US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 3.04 points or 0.07 per cent higher at 4,463.88, Dow Jones Industrial Average Index surged by 31.40 points or 0.09 per cent higher at 35,531.25, and the technology benchmark index Nasdaq Composite traded lower at 14,812.10, down by 4.20 points or 0.03 per cent against the previous day close (at the time of writing – 11:55 AM ET).

US Market News: The major indices of Wall Street traded in a green zone boosted by the strong earnings announcements. Among the gaining stocks, Embraer SA (ERJ) shares rose by about 6.85% after the Company had posted a first quarterly profit since the first quarter of 2018. Walt Disney (DIS) shares went up by about 2.79% after the Company’s quarterly profitability came out to be more than the consensus estimates. Among the declining stocks, SoFi Technologies (SOFI) shares tanked by around 13.75% after the Company had reported a loss of 48 cents per share for the second quarter. Airbnb (ABNB) shares slipped by around 1.60% after the Company had highlighted of uncertainty caused by the delta variant in the latest quarterly results.

UK Market News: The London markets traded in a green zone, with FTSE 100 witnessing the best weekly gain since November.

Babcock International Group shares surged by about 7.69% after the Company had decided to sell its wholly owned subsidiary Frazer-Nash Consultancy Limited for a cash consideration of 293 million pounds.

FTSE 250 listed Avon Protection shares plunged by around 26.03% after the Company had reduced the revenue guidance for 2021 and 2022 because of the supply chain disruptions and postponement of orders.

Sportech had signed an exclusive 10-year commercial arrangement with the Connecticut Lottery Corporation. Moreover, the shares jumped by around 14.29%.

Supply@Me Capital shares went down by around 6.02% after the Company had updated regarding the appointments of Dr. Thomas James and Mr. John Collis as Executive Directors.

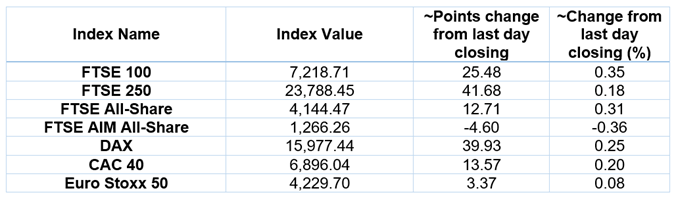

European Indices Performance (at the time of writing):

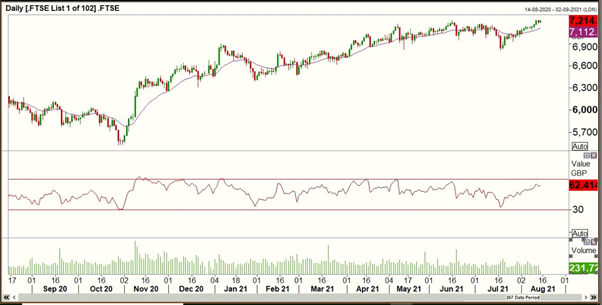

FTSE 100 Index One Year Performance (as on 13 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Real Estate (+1.76%), Healthcare (+1.14%) and Utilities (+0.75%).

Top 2 Sectors traded in red*: Energy (-1.06%) and Technology (-0.19%).

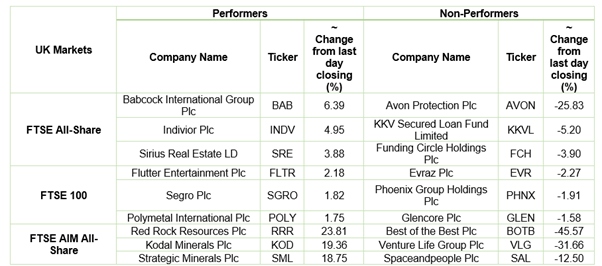

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $70.67/barrel and $68.53/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,780.05 per ounce, up by 1.61% against the prior day closing.

Currency Rates*: GBP to USD: 1.3871; EUR to GBP: 0.8505.

Bond Yields*: US 10-Year Treasury yield: 1.302%; UK 10-Year Government Bond yield: 0.5750%.

*At the time of writing