It was a good day for Bitcoin and Ethereum. Both the top cryptocurrencies started the month February on a positive note as the bearish sentiments seem to be receding. The month January, which was dubbed as the crypto winter for the entire market, saw all major digital assets underperforming as opposed to the usual trend.

In January 2022, Bitcoin saw its value go down by 19.2%, which was biggest decline since January 2018, when the BTC plunged by 25.4%. Similarly, Ethereum saw its biggest decline by plunging by over 30%, sending its prices down to its lowest levels since the July 2021 bearish market.

However, the market is showing signs of revival. Bitcoin registered gains of 2.70% after a gap of 11 days and Ethereum by 7.76% after a gap of 11 days, respectively, on 1 February. Many investors are watching their performance closely to see whether the tokens finish on a higher note by the end of February.

Let’s look at BTC and Ether and possibilities in the month of February.

Bitcoin

Bitcoin investors were upbeat on Tuesday as the token traded above the US$38,000 level on 1 January for the first time in 11 days. Bitcoin had slumped from US$40,672 on 20 January to US$35791 on 21 January following news of possible blanket ban by the Central Bank of Russia. This was in sharp contrast to its January 2020 and 2021 performance, where the prices went up by 30% and 14.5%, respectively. Since then, it largely hovered around the resistance mark of US$45,000 and support of US$34,000.

Market experts believe that February could well be the month when Bitcoin kicks on and returns to its positive return bracket. Bitcoin over the past nine years has given an average return of 12% in February.

Image credit: Stockcharts

As we can see in the chart above, traditionally February is the month that kicks off the rally for the leading crypto token. According to Santiment, the popular on-chain, and social metrics, even though the market is undergoing a negative sentiment overall, but that may in fact act as a trigger for the price rise.

Bitcoin, at the time of drafting, was trading at US$38,443.79 with a 24-hour trading volume of US$22,367,869,966. Its investors in the coming days will be hoping that this trigger could help Bitcoin breach its resistance level of US$45000. Bitcoin investors can take heart from the fact that El Salvador President Nayib Bukele expects that Bitcoin’s price could see a “gigantic price increase” in the coming months largely due to its limited supply.

In a tweet, Bukele further emphasized that there isn’t enough Bitcoin supply available for the newly crowned crypto millionaires to own at least own 1 BTC.

Image Credit: Twitter @santimentfeed (Santiment)

While the prospects of a bull run may be on the horizon, a few experts believe that US President Joe Biden’s executive order to regulate Bitcoin could have an impact on the market. Many believe that Bitcoin could well be around the mark of US$45,000-US$47,000 by the end of February assuming that the prices don’t fall further.

Ethereum

Ethereum just like Bitcoin started the year 2022 on a rocky terrain. Not only did it fall out of the US$3,000-mark on 20 January, but it also hasn’t come anywhere near to breaching its resistance level of US$3,500. Ethereum, which registered its all-time high of US$4,800 late last year, suddenly went from boom to bust much quickly than expected.

Between 2017 and 2020, the token has grown significantly. But it was in 2021, when it superseded its own potential with the NFT hype. In fact, Ethereum has seen a massive 25,000% surge between April 2016 and February 2022. In April 2016, its price was just US$11, and today is over US$2,700.

Many experts are calling the current bearish trend as the lull before the storm and expecting Ethereum to explode in 2022. With Ethereum 2.0 slated in June 2022, February could well be the month that cashes in on the momentum.

Image credit: Stockcharts

Just like Bitcoin, the month of February has traditionally been the phase when Ethereum goes from Gear 2 to Gear 4. Experts predict that given Ethereum’s inability to surpass its current resistance of US$4000, if ETH manages to come closer to US$3,800 by itself, it would be a major accomplishment.

Having said that, it is not all gloom for Ethereum. The Ethereum network has been working on disruptive ways like token burning to gain value. In fact, ever since Ethereum 2.0 was announced, approximately US$2.54 billion worth of ETHER has been burned.

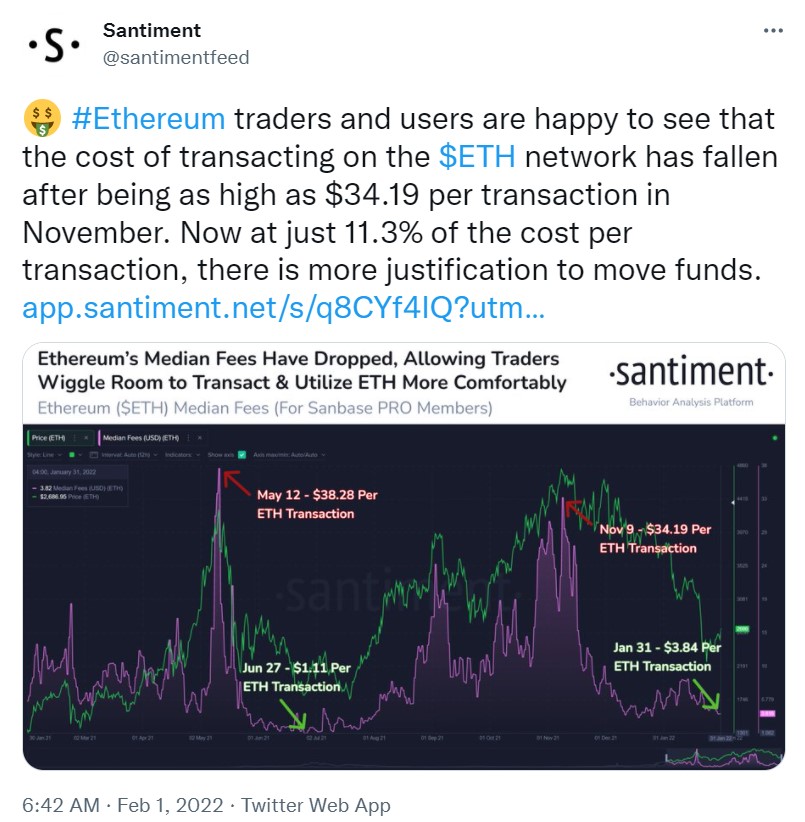

According to Santiment, market participants will be pleased to see that the cost of transactions has gone down. It was something around US$34.19 per transaction in November 2021. In January end, the transaction costs were cut by 3.84%.

Image Credit: Twitter @santimentfeed (Santiment)

Image Credit: Twitter @santimentfeed (Santiment)

Even with the RSI of Ethereum hovering around 43.91, following a low of 21.3% about ten days ago, which indicates that the selling spree is over, and the buying phase has started. This could trigger a price rise for ETHER and investors would be hoping that it can at least reach US$3,200-US$3,500 mark.

Conclusion

The leading two cryptos have shown promising signs on the first day of February, which should give investors a hope that the tokens may surge well this month.

Overall, market participants would be happy to see that the buying spree is slowing coming back. Provided that there aren’t any further blips, both Bitcoin and Ethereum should be able to enjoy a profitable February.

.jpg)