𝐆𝐞𝐭 𝐀𝐡𝐞𝐚𝐝 𝐰𝐢𝐭𝐡 𝐎𝐮𝐫 𝐑𝐞𝐩𝐨𝐫𝐭: 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐍𝐨𝐰! https://www.futuremarketinsights.com/reports/sample/rep-gb-14112

𝐁𝐞𝐲𝐨𝐧𝐝 𝐭𝐡𝐞 𝐒𝐮𝐫𝐟𝐚𝐜𝐞 𝐨𝐟 𝐒𝐜𝐫𝐚𝐩 𝐑𝐞𝐜𝐲𝐜𝐥𝐢𝐧𝐠

The global recycled scrap metal market is vast and growing, driven by factors such as rising environmental awareness, government regulations, and an increasing emphasis on sustainability. Industry reports on the market often focus on well-known trends like rising demand for recycled materials in manufacturing, or the fluctuating prices of scrap metals like aluminum, copper, and steel. However, behind these familiar discussions, there’s a crucial technological transformation happening that has profound implications for the market’s future.

A significant driver of this transformation is the ability to recover metals with higher purity and efficiency through advanced sorting and shredding methods. Traditional methods, which often rely on manual sorting and simple mechanical shredding, can struggle to meet the increasing quality standards demanded by high-end industries. This has led to the rise of cutting-edge technologies, such as AI-powered robotics, sensor-based sorting systems, and advanced shredding techniques, that are enhancing metal recovery processes.

𝐖𝐡𝐲 𝐭𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞 𝐨𝐟 𝐌𝐞𝐭𝐚𝐥 𝐑𝐞𝐜𝐲𝐜𝐥𝐢𝐧𝐠 𝐃𝐞𝐩𝐞𝐧𝐝𝐬 𝐨𝐧 𝐒𝐦𝐚𝐫𝐭𝐞𝐫 𝐒𝐨𝐫𝐭𝐢𝐧𝐠

Traditionally, metal recycling involved basic manual labor or simple mechanical sorting methods. While effective to a degree, these methods struggled with mixed scrap streams—where different metals and materials were often fused together in complex alloys or contamination-laden batches. As industries like automotive and electronics manufacturing demand higher-purity metals, it’s no longer enough to simply shred and melt scrap metal; the challenge lies in effectively sorting and separating metals from other materials.

For example, the automotive sector, which requires aluminum, steel, and copper with specific purity levels for vehicle components, has placed pressure on recyclers to improve the quality of the recovered metals. Traditional sorting methods struggle to achieve these standards due to limitations in separating different alloys, often resulting in lower quality recycled metals and higher processing costs. This creates a significant gap in the market, one that technology is beginning to fill.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭! https://www.futuremarketinsights.com/reports/recycled-scrap-metal-market

𝐀𝐈, 𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐨𝐧, 𝐚𝐧𝐝 𝐒𝐞𝐧𝐬𝐨𝐫-𝐃𝐫𝐢𝐯𝐞𝐧 𝐒𝐲𝐬𝐭𝐞𝐦𝐬: 𝐀 𝐐𝐮𝐢𝐞𝐭 𝐑𝐞𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧

Advancements in sorting and shredding technologies have ushered in a new era for metal recycling, primarily driven by automation, artificial intelligence (AI), and sensor technologies. Systems like Laser-Induced Breakdown Spectroscopy (LIBS), X-ray fluorescence (XRF), and robotic pickers are redefining how scrap metal is processed. These technologies enable recyclers to achieve high levels of purity in recovered metals while significantly increasing efficiency.

LIBS, for instance, uses a laser to analyze the elemental composition of metals at a microscopic level. It can instantly identify the precise metal composition of an alloy, allowing recyclers to sort mixed metals more effectively. XRF technology, which uses X-rays to scan metal components, is similarly effective in sorting metals based on their elemental makeup. When combined with AI-powered robotics, these sorting systems can automate the entire process, drastically reducing human labor costs and minimizing the chance of error.

For example, one company in Japan implemented AI-powered sorting systems to separate various types of metals from waste streams more effectively. The system uses machine learning algorithms to constantly improve its sorting capabilities, learning from previous batches and becoming more accurate with each operation. The result is a higher yield of clean, high-quality metals that can be sold at premium prices.

𝐂𝐚𝐬𝐞 𝐒𝐭𝐮𝐝𝐲: 𝐇𝐨𝐰 𝐚 𝐌𝐢𝐝-𝐒𝐢𝐳𝐞𝐝 𝐅𝐚𝐜𝐢𝐥𝐢𝐭𝐲 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞𝐝 𝐒𝐜𝐫𝐚𝐩 𝐕𝐚𝐥𝐮𝐞 𝐛𝐲 𝟐𝟓%

A medium-sized recycling facility in Germany offers a compelling example of how technology can dramatically improve profitability in the scrap metal industry. By integrating advanced shredding and sorting systems, this facility increased its metal recovery rate by 25%, directly impacting its bottom line. The adoption of an automated sorting system, which combines XRF sensors and AI algorithms, allowed the facility to separate aluminum, copper, and steel from mixed scrap with a level of accuracy that was previously unattainable.

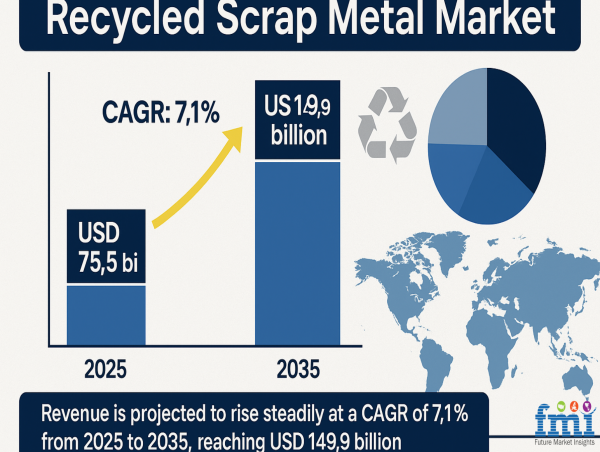

According to Future Market Insights (FMI), The global sales of recycled scrap metal are estimated to be worth USD 75.5 billion in 2025 and are anticipated to reach a value of USD 149.9 billion by 2035. Sales are projected to rise at a CAGR of 7.1% over the forecast period between 2025 and 2035. The revenue generated by recycled scrap metal in 2024 was USD 70.5 billion.

Before the technology integration, the facility’s metal recovery rate was hindered by contamination and inefficiencies in manual sorting. After installing the new system, the plant saw not only an increase in recovered metal quality but also a significant reduction in downtime. This case highlights the significant financial impact that technological upgrades can have on operations, showing how scrap metal recyclers can tap into higher-value markets with cleaner products.

𝐆𝐞𝐧𝐞𝐫𝐚𝐥 & 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐝 𝐌𝐚𝐭𝐞𝐫𝐢𝐚𝐥𝐬 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: https://www.futuremarketinsights.com/industry-analysis/general-and-advanced-materials

𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐭𝐨 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐭𝐡𝐞 𝐏𝐚𝐭𝐡 𝐀𝐡𝐞𝐚𝐝

Despite the promise of these technological advancements, adoption remains slow, especially in regions with less capital availability. The initial investment in advanced sorting and shredding systems can be high, with some setups costing millions of dollars. For smaller recyclers or those in developing economies, the financial barrier can be prohibitive. Furthermore, there is the challenge of skilled labor. Operating these sophisticated systems requires expertise in AI, machine learning, and sensor technology—skills that are not always readily available in the scrap metal industry.

However, the growing awareness of the economic and environmental benefits of advanced recycling technologies is encouraging adoption. Some governments and private sector players are stepping in to provide subsidies or incentives for upgrading recycling facilities. As the technology becomes more widely adopted, the costs will likely decrease, making these advanced systems accessible to a broader range of recyclers.

𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲 𝐚𝐬 𝐭𝐡𝐞 𝐔𝐧𝐬𝐞𝐞𝐧 𝐃𝐫𝐢𝐯𝐞𝐫 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞𝐧𝐞𝐬𝐬

While market reports frequently emphasize price trends and regulatory policies as key drivers of the recycled scrap metal market, the true competitive advantage for future market leaders will likely lie in their ability to adopt cutting-edge sorting and shredding technologies. By improving the purity, efficiency, and profitability of metal recovery processes, recyclers can offer higher-quality products to industries that demand premium-grade metals.

𝐊𝐞𝐲 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

By Metal Type:

In terms of metal type, the industry is divided into Ferrous Metals and Non-Ferrous Metals. Ferrous Metals is further segmented into Iron and Steel. Similarly, Non-Ferrous Metals is further segmented into Aluminum, Copper, Precious Metal, Tin, Zinc and Others.

By Source Type:

In terms of source type, the industry is divided into production scrap and post-consumer scrap.

By End-Use:

In terms of End-Use, the industry is divided into transportation, building & construction, consumer electronics, packaging, equipment & tools, art, decor & home furnishings, jewellery and others.

By Region:

Key regions of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific and Middle East & Africa have been covered in the report.

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

North America Organic Fertilizers Market: https://www.futuremarketinsights.com/reports/north-america-organic-fertilizers-market

Polysulfide Resin Market: https://www.futuremarketinsights.com/reports/polysulfide-resin-market

Biocides Market: https://www.futuremarketinsights.com/reports/biocides-market

Lithium Mining Market: https://www.futuremarketinsights.com/reports/lithium-mining-market

Potassium Carbonate Market: https://www.futuremarketinsights.com/reports/potassium-carbonate-market

𝐀𝐛𝐨𝐮𝐭 𝐅𝐮𝐭𝐮𝐫𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 (𝐅𝐌𝐈)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐅𝐌𝐈:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

For Sales Enquiries: [email protected]

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Ankush Nikam

Future Market Insights Global & Consulting Pvt. Ltd.

+ +91 90966 84197

email us here

Visit us on social media:

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()