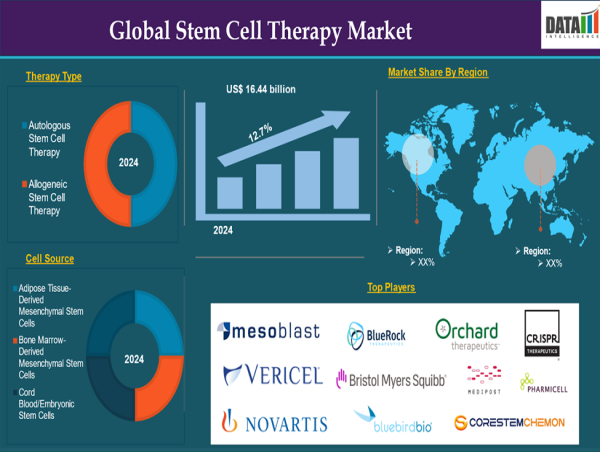

The Stem Cell Therapy Market is witnessing transformative momentum as advancements in regenerative medicine, gene editing, and cellular reprogramming accelerate clinical applications. From musculoskeletal and neurological disorders to cardiovascular diseases, stem cell therapy is redefining the future of disease management with its potential for tissue regeneration, immune modulation, and reduced reliance on conventional drugs. As of 2024, the market stood at US$ 16.44 billion and is forecasted to reach US$ 45.69 billion by 2033, growing at a CAGR of 12.7% during the forecast period 2025–2033.

Get Latest Sample Report Pdf : https://datamintelligence.com/download-sample/stem-cell-therapy-market

Market Drivers are :

Rising incidence of chronic diseases such as diabetes, osteoarthritis, and cardiovascular conditions is driving demand for alternative therapeutic approaches.

Growing investment in regenerative medicine from governments and private firms to boost cell therapy R&D and commercialization.

Technological advancements in cell harvesting and manufacturing, making therapies safer and more scalable.

Favorable regulatory frameworks and accelerated approvals in key regions like the U.S., Japan, and Europe.

Increased clinical trials and success rates in autologous and allogeneic stem cell therapies.

Strategic collaborations and M&A activity among pharmaceutical, biotech, and academic institutions to expand cell therapy pipelines.

Market Segmentation

By Type:

Allogeneic Stem Cell Therapy

Autologous Stem Cell Therapy

By Cell Source:

Adult Stem Cells

Embryonic Stem Cells

Induced Pluripotent Stem Cells (iPSCs)

Others

By Application:

Musculoskeletal Disorders

Cardiovascular Diseases

Neurological Disorders

Wounds and Injuries

Autoimmune Disorders

Others

By End-User:

Hospitals and Clinics

Academic & Research Institutes

Regenerative Medicine Centers

Others

Market Key Players are :

Key players shaping the competitive landscape of the stem cell therapy market include:

Mesoblast Ltd

Lineage Cell Therapeutics, Inc.

BlueRock Therapeutics LP

Orchard Therapeutics plc.

Vericel Corporation

CRISPR Therapeutics AG

Fate Therapeutics, Inc.

Novartis AG

Bristol Myers Squibb (Juno Therapeutics, Inc.)

Bluebird bio, Inc.

MEDIPOST Co., Ltd.

ANTEROGEN.CO., LTD.

CORESTEMCHEMON Inc.

PHARMICELL Co., Ltd

JCR Pharmaceuticals Co., Ltd.

These companies are heavily engaged in advancing pipeline candidates, expanding global partnerships, and launching commercial therapies for conditions like spinal cord injuries, GvHD, and age-related macular degeneration.

Latest News of USA -

In February 2025, Mesoblast Ltd received FDA guidance for a potential resubmission of its allogeneic stem cell therapy for pediatric steroid-refractory acute graft-versus-host disease.

CRISPR Therapeutics and Vertex Pharmaceuticals received FDA approval in 2024 for the first gene-edited stem cell therapy for sickle cell disease, a major breakthrough in precision medicine.

Bluebird bio resumed commercial distribution of its gene therapy Zynteglo, based on autologous stem cells, after addressing prior manufacturing issues.

Latest News of Japan -

In March 2025, JCR Pharmaceuticals launched a new clinical study using mesenchymal stem cells for treating pediatric lysosomal storage disorders, under Japan’s fast-track regenerative framework.

Anterogen Co., Ltd. partnered with a Tokyo-based hospital group to initiate trials for an adipose-derived stem cell therapy in chronic wound management.

The Japanese government increased funding to regenerative medicine hubs under its AMED program, promoting infrastructure for stem cell research and GMP manufacturing facilities.

Recent Key Developments are :

April 2024: Orchard Therapeutics expanded its ex-vivo gene therapy platform to include additional lysosomal disorder indications.

June 2024: Vericel Corporation received FDA approval for expanded labeling of its MACI® therapy to include broader cartilage defects in knee joints.

September 2024: Fate Therapeutics entered a collaboration with a leading hospital in Singapore to study NK and T-cell stem therapy combinations for leukemia.

December 2024: BlueRock Therapeutics presented positive Phase 1 results for DA01, its investigational therapy for Parkinson’s disease, using pluripotent stem cells.

Conclusion :-

The stem cell therapy market is entering a period of robust growth, driven by clinical innovation, regulatory evolution, and increasing acceptance of regenerative medicine. The convergence of stem cell technology with gene editing, personalized medicine, and biomanufacturing will continue to unlock new therapeutic possibilities. Regions like the U.S. and Japan are leading the charge with progressive regulatory frameworks and heavy investment in R&D. As more cell-based therapies move from bench to bedside, the market is well-positioned to address a wide range of chronic and degenerative diseases, offering hope where few treatment options existed before.

Related Reports :

Stem Cell Banking Market

Prostate Cancer Treatment Market

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()