Hargreaves Services PLC

Hargreaves Services Plc (HSP) is a UK based diversified group and is engaged in the delivery of projects and services to the infrastructure, energy and property sectors. It is involved in the sourcing, production, processing, handling and transportation of a wide variety of bulk materials. The company operates surface coal mines in Scotland, Wales and England and produces million tons of coal per annum.

Hargreaves is specialised in the provision of haulage services, waste transportation, mineral import, mining and processing, together with specialist earthworks and related activities. It serves logistics, heavy industry, mining and minerals and Civil Engineering industries. The company also offers services such as transport, handling, and recycling of waste for the industrial and domestic sectors. Hargreaves is headquartered in Esh Winning, Durham, the UK.

Recent News

On 31st July 2019, the Hargreaves Services announced its Preliminary Results for the year ending 31st May 2019.

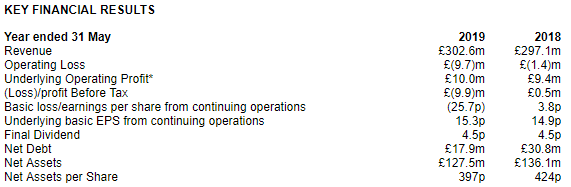

Financial Highlights â Financial Year 2019 (£)

(Source: Annual Report, Company Website)

Â

For the financial year ending 31st May 2019, the companyâs reported revenue (continuing operations) stood at £302,613 thousand as against £297,119 thousand in the financial year 2018, up by 1.9 per cent for the period due to an increase in the Distribution & Services revenue.

The companyâs gross profit for FY2019 stood at £16,711 thousand versus £30,373 thousand in FY2018. The company reported an operating loss of £9,688 thousand in FY2019 versus a loss of £1,376 thousand in FY2018.

The company reported Loss for the year (continuing operations) of £8,193 thousand in FY2019 versus a profit for the year (continuing operations) of £1,181 thousand in FY2018. The company reported Loss for the year (continuing & discontinued operations) of £4,667 thousand in FY2019 versus a profit (continuing & discontinued operations) of £181 thousand in FY2018.

The company reported a basic loss per share (continuing operations) of 25.7 pence in FY2019 versus an earnings per share of 3.8 pence in FY2018. The companyâs underlying basic earnings per share (continuing operations) were 15.3 pence in FY2019 against 14.9 pence in FY2018.

The companyâs final dividend stood flat at 4.5 pence for the period. The companyâs Net debt declined to £17.9 million in FY2019 from £30.8 million in FY2018. The companyâs Net assets declined to £127.5 million in FY2019 from £136.1 million in FY2018.

Hargreaves Services Plc Share Price Performance

Daily Chart as at August-02-19, before the market close (Source: Thomson Reuters)

On August 2, 2019, at the time of writing (before the market close, at 4:03 PM GMT), Hargreaves Services Plc shares were trading at GBX 267.20, up by 2.38 per cent against the previous day closing price. Stock's 52 weeks High and Low are GBX 359.00/GBX 217.80. At the time of writing, the share was trading 25.57 per cent lower than the 52w High and 22.68 per cent higher than the 52w low. Stockâs average traded volume for 5 days was 24,272.40; 30 days â 23,796.63 and 90 days â 17,985.18. The average traded volume for 5 days was up by 2 per cent as compared to 30 days average traded volume. The companyâs stock beta was 0.83, reflecting lower volatility as compared to the benchmark index. The outstanding market capitalisation was around £84.03 million, with a dividend yield of 2.76 per cent.

Mitchells & Butlers PLC

Mitchells & Butlers PLC (MAB) is a UK based Travel & Leisure company established in the year 1898. The company is amongst the largest operator of bars, pubs and restaurants in the United Kingdom. The company had many brand under its name such as Orchid Pubs, Oak Tree, Innkeeper's Lodge, Browns, Miller & Carter, All Bar One, Alex, O'Neill's, Premium Country Pubs, Nicholson's, Castle, Crown Carveries, Toby Carvery, Ember Inns, Harvester, Vintage Inns and Sizzling Pubs. The company, through its 1,700 pubs and restaurants offers a wide variety of eating choices and great drinking out experience.

Trading Update

On 31st July 2019, the Mitchells & Butlers announced its trading update for the third quarter ending 27th July 2019. The companyâs Like-for-like sales went up by 2.8 per cent. The company witnessed strong growth in food sales and robust drink sales during the world cup and extended sunny weather. For the period, the total sales were up by 4.1 per cent year-to-date.

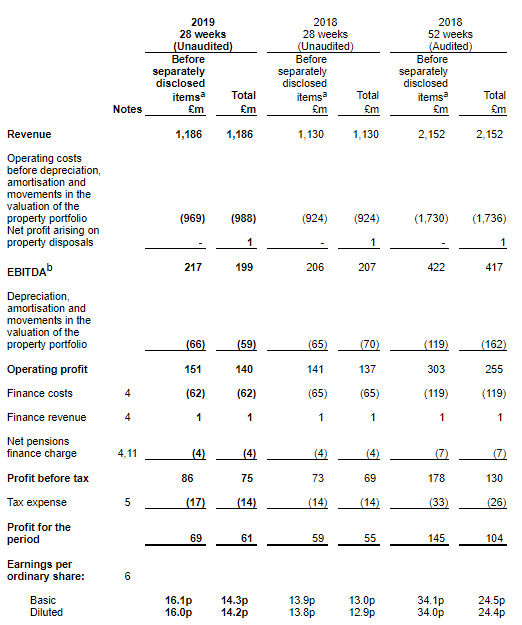

Financial Highlights â H1 Financial Year 2019 (£, million)

(Source: Interim Report, Company Website)

For the first half of the Financial year 2019, Mitchells & Butlers Plcâs reported revenue stood at £1,186 million as against £1,130 million for the previous year of the same period and was up by 5 per cent mainly due to initiatives taken by the company under its Ignite 2 programme which resulted in an incremental gains for the period. The companyâs sales (Like-for-like) went up by 4.1 per cent for the period. Â

The groupâs adjusted EBIT for H1 FY2019 stood at £151 million as compared to £141 million reported in H1 FY2018. The groupâs Reported operating profit for H1 FY2019 stood at £140 million as compared to £137 million reported in H1 FY2018.

The groupâs adjusted PBT (Profit before tax) for H1 FY2019 stood at £ 86 million as compared to £73 million reported in H1 FY2018. The groupâs Reported PBT for H1 FY2019 stood at £75 million as compared to £69 million reported in H1 FY2018.

The adjusted profit for the year stood at £69million in H1 FY2019 against £59 million in H1 FY2018. The reported profit for the year stood at £61 million in H1 FY2019 against £55million in H1 FY2018. Â

The adjusted Basic earnings per share stood at 16.1 pence in H1 FY2019 as compared to 13.9 pence in H1 FY2018. The Basic earnings per share stood at 14.3 pence in H1 FY2019 as compared to 13 pence in H1 FY2018.

The adjusted Diluted earnings per share stood at 16 pence in H1 FY2019 as compared to 13.8 pence in H1 FY2018. The Diluted earnings per share stood at 14.2 pence in H1 FY2019 as compared to 12.9 pence in H1 FY2018.

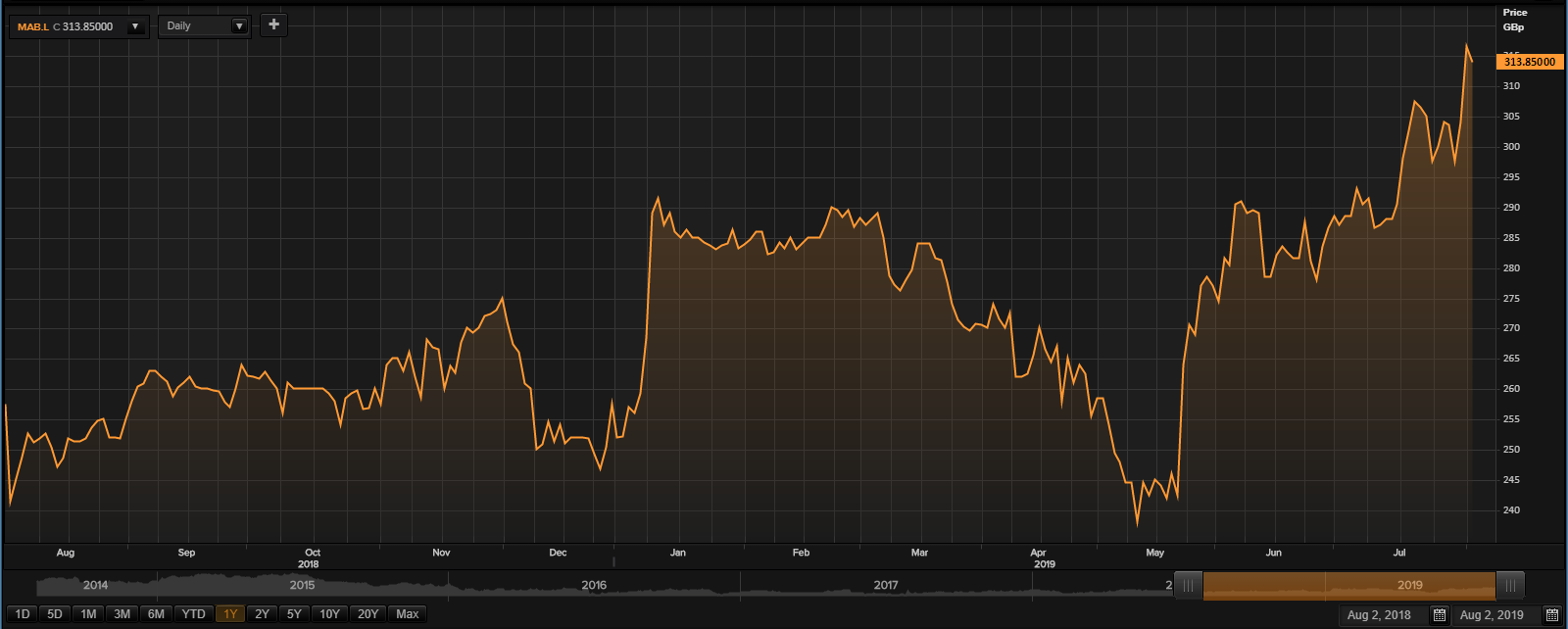

Mitchells & Butlers Plc Share Price Performance

Daily Chart as at August-02-19, before the market close (Source: Thomson Reuters)

On August 2, 2019, at the time of writing (before the market close, at 4:09 PM GMT), Mitchells & Butlers PLC shares were trading at GBX 313.85, down by 0.84 per cent against the previous day closing price. Stock's 52 weeks High and Low are GBX 320.00/GBX 235.00. At the time of writing, the share was trading 1.92 per cent lower than the 52w High and 33.55 per cent higher than the 52w low. Stockâs average traded volume for 5 days was 382,302.00; 30 days â 293,054.00 and 90 days â 318,834.84. The average traded volume for 5 days was up by 30.45 per cent as compared to 30 days average traded volume. The companyâs stock beta was 0.89, reflecting slightly lower volatility as compared to the benchmark index. The outstanding market capitalisation was around £1.36 billion.

3i Group Plc

3i Group Plc (III) is a London, the United Kingdom investment management company. Its areas of operation are categorised into three segments, which are private equity, infrastructure and debt management. The group has a geographical presence in Northern Europe, Asia/Pacific, United Kingdom and North America.

Recent News

On 31st July 2019, the 3i Group issued its performance update for the first quarter of the financial year 2020. The company made a decent start with an increase in NAV to 864 pence per share in Q1 FY2020 versus 815 pence per share in Q4 FY2019. The companyâs total return stood at 6.2 per cent for the period. The company completed Private Equity investment of £139 million in Magnitude Software Inc and completed an Infrastructure investment in US Regional Rail LLC. The company made an investment in Joulz and announced an investment for Valorem, which resulted in strong share price performance.

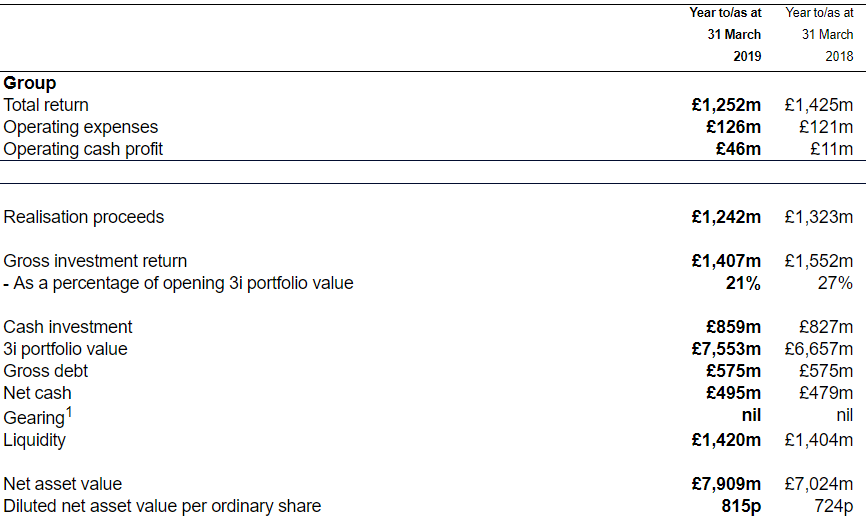

Financial Highlights â Financial Year 2019 (£, million)

(Source: Annual Report, Company Website)

Â

During the financial year ending 31st March 2019, the group has reported a total return of 18 per cent on the opening shareholderâs fund, against the total return of 24 per cent in the last year. Total return for FY19 stood at £1,252 million against the total return of £1,425 million in the FY18. In FY19, the group's private equity segment continued to perform well, with an investment return (gross) of 20 per cent or £1,148 million. In a highly competitive private equity market, the private equity team took a cautious approach while deploying capital. The company introduced a proprietary capital of £332 million, which includes two new investments. The companyâs diluted NAV (net asset value) was 815 pence per share in FY2019 versus 724 pence in FY2018. The board of 3i Group Plc recommended a second dividend of 20.0 pence, and together with the first dividend of 15 pence, the total dividend for FY19 was at 35 pence per share against 30 pence in FY18.

3i Group Plc Share Price Performance

Daily Chart as at August-02-19, before the market close (Source: Thomson Reuters)

On August 2, 2019, at the time of writing (before the market close, at 4:15 PM GMT), 3i Group Plc shares were trading at GBX 1,096.80, down by 2.64 per cent against the previous day closing price. Stock's 52 weeks High and Low are GBX 1,166.00/GBX 754.60. At the time of writing, the share was trading 5.93 per cent lower than the 52w High and 45.35 per cent higher than the 52w low. Stockâs average traded volume for 5 days was 1,327,463.60; 30 days â 1,403,175.97 and 90 days â 1,619,443.28. The average traded volume for 5 days was down by 5.40 per cent as compared to 30 days average traded volume. The companyâs stock beta was 1.56, reflecting higher volatility as compared to the benchmark index. The outstanding market capitalisation was around £10.98 billion, with a dividend yield of 3.11 per cent.