The data center colocation market shows bullish trend with the rapid adoption of data center across all industry verticals.

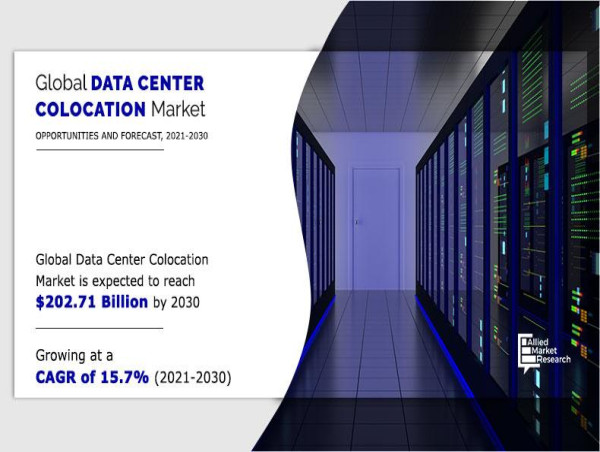

WILMINGTON, DE, UNITED STATES, December 15, 2023 /EINPresswire.com/ -- According to the report published by Allied Market Research, the global data center colocation market generated $46.08 billion in 2020, and is expected to garner $202.71 billion by 2030, witnessing a CAGR of 15.7% from 2021 to 2030. The report provides a detailed analysis of changing market dynamics, top segments, value chain, key investment pockets, regional scenario, and competitive landscape.

The global data center colocation market is experiencing growth propelled by the need for economical IT operations, the essential criteria of secure, reliable, and scalable data center infrastructure, and the increasing demand for environmentally sustainable colocation services. Despite these positive factors, challenges such as high initial and long-term leasing expenses and issues related to network bandwidth are impeding market expansion. Conversely, opportunities emerge with the growing adoption of hybrid cloud and virtualization, along with increased investments aimed at the development of advanced data centers in the foreseeable future.

☛ Request Sample Report at: https://www.alliedmarketresearch.com/request-sample/338

Covid-19 Scenario:

1. Many organizations adopted the “work from home” culture due to the shutdown of offices and manufacturing factories. This led to increase in usage of data center colocation facilities for accessibility and security of data.

2.In addition, education institutions began conducting online classes and examinations. This led to surge in utilization of data center colocation.

3.Service providers have been carrying out considerable investments in data center colocation facilities due to various factors such as the growth of over the top (OTT) market and increased traffic demand across the world.

The report provides an intricate breakdown of the worldwide data center colocation market, categorizing it by type, enterprise size, industry vertical, and region.

☛ For Report Customization: https://www.alliedmarketresearch.com/request-for-customization/338

In 2020, the retail colocation segment dominated, securing over two-thirds of the overall market share. It is projected to continue leading throughout the forecast period. Conversely, the wholesale colocation segment is anticipated to exhibit the highest compound annual growth rate (CAGR) of 17.4% from 2021 to 2030.

The IT and telecommunications sector held the largest market share, comprising almost one-fifth of the global data center colocation market. This segment is anticipated to sustain its leading position throughout the forecast period. Conversely, the media and entertainment sector is forecasted to experience the swiftest Compound Annual Growth Rate (CAGR) of 20.0% from 2021 to 2030.

☛ Buy Now & Get Exclusive Discount on this Report: https://www.alliedmarketresearch.com/colocation-market/purchase-options

In terms of geographical distribution, North America dominated the market in 2020, contributing to almost half of the total revenue share and is expected to uphold its supremacy in revenue until 2030. Nevertheless, the Asia-Pacific region is poised to exhibit the highest CAGR of 19.3% during the forecast period.

Leading Market Players:

➢ China Telecom Corporation Limited

➢ CoreSite Realty Corporation

➢ Cyrusone Inc.

➢ Cyxtera Technologies, Inc.

➢ Digital Realty Trust,

➢ Equinix, Inc.

➢ Global Switch

➢ KDDI Corporation

➢ NTT Communications Corporation.

☛ Inquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/338

Similar Reports:

1. Asia Pacific Colocation Market

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia

If you have any special requirements, please let us know and we will offer you the report as per your requirements.

Lastly, this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP, based in Portland, Oregon. AMR provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

AMR launched its user-based online library of reports and company profiles, Avenue. An e-access library is accessible from any device, anywhere, and at any time for entrepreneurs, stakeholders, researchers, and students at universities. With reports on more than 60,000 niche markets with data comprising of 600,000 pages along with company profiles on more than 12,000 firms, Avenue offers access to the entire repository of information through subscriptions. A hassle-free solution to clients’ requirements is complemented with analyst support and customization requests.

Contact:

David Correa

1209 Orange Street

Corporation Trust Center

Wilmington

New Castle

Delaware 19801

USA Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

[email protected]

Allied Market Research

Allied Market Research

+ +1 800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn