Truss Financial Group launches the No Tax Return HELOC, home equity option for self-employed individuals facing barriers with traditional financing.

LADERA RANCH, CA, UNITED STATES, October 29, 2024 /EINPresswire.com/ -- With nearly 10.1% of the U.S. workforce, about 16.2 million people identifying as self-employed in early 2023, many face unique challenges accessing traditional financing options. Due to fluctuating income or unconventional documentation, self-employed individuals are often seen as higher-risk borrowers, making standard HELOCs less accessible.

However, a No Tax Return HELOC offers a simplified approach that allows borrowers to tap into home equity without the need for extensive tax documentation. That’s why we at Truss Financial Group gathered data that can tell us what problems self-employed individuals have to face when getting credit and how No Tax Return HELOC can be their lifeline!

Challenges Self-Employed Individuals Face in Securing Traditional HELOCs:

1. Strict Documentation Requirements:

Conventional HELOCs often require multiple years of tax returns, which can be problematic for self-employed individuals. Tax returns may not accurately represent income for those with deductions and business expenses, creating a barrier for borrowers whose true earning potential is not fully reflected on paper.

2. Income Verification Difficulties:

Traditional HELOC lenders focus heavily on W-2 income, making it difficult for self-employed individuals with varied income sources, whether from incorporated or unincorporated businesses, to qualify. This approach limits opportunities for the 30% of the U.S. workforce who were self-employed or employed by self-owned businesses in 2019 (Pew Research).

3. Inconsistent Income Cycles:

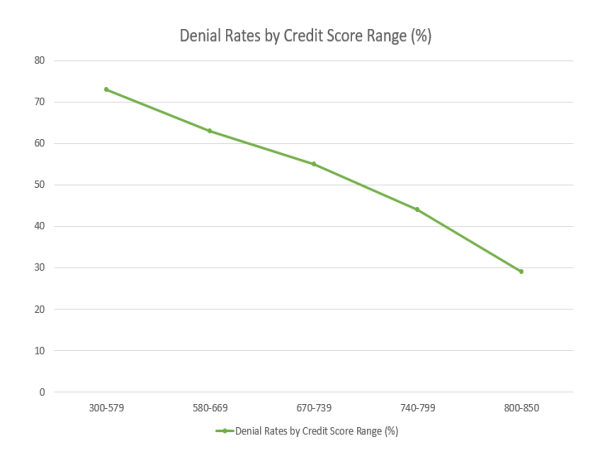

Self-employed individuals, including freelancers and small business owners, often experience income fluctuations due to seasonal demand or project-based work. Traditional HELOCs, which favor consistent cash flow, can lead to higher rejection rates for these applicants.

4. Higher Decline Rates Despite Solid Financial Profiles:

Due to their complex income structures, self-employed borrowers face higher decline rates for conventional HELOCs, even if they have strong equity or high net worth. Data from the Bureau of Labor Statistics shows that the average net worth of self-employed families ($380,000) significantly exceeds that of traditionally employed families ($90,000), yet strict documentation requirements often hinder their approval.

These challenges highlight why a No Tax Return (NTR) HELOC, which allows alternative documentation like bank statements, provides a more practical and accessible financing option for self-employed individuals.

How a No Tax Return HELOC Can Help Self-Employed Individuals:

1. Accessible Funding Without Extensive Documentation:

Traditional HELOCs require W-2s or tax returns, which can be a barrier for self-employed individuals with non-standard income. A No Tax Return HELOC (NTR HELOC) allows simpler income verification, using alternative documents like bank statements.

2. Flexible Access to Cash Flow:

Self-employed individuals often face irregular cash flows. An NTR HELOC provides a line of credit they can draw from as needed, with interest charged only on the amount used, making it an effective tool for managing seasonal or project-based income.

3. Supports Business and Personal Financial Goals:

The funds from an NTR HELOC can be used for various needs, such as business expansion, home improvements, or emergency expenses, providing versatile financial support that adapts to changing goals.

4. Potential Tax Benefits:

In some cases, interest payments on HELOCs are tax-deductible, which can be beneficial for high-net-worth self-employed individuals. Self-employed families tend to have a median net worth of $380,000, much higher than traditionally employed families, enhancing the value of potential tax savings. (Bureau of Labor Statistics)

5. Enhances Financial Stability During Income Fluctuations:

The flexibility of an NTR HELOC helps self-employed individuals manage unexpected expenses or slow income periods, allowing them to maintain stability without taking on unnecessary debt.

How a No Appraisal HELOC Can Also Help:

For homeowners who prefer not to disturb their low-rate first mortgage, a No Appraisal HELOC from Truss Financial Group offers a streamlined path to tapping into home equity. By removing the appraisal requirement, this option allows faster approval times and a simplified process, enabling borrowers to access funds without undergoing a potentially lengthy or costly appraisal.

Conclusion:

The No Tax Return HELOC offers a lifeline for self-employed individuals, allowing access to home equity without the hassle of extensive tax documentation. With flexible, accessible funding that adapts to fluctuating income cycles, it’s a smart choice for meeting both business and personal financial needs. No Appraisal HELOC and No Tax Return HELOC are gaining popularity as they empower homeowners to secure additional financing without touching their low-rate first mortgage. Truss Financial Group is here to make financing simpler for self-employed professionals, empowering them to achieve greater financial stability and freedom.

About Truss Financial Group:

Truss Financial Group is a leading independent mortgage broker helping real estate investors and self-employed business owners secure financing. With over 20 years of experience, TFG offers personalized attention and creative loan solutions, backed by strong relationships with well-capitalized banking partners.

Jason Nichols

Truss Financial Group

+1 888-878-7715

[email protected]

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

TikTok

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()