Summary

- Fraser Group has been negotiating rent payment with landlords

- The underlying profit before taxation of the company was down by 18.1 per cent to £117.4 million

The High street retail and businesses have been severely impacted as they suffered lockdown, which was aimed at curbing the spread of the virus. As the lockdown is now lifted, still consumers are fearing to go and buy things from stores. In addition, the consumers are in a savings mode due to prevalent uncertainties in the economy with reference to Brexit and the coronavirus pandemic.

As most of the high street retailers struggle to get revenue through their doors, they are leaving no stone unturned to reduce their cost structure. For instance, irrespective of the amount of profit a business makes, it is supposed to pay rent, which is a fixed cost. Paying commercial rents could be painful if a business is into losses.

Irrespective of the market conditions, the business is liable to pay rent, which is decided and documented mutually in the lease agreement. The business is liable to pay the rent amount for the entire term of the lease. Due to the unprecedented crisis initiated by the novel coronavirus, businesses are really struggling to remain afloat and have latched on to support schemes backed by the government.

FTSE 250 listed Frasers Group Plc (LON: FRAS), formerly known as Sports Direct International Plc, UK’s leading sporting goods retailer company, has been negotiating rent payments with landlords in the wake of novel coronavirus. The sports retail company has threatened to close its stores if the landlords disapprove their proposals.

According to Office of National Statistics (ONS), clothing store sales recorded 25.7 per cent lower volume sales in July 2020 in comparison to February for the same year, which remained worst hit during the pandemic. However, the overall retail sales volumes increased by 3.6 per cent in July 2020, indicating a mild recovery in the sector.

It has been the most difficult year for the company since its inception in 1982. Due to the economic impact of the coronavirus pandemic and Brexit, Frasers Group is looking forward to striking a rent agreement with landlords which is linked with its sales figures.

For the leasehold estate across territories, the Group aims to strike turnover-based rent agreements across all its chains going forward. These turnover-based rent agreements are less expensive than conventional leases which usually span for a term of six years in the UK.

The commercial property owners have been making concessions to the struggling business owners during the unprecedented crisis. According to industry experts, the commercial leases are now getting shorter by almost a year. Shorter leases would translate to lesser certainty over rental incomes and future occupancy.

As businesses exercise caution and avoid making long-term decisions due to prevalent uncertainties such as Brexit and Covid-19, the trend towards a shorter lease is expected to rise. According to industry experts, businesses are negotiating term reductions with the property owners. Moreover, businesses nearing maturity are choosing to renew or extend their existing lease agreements with added flexibility.

In the UK, an average lease lasts for six years, according to market exports. During the pandemic times, this term has gone down by 10 months on an average. Businesses are looking forward to shortening the lease term, flexible options, and more agile office solutions amid the economic pressures and uncertainty triggered by the coronavirus pandemic and Brexit.

While most of the industry sectors were deeply impacted due to the pandemic and consequently, the lockdown implemented by the British government. Few of the sectors have been devastated, as the coronavirus pandemic takes a toll on the whole global economy.

Many of the high street retailers have closed their shops due to falling footfall and ensuring safety of their employees. Despite the fact that the high street retail sector in UK has reopened, nothing much can be said regarding the timelines of things returning to normalcy. The coronavirus pandemic had put millions of jobs at risk around the world as businesses struggle to get revenue through the doors and coping with the financial crisis created by the shutdown. High-street business is one of the hardest hit sectors which heavily rely on footfall, and shoppers.

Do read: Is The UK Retail Spending Approaching Pre-Pandemic Levels?

Earlier in April, Arcadia Group, London based multi-retailer of clothing with several hundred franchises across the world, had reportedly notified the property owners, that it will vacate those stores where the leases are due for renewal. According to some media reports, the company tried to negotiate with landlords over reduction in rent for the lockdown period but could not succeed. Fashion chains, Oasis and Warehouse Limited are likely to collapse into administration, according to industry insiders.

Recently, another prominent London based multi-retailer, which deals in clothing & household products, Debenhams’ has reportedly appointed restructuring experts to undergo potential liquidation, which would eventually lead to job losses.

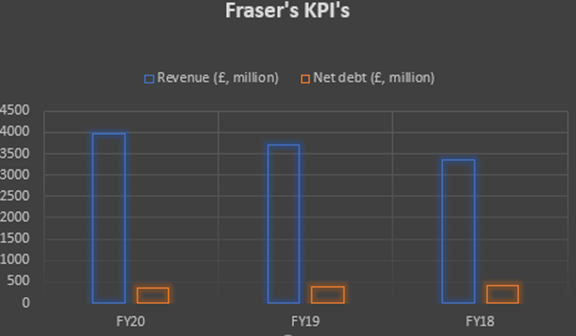

Fraser Group’s Business Highlights FY20

(Source: Company’s filings, London Stock Exchange)

On a year on year basis, the revenue has gone up and net debt has gone down for the company. However, 2020 would be remembered as the most difficult year since the company began its operations decades ago. During the fiscal year 2020, the Group’s revenue was up by 6.9 per cent to £3,957.4 million. The Group made several acquisitions this year, such as GAME Digital plc, Sofa.com, and Jack Wills, which led to an increase of 4.5 per cent in Group’s operating costs (2019: £1,287.1 million).

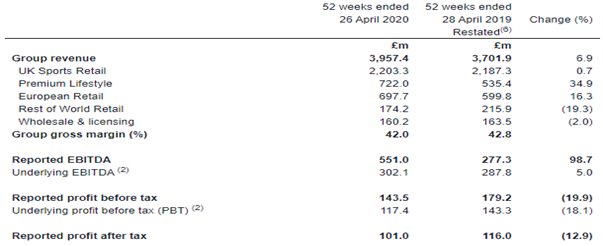

(Source: Company’s filings, London Stock Exchange)

The Gross margin of the company plunged by 80 basis points to 42 per cent during the fiscal year 2020. In addition, due to closure of retail stores in the wake of coronavirus pandemic, the underlying profit before taxation of the company was down by 18.1 per cent to £117.4 million (2019: £143.3 million).

|

CMP (GBX) as on 21 August 2020, GMT 12.44 PM+1 |

345 |

|

Marker Capitalisation (£ million) |

1800.04 |

|

52 weeks High (GBX) |

518 |

|

52 weeks Low (GBX) |

182.6 |

(Source: London Stock Exchange)

According to the British Retail Consortium (BRC), the decrease in retail sales post March 2020 was the worst which the world has ever witnessed. The sales numbers in fashion & clothing has particularly been hit hard. In addition, to support the disbursement of commercial rents to landlords, the British Retail Consortium has joined forces with landlord bodies, the British Property Federation, and Revo (UK’s leading council for shopping centers) recently to avoid further retail bankruptcies.