioNTech shares jumped by around 3.40% after the Company had reported better-than-expected top-line and bottom-line business for the first quarter. Eli Lily & Co shares went up by about 0.11% after the Company had signed licensing agreements with three Indian generic drug makers. Among the declining stocks, Coty shares plunged by about 8.90% after the Company had reported a 3.3% drop in the third-quarter revenue. Marriott International shares went down by about 2.58% after the Company had posted a quarterly loss.

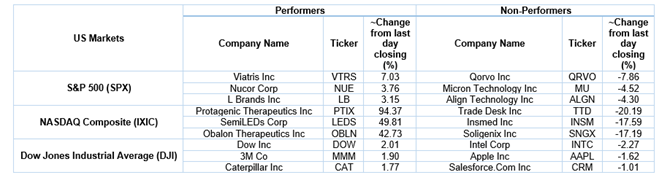

US Stocks Performance*

UK Market News: The London markets traded in a red zone after the strengthening of the sterling pound against the US dollar. FTSE 100 traded lower by around 0.09% even after the good performance of mining and energy stocks mitigated the adverse impact of a stronger pound to a certain extent. According to Halifax’s house price index, the average house prices in the UK had witnessed a year-on-year growth of around 8.2% during April 2021 and stood at 258,204 pounds, while it remained nearly 1.4% higher when compared with March 2021. Moreover, the shopper number across the UK dropped by around 4.1% for the week ended 08 May 2021 as compared to the prior week.

Greggs shares surged by about 10.79% after the Company had reported significant sales recovery following the easing of the Covid-19 restrictions.

Hotel Chocolat Group had expected FY21 trading performance to remain ahead of expectations as it had witnessed robust trading performance across all channels since the reopening of physical retail stores in the UK. Moreover, the shares grew by around 8.57%.

Polymer maker Victrex shares climbed by around 8.29% after the Company witnessed moderate growth of about 5% in the sales volume during H1 FY21.

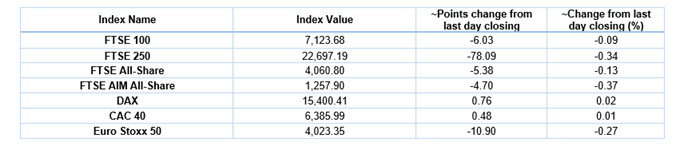

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 10 May 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); BT Group Plc (BT.A).

Top 3 Sectors traded in green*: Basic Materials (+1.52%), Energy (+0.82%) and Real Estate (+0.78%).

Top 3 Sectors traded in red*: Industrials (-1.43%), Consumer Cyclicals (-1.22%) and Technology (-0.88%).

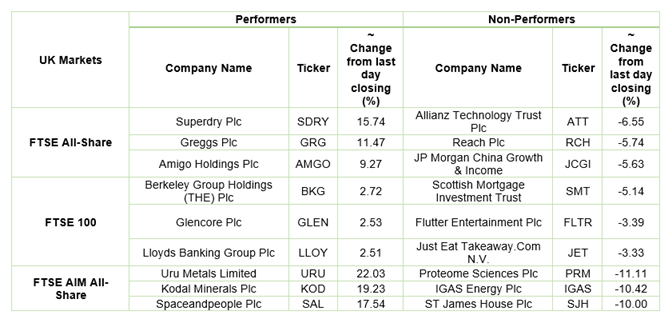

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $68.23/barrel and $64.83/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,837.85 per ounce, up by 0.36% against the prior day closing.

Currency Rates*: GBP to USD: 1.4144; EUR to GBP: 0.8593.

Bond Yields*: US 10-Year Treasury yield: 1.597%; UK 10-Year Government Bond yield: 0.7950%.

*At the time of writing

.jpg)

_09_03_2024_01_03_36_873870.jpg)