Summary

- Nasdaq-listed biopharmaceutical company Gilead has been in the limelight with strong sales of remdesivir in 2020.

- Total revenues of Gilead for the fourth quarter and full-year 2020 rose by 26% and 10%, respectively.

- Immunomedics acquisition to contribute immediately to the revenue growth of Gilead.

American biopharmaceutical player Gilead Sciences Inc (Nasdaq:GILD) continues to play a central role in the COVID-19 pandemic, with its drug remdesivir (Veklury®).

On 4 February 2021, the biopharmaceutical player announced its Q4 and FY 2020 results, reporting strong sales led by Veklury®. The Company also updated the market with its guidance for full-year 2021.

Post the announcement of results, on 4 February 2021, GILD shares closed the day’s trade at US$65.83, up by 2.03% on Nasdaq.

Gilead witnesses better-than-expected revenue growth with Veklury® sales

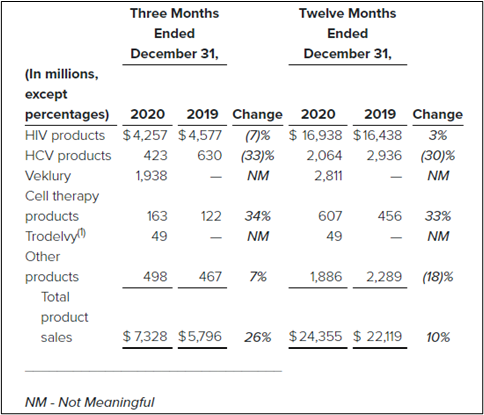

Total revenues for the fourth quarter and full-year 2020 rose 26% and 10%, respectively, compared to 2019. The Company stated that the launch of Veklury® in 2020 supported growth in revenue. The quick highlights from the quarterly and full-year results are:

Fourth Quarter 2020 on YoY:

- Total product sales increased by 26% to US$7.3 billion, mainly due to Veklury® (remdesivir).

- Veklury® sales contributed almost US$1.9 billion in sales of 4Q.

- Cell therapy product sales, including Yescarta® and TecartusTM, rose by 34% to US$163 million for the quarter.

Gilead’s strong performance driven by Veklury® sales (Source: Copyright © 2021 Kalkine Media Pty Ltd.)

Full-year 2020 YoY Performance

- Product sales rose by 10% to US$24.4 billion, primarily due to Veklury® sales.

- Veklury® had contributed approximately US$2.8 billion in sales for 2020.

- Cell therapy product sales increased by 33% to ~US$607 million for the full-year 2020.

Notably, Gilead highlighted that Trodelvy generated US$49 million sales in the US, after the acquisition of Immunomedics on 23 October 2020.

Gilead’s Product Sales, Source: Gilead Update, 4 February 2021

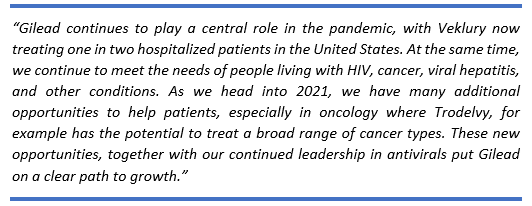

Daniel O’Day Chairman and CEO, Gilead Sciences commented:

MUST READ: How Does Gilead’s Antiviral Drug Remdesivir Help to Combat COVID-19?

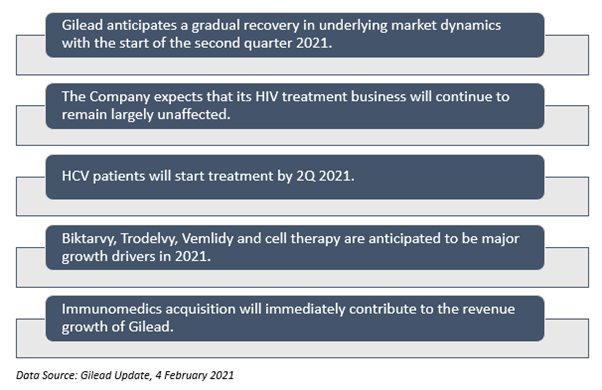

Outlook and Full-year 2021 Guidance

COVID-19 pandemic continues its impact on Gilead’s business and broader market dynamics, including market volume for HCV and HIV.

Gilead’s outlook for 2021:

In a nutshell, the Company is well-placed to drive its future development potential through the new oncology pipeline.

The Company further notified that Veklury® (remdesivir) sales are subject to significant market volatility and uncertainty amid a highly complex global health environment.

Gilead’s full-year 2021 guidance-

- Product sales, including Veklury®, expected in the range of US$23.7 billion-US$25.1 billion.

- The Company anticipates operating expenses to be flat or report a low single-digit percentage decline.

- Non-GAAP Diluted earnings per share (EPS) anticipated in the range US$6.75-US$7.45.

Increase in First Quarter 2021 Dividend

Gilead also announced that the Board of Directors had declared an increase of 4.4% in the quarterly cash dividend, starting in the first quarter of 2021. The increase will result in a quarterly dividend of US$0.71 per share of common stock.

GOOD READ: US to get 3rd COVID-19 vaccine, Johnson & Johnson files Emergency Use Authorization

.jpg)