US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 25.87 points or 0.59 per cent higher at 4,431.67, Dow Jones Industrial Average Index surged by 172.64 points or 0.49 per cent higher at 35,066.76, and the technology benchmark index Nasdaq Composite traded higher at 14,670.80, up by 129.00 points or 0.89 per cent against the previous day close (at the time of writing – 11:30 AM ET).

US Market News: The major indices of Wall Street traded in a green zone after witnessing a correction due to the tapering fears. Among the gaining stocks, Foot Locker (FL) shares surged by about 8.88% after the Company reported better-than-expected second-quarter results. Spotify Technology (SPOT) shares went up by about 5.68% after stating that the Board had approved a USD 1 billion stock buyback. Petco Health & Wellness (WOOF) shares grew by around 4.21% after Credit Suisse had upgraded the stock to “outperform”. Among the declining stocks, Ross Stores (ROST) shares went down by around 2.80% after the forecast for the current quarter and fiscal year fell short of analysts’ expectations.

UK Market News: The London markets traded in a green zone after reporting heavy losses in the previous trading session. According to the latest figures from the Office for National Statistics, UK retail sales had shown an unexpected month-on-month decline of around 2.50% during July 2021 as compared to June 2021

Marks & Spencer shares grew by about 13.69% after the Company had anticipated full-year profit to remain at the top-end of the expectations. Moreover, it had reported robust sales growth during the summer.

FTSE 250 listed Babcock International Group shares rose by around 2.81% after Morgan Stanley had upgraded the Company from “equal-weight” to “overweight”.

WM Morrison Supermarkets had agreed upon the takeover offer worth approximately 7.00 billion pounds. Moreover, the shares went up by around 4.48%.

Vertu Motors shares surged by around 6.36% after the Company had upgraded the full-year profit before tax forecast for the current financial year.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 20 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Glencore Plc (GLEN); HSBC Holdings Plc (HSBA).

Top 3 Sectors traded in green*: Real Estate (+1.20%), Technology (+0.74%) and Consumer Cyclicals (+0.72%).

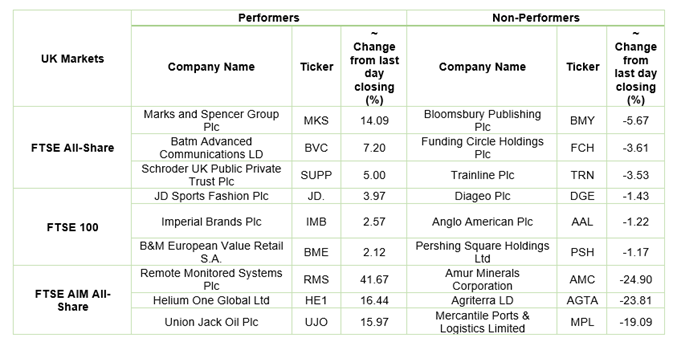

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $65.36/barrel and $62.28/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,783.95 per ounce, up by 0.05% against the prior day closing.

Currency Rates*: GBP to USD: 1.3623; EUR to USD: 1.1694.

Bond Yields*: US 10-Year Treasury yield: 1.262%; UK 10-Year Government Bond yield: 0.5270%.

*At the time of writing