Henry Boot Plc

Henry Boot Plc (BOOT) is a British property developer, having interests in property investments, construction, plant hiring and highway construction. The company was founded in 1886 and got listed on the London stock exchange in 29-Nov 1974 and was the first builder to have been listed on the exchange. The company has six subsidiaries within its group. Henry Boot Development- develops properties in the United Kingdom, Hallam Land Management- strategic land and planning promotion, Henry Boot Construction- public and private sector construction, Banner Plant Limited- plant hiring business, Stonebridge Homes Limited- joint venture housing business in north of England and Road Link (A69) Limited- operates a thirty years contract for maintenance of A 69 trunk road.

The companyâs shares are listed on the London Stock exchange where they trade under the ticker name BOOT.

Recent News Update

The company on 23 August 2019 came out with its unaudited interim results for the first half year ending on 30 June 2019 for FY2019. The performance of the company during the six month period remained inferior to what it was during the corresponding six-month period last year ending on 30 June 2018. The revenues were down by 3.68 per cent, operating profit declined by 6.4 per cent, profit before tax deteriorated by 8 per cent and earnings per share were lower by 9.6 per cent. On the same time the net Debt, increased during the period by 93.5 per cent.

The company had informed on 9 August 2019, that its subsidiary Henry Boot Construction has acquired a majority stake in Starfish Commercial limited for a nominal sum.

John Sutcliffe, the Chief Executive of the company will be stepping down at the end of 2019, and the position will be taken over by Tim Roberts.

Financial Updates of Henry Boot Plc for the first half year ending on 30 June 2019

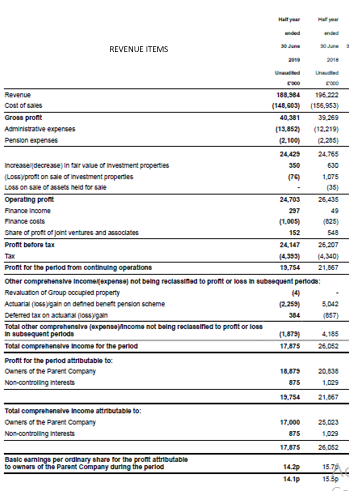

The companyâs revenue for the six-month period ending 30 June 2019 was £188.98 million, whereas for the corresponding six-month period ending 30 June 2018 it was £196.22 million. The gross profit for the half-year period ending 30 June 2019 was £40.381 million and for the corresponding half-year period ending 30 June 2018 it was £39.269 million. The operating profit for the first-half period ending 30 June 2019 was £24.703 million in contrast to operating profit of £26.435 million for the corresponding previous first-half year period ending on 30 June 2018. The total comprehensive income for the six-month period ending 30 June 2019 was £17.875 million, whereas for the corresponding last year six-month period ending 30 June 2018, it was £ 26.052 million. The diluted earnings per share for the half-year period ending 30 June 2019 was 14.1 pence while for the corresponding half-year period ended 30 June 2018 it was 15.5 pence. The board of the company has declared an interim dividend for the six-month period ended 30 June 2019 of 3.70 pence per share to be paid to shareholders on 18 October 2019, whose name appears in the register of the company on the business day close of 20 September 2019.

The lower earnings during the period were on account of lower sales, higher administrative expense despite lower revenue, higher finance cost and higher actuarial loss on defined benefit pension scheme for the six-month period ended 30 June 2019, compared to previous corresponding six- month period ending 30 June 2018.

(Source â Companyâs half-yearly report published on 23 August 2019)

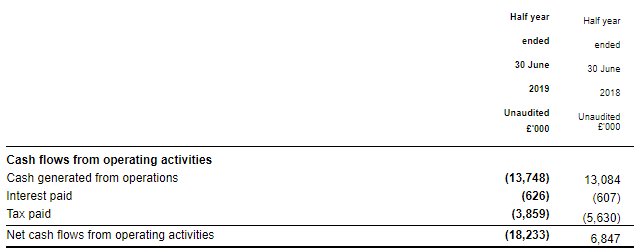

The companyâs operating cash flow for the period has been negative, with cash outflow of £ 18.233 million for the six month period ended 30 June 2019 compared to an Operating cash inflow of £6.847 million for the corresponding six-month period ending 30 June 2018.

(Source â Company half-yearly report published on 23 August 2019)

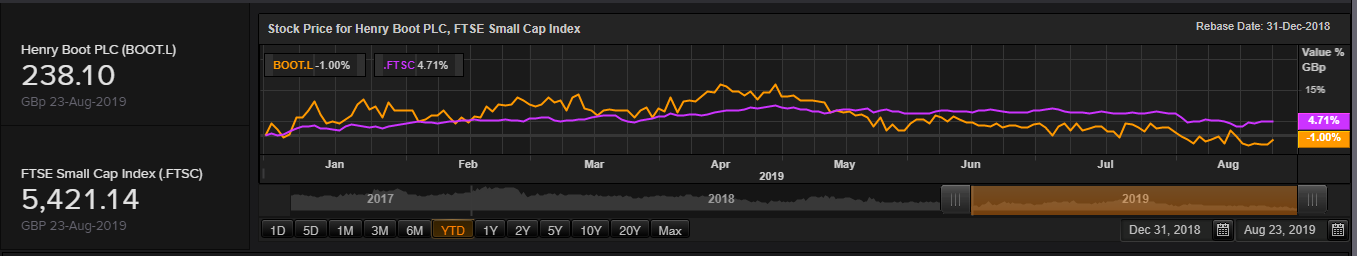

Stock Price performance at the London stock exchange (YTD).

(Comparative chart of the stock with the relevant index YTD, Source â Thomson Reuters)

The stock of the company has been performing in consonance with the FTSE small-cap index over the past year to date 23 August 2019. The stock was performing slightly better than the index from January 2019 to May 2019 and had been performing slightly below the index ever since.

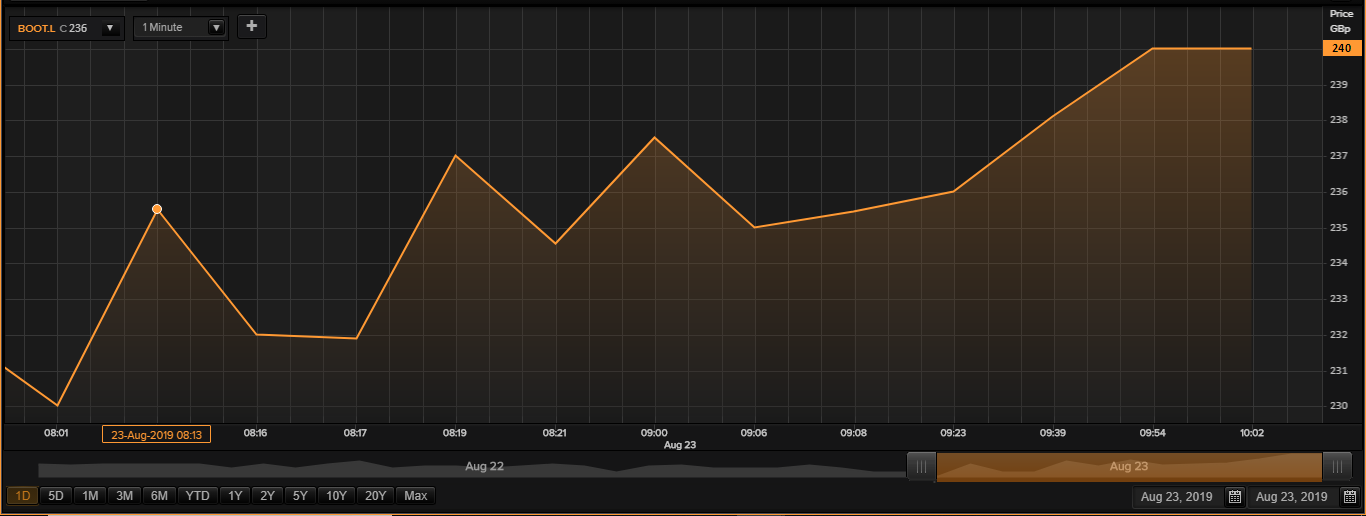

Todayâs stock performance at the London stock exchange

Daily Chart as on 23 August 2019, before the market close (Source: Thomson Reuters)

On 23 August 2019, at the time of writing of the report (before the market close, GMT 10.02 AM), BOOT shares were trading on the London Stock Exchange at GBX 240.00, down by 2.56 per cent over the previous day's closing price of GBX 234.00. The stock has a 52- week High of GBX 304.00, and a 52-week low of GBX 228.16. The total market capitalization of the company was around £308.45 million.

Outlook

The Chief Executive of the company John Sutcliffe, commenting on the interim results, said, that the company is confident of meeting its full year expectations despite a below-par performance this first-half period. The risk factors, however, are the impending economic conditions consequential to Brexit.

The companyâs subsidiary Hallam Land Management has performed strongly during the reported period due to solid trading conditions, aided by high demand in the housing sector in the United Kingdom.

Hummingbird Resources Plc

Hummingbird Resources Plc (HUM) is the United Kingdom based mining company with a focus on gold mining. The company has its main operations in the countries of Liberia and Mali. The companyâs exploration interest in Mali is known as Yanfolila gold project, and the exploration interest in Liberia is known as Dugbe gold project. Both of the companyâs projects are de-risked and hold a total inventory of 6.4 million ounces of gold.

The companyâs shares are listed on AIM at the London stock exchange where they trade under the ticker name HUM.

Recent News Update.

The company on 23 August 2019 came out with its financial results for the first half of 2019 ending on 30 June 2019, along with updates on its progress on both of its Yanfolila gold and Dugbe gold projects. The companyâs revenues improved marginally, increasing by 0.8 per cent, while gross profit has fallen by 79.6 per cent and the company suffered a net loss for the six-month period ending 30 June 2019, whereas it was in the green in the corresponding six-month period ending 30 June 2018.

The companyâs Yanfolila project produced 51,273 ounces of gold during the reported six-month period with an improved cost-benefit ratio. It signed a 25-year MDA with the Liberian government over a 2000 square kilometre area where the Dugbe gold project is located. Towards the end of this six-month period ending 30 June 2019 the company was holding an inventory of 3,500 ounces of gold valued at $5 million.

Financial Updates of Hummingbird resources Plc for the first half-year financial period ending on 30 June 2019

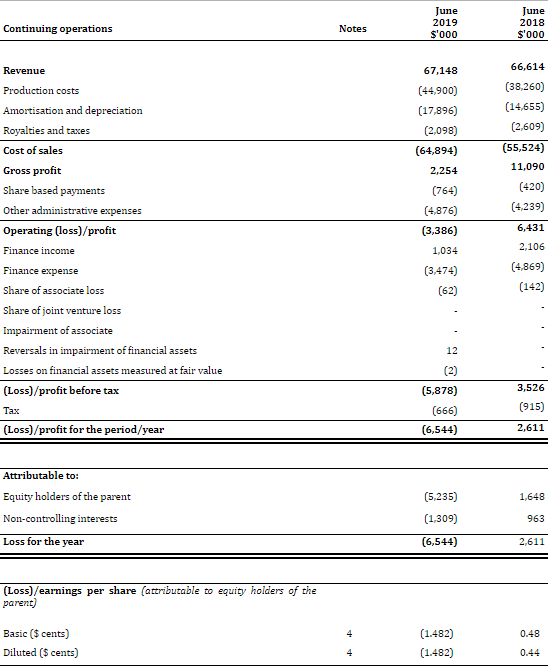

The companyâs revenue for the six-month period ending 30 June 2019 was $67.148 million, while it was $66.614 million for the six-month period ended 30 June 2018. The companyâs gross profit for the half-year period ending 30 June 2019 was $2.254 million, whereas for half year period ending 30 June 2018 it was $11.090 million. The operating loss of the company in the first-half period ending 30 June 2019 was $ 3.386 million, while it was an operating profit of $6.431 million for the half-year period ended 30 June 2018. The net loss for the six-month period ended 30 June 2019 was $6.544 million whereas for the six-month period ended 30 June 2018 it was a net profit of $2.611 million. The loss per share (Diluted) for this half-year period ended 30 June 2019 was 1.482 cents, while it was a profit per share of 0.44 cents for the half-year period ended 30 June 2018. The company did not declare any dividend for this six-month period ended 30 June 2019.

(Source â Companyâs half-yearly report published on 23 August 2019)

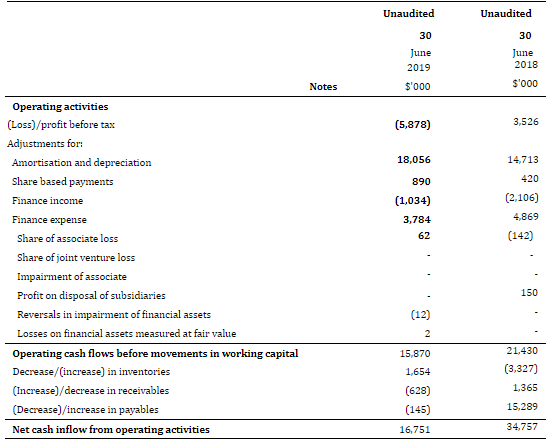

The company had a positive cash inflow from operating activities during this six-month period ending 30 June 2019 stood at $16.751 million, which is lower in comparison to a cash inflow from operating activities $34.757 million for the corresponding six-month period ended 30 June 2018.

(Source â Company half-yearly report published on 23 August 2019)

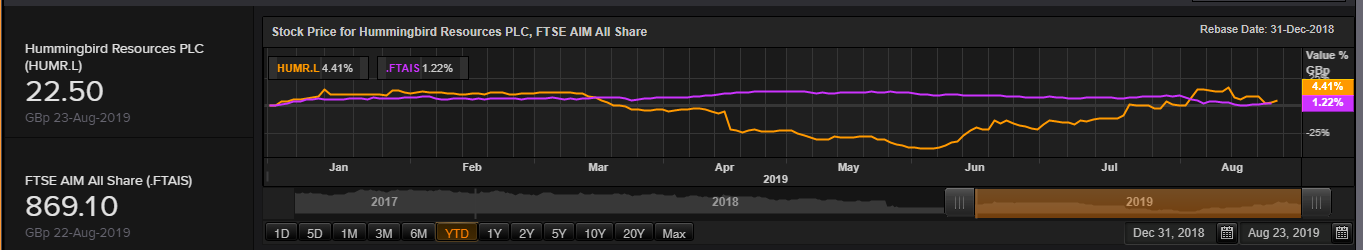

Stock Price performance at the London stock exchange (YTD).

(Source: Thomson Reuters)

The stock of the company was performing in consonance with the AIM all-share index till march of 2019, after that it started underperforming the index till mid of July 2019 and has been outperforming the index from then, unto the time of writing of this report.Â

Stock performance at the London stock exchange

Daily Chart as on 23 August 2019, before the market close (Source: Thomson Reuters)

On 23 August 2019, at the time of writing of the report (before the market close, GMT 11.26 AM), HUM shares were trading on the London Stock Exchange at GBX 22.5, up by 1.58 per cent over the previous day's closing price of GBX 22.15. The stock has a 52- week High of GBX 29.50, and a 52-week low of GBX 12.47. The total market capitalization of the Company was £77.55 million

Outlook

The company has established itself as one of the lowest cost producers of gold. While exploration activity continues in the Dugbe gold project, the production at the Yanfolila site is being ramped up. Though the company has suffered a loss for this half-year period, its increased production and sales in future periods will bring about significant value creation for its shareholders.