The London markets inched higher today (as on 19th June 2020, before the market close) as a rebound in retail sales strengthened hopes for swift economic recovery, while oil price surge bolstered the energy stocks.

The major factors which can act as catalysts to dominate the UK stock markets today are:

- British retail sales jumped to 12 per cent in May 2020 after an 18 per cent slump in April 2020.

- The UK public sector net borrowing increased to GBP 55.2 billion in May 2020, as per the data from the Office for National Statistics.

- The Bank of England decided to introduce further stimulus of GBP 100 billion by the bond-buying programme on Thursday.

In light of the above sentiments in mind, we are going to analyse two LSE listed Construction & Materials stocks - CRH PLC (LON:CRH) and Costain Group PLC (LON:COST). As on 19th June 2020 (before the market close at 11.43 AM GMT+1), CRH slightly gained over 1.04 per cent while COST’s stock price slid around 1.2 per cent. The CRH announced transactions in its own shares yesterday, while the COST came up with its trading update along with the statement on the annual general meeting. Let us skim through the operational and financial position of both the Companies to infer the stock price movements better.

CRH PLC (LON:CRH): Comprehensive Cost Cutting Actions Implemented to Curtail the Financial Impact of the Pandemic

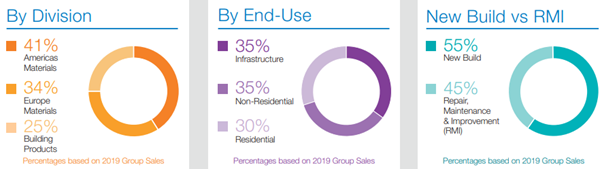

The Dublin, Ireland based, CRH PLC is a FTSE 100 listed Company, which deals in diversified building materials. It is the second largest building materials company worldwide and largest in North America, the largest heavy side player in Europe as well as strategic operations in Asia and South America. The Group was formed in 1970 through a merger of two leading Irish public companies, Roadstone, Limited (1949) and Cement Limited (established in 1936) and has today expanded to serve all segments of construction industry demand. The business spans across 30 countries and, along with subsidiaries, has operations at around 3,100 locations around the world, employing around 79,200 people.

(Source: Annual Report, Company Website)

Recent Significant Developments of 2020

18th June 2020: The Company announced that it transferred 17,531 Ordinary Shares in its employee share schemes. Following the transaction, the Company has 784,907,110 Ordinary Shares in issue (excluding Treasury Shares).

23rd April 2020: The Company announced the retirement of two non-executive Directors, Mr. Henk Rottinghuis and Mr. Patrick Kennedy.

22nd April 2020: The financial position of the Company at the end of March can be understood by its USD 6 billion in cash and cash equivalents.

Trading Update – Well Positioned for the Recovery in the Markets and Taken Necessary Actions to Protect Businesses

On 22nd April 2020, the Group provided an update on the trading performance for the first quarter of the financial year 2020, with a positive start to the year 2020. Along with this update, the Group is also taken actions to reduce the impact of covid-19 on business performance. Other major highlights of the update were as follows:

- In the first quarter of 2020, the Group’s sales growth stood at 3 per cent on a like-for-like basis.

- Although it has experienced the impact of the pandemic in the mid-March and has been closely monitoring the situation, it has also taken multiple measures to reduce costs and preserve cash.

- The Company is focused on ensuring the health and safety of its employees and protecting its businesses, resources, and market positions.

- At the time of the update, the outlook for FY 20 is uncertain, and the management was unable to predict the impact.

- CRH has reduced its working capital (as per lower activity levels) and suspended its capital expenditure plans.

- The Board members and leadership teams have agreed to take reduced salaries by 25 per cent and are also being temporarily laid-off employees in affected areas.

- The building material Company has a robust financial position, with a cash & cash equivalents of more than USD 6 billion.

Share Price Performance Analysis

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 19th, 2020, before the market close

CRH’s shares were quoting at GBX 2,910.00 on 19th June 2020 (before the market close at 2:30 PM GMT+1). Stock's 52 weeks High is GBX 3,116.00 and Low is GBX 1,500.00. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 22.77 billion.

Business Outlook

The Company seems to be well-positioned to take benefits from growth trends across the construction and material markets. On a disciplined & focused approach, the Group has a decent pipeline of value-accretive acquisition opportunities. CRH has significant strength & flexibility in the balance sheet. It is also allocating capital to enhance value, with active portfolio management & cash returns to shareholders. Presently, the global market is facing uncertainty regarding coronavirus (COVID-19); however, the Group is expecting that FY20 will yield further growth. Moreover, the long-term prospects for the Company remained positive, with a portfolio of high-quality assets in attractive markets.

Costain Group PLC (LON:COST) – Received an Eight-Year Contract for GBP 350 million

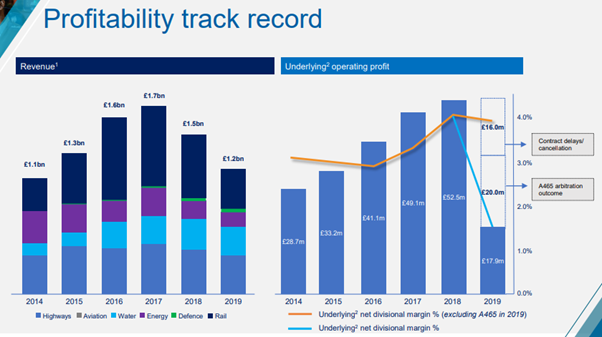

Costain Group PLC is a FTSE All-Share listed Company, which provides technology-based engineering solutions. It provides a range of services, which comprised of Consultancy, which include advisory, design, program management; Complex delivery; Technology; and Asset optimization. It operates with two business divisions, which provides technology-based solutions to meet natural needs across the UK's energy, water and transportation infrastructures. The Company’s infrastructure division operates in the highways, rail and nuclear markets, while its natural resources division operates in the water, power and oil & gas markets.

(Source: Presentation, Company Website)

Synopsis of Recent Regulatory Updates

19th June 2020: The Company reported an increase in overall activity post lockdown easing. Meanwhile, the Company has decent liquidity position after the GBP 100 capital raising on 29th May 2020.

8th June 2020: The Company announced a strategic alliance under the eight-year contract of over GBP 350 million, wherein it will be providing integrated services for Anglian Water's Water Resources Management Plan.

Trading Update – Expects GBP 4.2 billion in Order Book

On 19th June 2020, the Group provided an update on trading including the impact of Covid-19 on the Group's operations. Although the impact of Covid-19 and ongoing implications stay uncertain, the Group resumed its working on-site across all the operations. Overall, the activity levels have augmented since the commencement of the lockdown and have now stabilised. Additional Highlights are stated below:

- In London, the on-site activities were significantly wedged to ensure safe travel and working conditions. Whilst the current activity levels on these sites have improved and stabilised over the second quarter.

- The Group has taken effective steps to mitigate the immediate financial impact on the Costain Group in the second quarter.

- The construction engineering Company completed a capital raise of GBP 100 million, which has significantly increased the financial position and provided a robust platform.

- The Group witnessed a decent balance sheet and liquidity position, with a net cash balance of GBP 110 million (including GBP 66 million of drawn debt, GBP 80 million share of cash in joint operations and GBP 96 million of cash) and GBP 121 million of additional undrawn committed bank debt facilities (which will mature in 2023).

- COST anticipates the order book to be around GBP 4.2 billion at the end of the first half on 30th June 2020 with recent contracts wins and comprising framework contract with Highways England's Smart Motorway Alliance.

Share Price Performance Analysis

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 19th, 2020, before the market close

COST’s shares were quoting at GBX 75.07 on 19th June 2020 (before the market close at 2:35 PM GMT+1). Stock's 52 weeks High is GBX 295.33 and Low is GBX 29.18. Total outstanding M-Cap. (market capitalization) stood at approximately GBP 212.81 million.

Business Outlook

Back on-site at significantly all operations and activity levels have steadied. The Company has a decent track record of value creation for its stakeholders and delivering the other objectives as an independent business. The Group is focused on ensuring the health and safety of its employees, clients, communities, and supply chain partners. COST has taken required steps to preserve cash, reduce costs and capital expenditure. The Group stay confident in the positive forward outlook for the business.