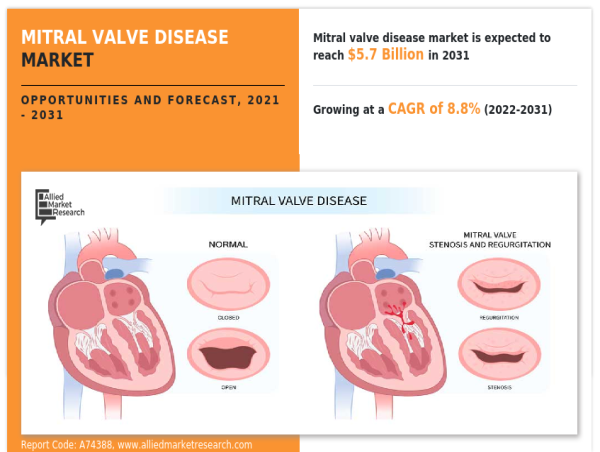

PORTLAND, OREGON, UNITED STATES, March 15, 2024 /EINPresswire.com/ -- According to a new report published by Allied Market Research, titled, “Mitral Valve Disease Market," The mitral valve disease market size was valued at $2.5 billion in 2021, and is estimated to reach $5.7 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031. The increase in the prevalence of mitral valve diseases and the development of advanced technologies for mitral valve are some treatment act as the key mitral valve disease market trends for growth of market.

𝑹𝒆𝒒𝒖𝒆𝒔𝒕 𝑺𝒂𝒎𝒑𝒍𝒆 𝑪𝒐𝒑𝒚 𝒐𝒇 𝑹𝒆𝒑𝒐𝒓𝒕-

https://www.alliedmarketresearch.com/request-sample/75123

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 (374+ 𝐏𝐚𝐠𝐞𝐬 𝐏𝐃𝐅 𝐰𝐢𝐭𝐡 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐂𝐡𝐚𝐫𝐭𝐬, 𝐓𝐚𝐛𝐥𝐞𝐬, 𝐚𝐧𝐝 𝐅𝐢𝐠𝐮𝐫𝐞𝐬: https://www.alliedmarketresearch.com/mitral-valve-disease-market/purchase-options

Recent Approvals in Mitral Valve Disease Market

In January 2020, Abbott received the CE Mark approval of Abbott’s Tendyne Transcatheter Mitral Valve Implantation (TMVI) system used in the treatment of mitral regurgitation (MR) in patients who require a heart valve replacement and is now approved for use in Europe.

In September 2021, Abbott received the U.S. Food and Drug Administration (FDA) approval for Epic Plus and Epic Plus Supra Stented Tissue Valves. These new devices are based on Abbott’s Epic surgical valve platform, which improve therapy options for people with aortic or mitral valve disease.

Divestment in Mitral Valve Disease Market

In June 2021, Corcym announced the launch of its operations globally, which is formed from the acquisition of the LivaNova Plc. heart valve business by Gyrus Capital. The new, independent, medical device company will be dedicated towards providing patients and heart surgeons with the best solutions to fight structural heart disease.

Investment in the Mitral Valve Disease Market

In March 2019, Edwards Lifesciences Corporation has announced two strategic transactions involving companies with structural heart disease technologies. The transaction involves a $35 million investment in an exclusive right to acquire Corvia Medical, Inc. and the acquisition of certain assets of Mitralign, Inc, a company that specializes in developing devices for the treatment of mitral valve regurgitation.

New Product Development in Mitral Valve Disease Market

In November 2021, Medtronic plc. presented early data for Intrepid transcatheter mitral valve replacement (TMVR) system in patients with severe, symptomatic mitral valve regurgitation (MR) utilizing the transfemoral access route. The data from first 5 patients enrolled in an Early Feasibility Study of the Intrepid Transfemoral System showed 100% survival and no stroke and none or trace MR in all implanted patients at 30 days.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐘𝐨𝐮𝐫 𝐄𝐯𝐞𝐫𝐲 𝐃𝐨𝐮𝐛𝐭 𝐇𝐞𝐫𝐞: https://www.alliedmarketresearch.com/purchase-enquiry/74863

𝐌𝐢𝐭𝐫𝐚𝐥 𝐕𝐚𝐥𝐯𝐞 𝐃𝐢𝐬𝐞𝐚𝐬𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬

Medtronic plc

Labcor Laboratorios Ltda

Pfizer Inc.

Novartis AG

ShockWave Medical, Inc.

Braile Biomedica

Corcym UK Limited

Artivion, Inc.

Edwards Lifesciences Corporation

Affluent Medical

Bayer AG

Zydus Lifesciences Limited

Teva Pharmaceutical Industries Ltd.

Abbott Laboratories

Valcare Medical

𝐎𝐭𝐡𝐞𝐫 𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐢𝐧 𝐋𝐢𝐟𝐞 𝐒𝐜𝐢𝐞𝐧𝐜𝐞 𝐃𝐨𝐦𝐚𝐢𝐧 –

𝑻𝒖𝒎𝒐𝒓 𝑨𝒃𝒍𝒂𝒕𝒊𝒐𝒏 𝒎𝒂𝒓𝒌𝒆𝒕 https://www.alliedmarketresearch.com/tumor-ablation-market-A17208

𝑽𝒊𝒅𝒆𝒐 𝑳𝒂𝒓𝒚𝒏𝒈𝒐𝒔𝒄𝒐𝒑𝒆 𝑴𝒂𝒓𝒌𝒆𝒕 https://www.alliedmarketresearch.com/video-laryngoscope-market-A17524

David Correa

Allied Market Research

+1 5038946022

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

![]()