The rolling stock market is a vital component of the global transportation infrastructure, encompassing all vehicles that move on a railway. This includes locomotives, passenger cars, freight cars, and maintenance-of-way vehicles. As urbanization and environmental concerns grow, the rolling stock market is undergoing significant transformations. This article explores the current state of the rolling stock market, key trends shaping its future, challenges faced by industry players, and the outlook for the coming years.

Current State of the Rolling Stock Market

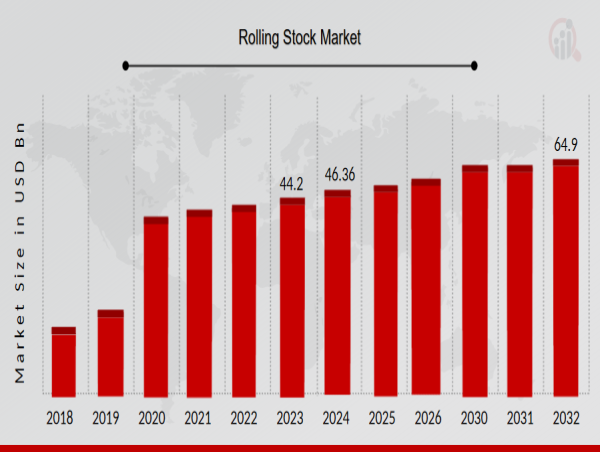

The global rolling stock market was valued at approximately $50 billion in 2023 and is expected to grow at a CAGR of around 4.5% over the next several years. This growth is driven by increasing investments in rail infrastructure, urban transit systems, and the demand for efficient freight transport.

📍 Get Free Sample Report for Detailed Market Insights: https://www.marketresearchfuture.com/sample_request/7884

Key Segments

Locomotives: These are powerful railway vehicles that provide the motive power for trains. The demand for electric and hybrid locomotives is rising due to their lower emissions and operational costs.

Passenger Cars: This segment includes various types of passenger trains, such as high-speed trains, commuter trains, and light rail vehicles. The growing urban population and demand for efficient public transport are driving this segment.

Freight Cars: These vehicles are designed to transport goods and materials. The increasing need for efficient freight transport solutions, especially in e-commerce, is boosting demand for freight cars.

Maintenance-of-Way Vehicles: These specialized vehicles are used for track maintenance and repair. As rail networks expand and age, the need for maintenance vehicles is becoming more critical.

Trends Shaping the Rolling Stock Market

Electrification of Rail Networks

Electrification is a significant trend in the rolling stock market, driven by the need for sustainable transport solutions. Electric trains are more efficient and environmentally friendly compared to their diesel counterparts. Many countries are investing in electrifying their rail networks to reduce greenhouse gas emissions and improve energy efficiency.

Technological Advancements

The integration of advanced technologies such as IoT, AI, and big data analytics is revolutionizing the rolling stock market. These technologies enhance operational efficiency, improve safety, and enable predictive maintenance, reducing downtime and operational costs.

Urbanization and Public Transport Demand

Rapid urbanization is increasing the demand for efficient public transport systems. Cities are investing in rail infrastructure to alleviate traffic congestion and reduce pollution. This trend is driving the growth of passenger rolling stock, particularly in metropolitan areas.

Sustainability Initiatives

There is a growing emphasis on sustainability in the rolling stock market. Manufacturers are focusing on developing eco-friendly trains and components, utilizing recyclable materials, and reducing energy consumption. This shift is influenced by regulatory pressures and changing consumer preferences.

🛒 You can buy this market report at: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=7884

Challenges Facing the Rolling Stock Market

High Initial Investment Costs

The rolling stock market requires significant capital investments for manufacturing and infrastructure development. This can be a barrier for new entrants and smaller companies, making it challenging to compete with established players.

Regulatory Compliance

The rolling stock industry is subject to stringent safety and environmental regulations. Compliance with these regulations can be complex and costly, particularly for manufacturers operating in multiple regions with varying standards.

Supply Chain Disruptions

Global supply chain disruptions, exacerbated by the COVID-19 pandemic, have impacted the availability of raw materials and components for rolling stock manufacturing. Delays in production and increased costs can affect the overall market dynamics.

Competition from Alternative Transport Modes

The rolling stock market faces competition from alternative transport modes such as road transport and air travel. The rise of electric vehicles and advancements in logistics and freight transport can divert demand away from rail.

To explore more market insights, visit us at: https://www.marketresearchfuture.com/reports/rolling-stock-market-7884

Future Outlook

The future of the rolling stock market is promising, with several factors contributing to its growth:

Investment in Infrastructure: Governments worldwide are increasing investments in rail infrastructure to enhance connectivity and promote sustainable transport solutions. This will drive demand for new rolling stock.

Adoption of Smart Technologies: The ongoing integration of smart technologies will lead to more efficient and safer rail operations. Manufacturers that embrace innovation will be better positioned to capture market share.

Focus on Sustainability: The trend towards sustainability will continue to shape the market, with manufacturers developing greener trains and components to meet regulatory requirements and consumer expectations.

Expansion of Urban Transit Systems: As urban populations grow, the demand for efficient public transport solutions will increase. This will drive the development of passenger rolling stock, particularly in urban areas.

The rolling stock market is at a pivotal point, influenced by technological advancements, urbanization, and sustainability initiatives. While challenges remain, the future outlook is positive, driven by investments in infrastructure, the adoption of smart technologies, and a focus on eco-friendly solutions. Manufacturers that adapt to these changes and invest in innovation will be well-positioned to thrive in the evolving landscape of the rolling stock market.

As the industry continues to evolve, staying ahead of trends and challenges will be essential for success in this competitive market.

More Related Reports from MRFR Library:

Bicycle Component Market: https://www.marketresearchfuture.com/reports/bicycle-component-market-23100

Autonomous Self Driving Cars Market: https://www.marketresearchfuture.com/reports/autonomous-self-driving-cars-market-23099

Automotive Transmission Oil Filter Market: https://www.marketresearchfuture.com/reports/automotive-transmission-oil-filter-market-23103

Light Vehicle Market: https://www.marketresearchfuture.com/reports/light-vehicle-market-23154

Automotive Transaxle Market: https://www.marketresearchfuture.com/reports/automotive-transaxle-market-23151

Market Research Future

Market Research Future

+ + 1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

_06_12_2025_08_17_26_396243.jpg)