QinetiQ Group Plc

QinetiQ Group Plc (QQ.) is a Farnborough, the United Kingdom based engineering company that is engaged in the business of providing defence and security related products to defence departments of various governments as well as to military organisations around the world.

Financial Performance

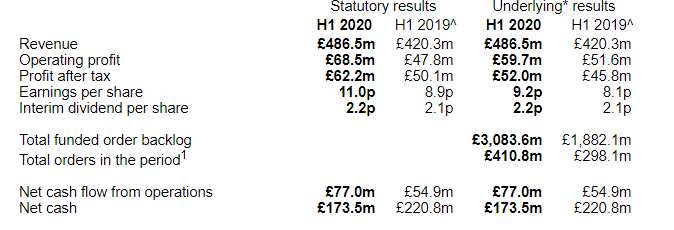

On 14th November 2019, the company announced its interim results for the six months ended 30th September 2019. The company reported a robust 16 per cent year on year growth in the revenue (10 per cent on an organic basis). The company also reported a year on year growth of 16 per cent in the underlying operating profit for the year. The board proposed a dividend of GBX 2.2 per share, a marginal increase compared to the previous year.

Source: Company Website

Stock Price Performance

Daily Chart as at 19-November-19, before the market close (Source: Thomson Reuters)

On 19th November 2019, at 10:15 A.M GMT, While writing, QinetiQ Group Plcâs stock price has been reported to be trading at GBX 336.6 per stock, a decrease of 0.41 per cent or GBX 1.4 per stock as compared to the previous dayâs closing price, which was reported to be at GBX 338.00 per stock. By the time of writing, the QinetiQ Group Plc stock was reported to be trading 26.91 per cent above the 52-week low stock price, which was at GBX 265.22 per stock, that the companyâs stocks reached on August 14, 2019. This was also 5.18 per cent below the 52-week high price at GBX 355.00 per stock, which the companyâs stock achieved on November 15, 2019. QinetiQ Group Plcâs reported market capitalisation (M-Cap) stands at a value of GBP 1.919 billion.

The stock has reportedly displayed a positive change of 23.52 per cent in value in the last one year, from the price of GBX 272.50 per stock. There also has seen a positive movement in the last six months in the value of QinetiQ Group Plcâs stock of around 10.65 per cent from the stock price of GBX 304.20 per stock. QinetiQ Group Plcâs stock has also reportedly gained 9.29 per cent in value in the last one month from the price of GBX 308.00 per stock.

The beta of the QinetiQ Group Plcâs stock was reported to be at 0.93. Through this, it can be inferred that the companyâs stock price movement is less volatile in its trend, as compared to the benchmark market indexâs movement.

Howden Joinery Group Plc

Howden Joinery Group Plc (HWDN) is the UK based support services company that acts as the parent company of Howdens Joinery, which is one of the biggest provides of Kitchen and Joineries in the country. Howdens offers around 70 kitchen ranges designed into 'families' for simple choice, it also offers kitchen cupboards and frontals.

HWDN trading Statement

On 7th November 2019, the company published a trading statement for the period ended 2nd November 2019. The company reported that the Howdens UK depots' total revenue for the reporting period was up by 4.9 per cent and by 2.0 per cent on same depot basis, compared to the same period in 2018, with gross margin during the reporting period in sync with the boardâs anticipations.

HWDN Stock Price Performance

Daily Chart as at 19-November-19, before the market close (Source: Thomson Reuters)

On 19th November 2019, at 10:21 A.M GMT, While writing, Howden Joinery Group Plcâs stock price has been reported to be trading at GBX 622.4, an increase of 1.24 per cent or GBX 7.60 per stock as compared to the previous dayâs closing price, which was reported to be at GBX 614.80 per stock. By the time of writing, the Howden Joinery Group Plc stock was reported to be trading 50.92 per cent above the 52-week low stock price, which was at GBX 412.40 per stock, that the companyâs stocks reached on December 18, 2018. The stock reached its 52-week high price at GBX 624.4 per stock, in dayâs trading session. Howden Joinery Group Plcâs reported market capitalisation (M-Cap) stands at a value of GBP 3.680 billion.

The stock has reportedly displayed a positive change of 38.71 per cent in value in the last one year, from the price of GBX 448.70 per stock. There also has seen a positive movement in the last six months in the value of Howden Joinery Group Plcâs stock of around 21.37 per cent from the stock price of GBX 512.80 per stock. Howden Joinery Group Plcâs stock has also reportedly gained 9.19 per cent in value in the last one month from the price of GBX 570.00 per stock.

The beta of the Howden Joinery Group Plcâs stock was reported to be at 0.55. Through this, it can be inferred that the companyâs stock price movement is less volatile in its trend, as compared to the benchmark market indexâs movement.

Drax Group Plc

Drax Group Plc (DRX) is a Selby, the United Kingdom based power organisation that is associated with the business of electricity generation, particularly for business and industrial clients. The organisation is also associated with the generation of manageable and packed wooden pellets. Drax Group's divisions include Power Generation Division, Biomass Supply Division, that is associated with the assembling of wooden pellets at its Operating spaces in the United States of America, and the Retail division, that is engaged with the power supply to business and industrial clients around the United Kingdom and wood pellets to the local thermal energy clients.

DRX Trading Update

On 19th November 2019, the company announced a trading update as a part of the capital markets day for investors and analysts. The organisation detailed that it is focusing on a biomass self-supply limit of 5,000,000 tons by 2027. The company also reported that it has been trading in line with expectations in the current period, including recently acquired assets which have shown robust performance.

DRX Stock Price Performance

Daily Chart as at 19-November-19, before the market close (Source: Thomson Reuters)

On 19th November 2019, at 10:30 A.M GMT, while writing, Drax Group Plcâs stock price has been reported to be trading at GBX 290.8, a decrease of 1.82 per cent or GBX 5.4 per stock as compared to the previous dayâs closing price, which was reported to be at GBX 296.2 per stock. By the time of writing, the Drax Group Plc stock was reported to be trading 17.35 per cent above the 52-week low stock price, which was at GBX 247.8 per stock, that the companyâs stocks reached on October 04, 2019. This was also 29.93 per cent below the 52-week high price at GBX 415.00 per stock, which the companyâs stock achieved on January 17, 2019. Drax Group Plcâs reported market capitalisation (M-Cap) stands at a value of GBP 1.174 billion.

The stock has reportedly displayed a negative change of 23.27 per cent in value in the last one year, from the price of GBX 379.00 per stock. There also has seen a negative movement in the last six months in the value of Drax Group Plcâs stock of around 9.80 per cent from the stock price of GBX 322.40 per stock. Drax Group Plcâs stock has reportedly lost 4.34 per cent in value in the last one month from the price of GBX 304.00 per stock.

The beta of the Drax Group Plcâs stock was reported to be at 1.39. Through this, it can be inferred that the companyâs stock price movement is more volatile in its trend, as compared to the benchmark market indexâs movement.

Entertainment One Limitedâs

Entertainment One Limited (ETO) is an entertainment company, based in Canada. The company operates as a Film and TV production studio. The company has produced TV shows like Designated Survivor in partnership with Netflix, Cardinal as well as the Hollywood Puppet show, which is an animated series. The company is also in the business of music production, where they partner up with various artists for music productions. The company also has a wide variety of family animated as well as Digital, VR based content for the purposes of entertainment.

ETO Stock Price Performance

Daily Chart as at 19-November-19, before the market close (Source: Thomson Reuters)

On 19th November 2019, at 10:39 A.M GMT, While writing, Entertainment One Limitedâs stock price has been reported to be trading at GBX 557.5, an increase of 0.09 per cent or GBX 0.5 per stock as compared to the previous dayâs closing price, which was reported to be at GBX 557.00 per stock. By the time of writing, the Entertainment One Limited stock was reported to be trading 67.39 per cent above the 52-week low stock price, which was at GBX 333.06 per stock, that the companyâs stocks reached on December 27, 2018. This was also 9.50 per cent below the 52-week high price at GBX 616.00 per stock, which the companyâs stock achieved on August 23, 2019. Entertainment One Limitedâs reported market capitalisation (M-Cap) stands at a value of GBP 2.778 billion.

The stock has reportedly displayed a positive change of 45.03 per cent in value in the last one year, from the price of GBX 384.4 per stock. There also has seen a positive movement in the last six months in the value of Entertainment One Limitedâs stock of around 21.09 per cent from the stock price of GBX 460.40 per stock. Entertainment One Limitedâs stock has reportedly lost 0.18 per cent in value in the last one month from the price of GBX 558.50 per stock.

The beta of the Entertainment One Limitedâs stock was reported to be at 0.55. Through this, it can be inferred that the companyâs stock price movement is less volatile in its trend, as compared to the benchmark market indexâs movement.